Just how strong is the Aussie economy ahead of federal election?

It’s an issue the Morrison government appears to have in hand – but scratch below the surface and for some Aussies that’s simply not the case.

With the next federal election now less than four months away, the battle over which of the major parties is seen by the electorate as the superior manager of the nation’s economy may once again be a key factor in determining the outcome on election day.

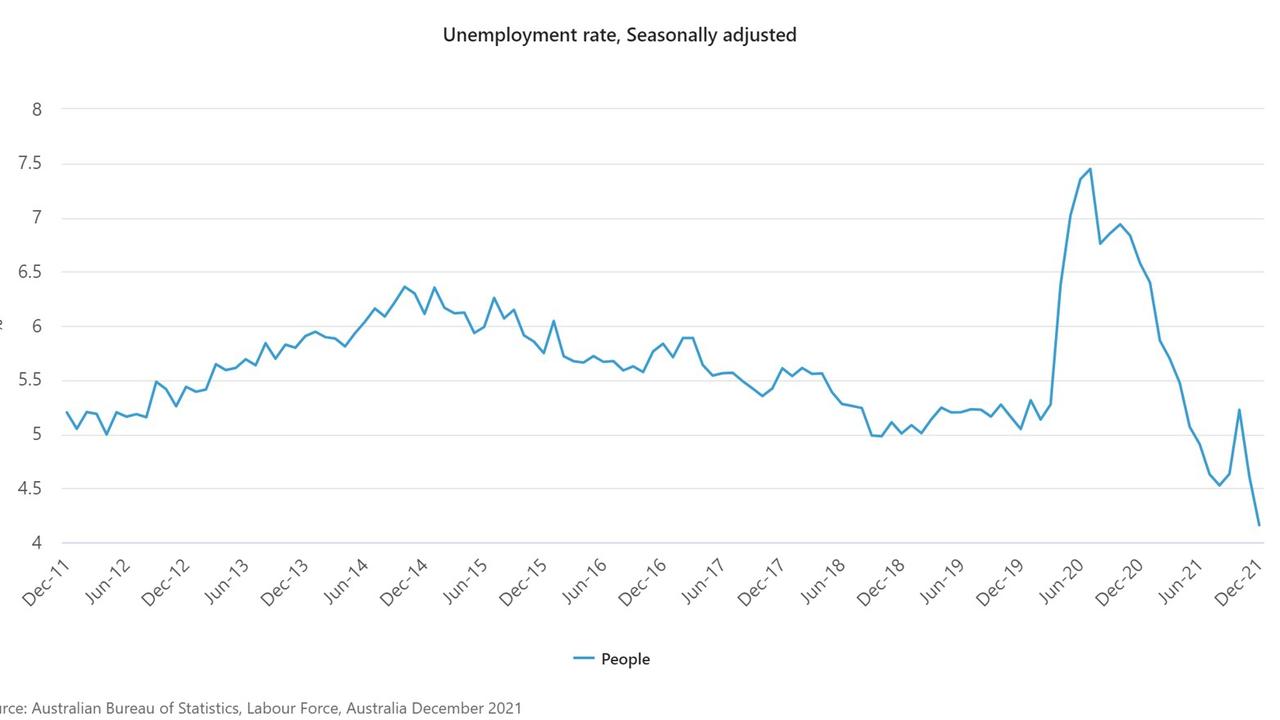

While the economy has taken some substantial hits in recent months as a result of curtailed activity due to the pandemic, in terms of some key indicators such as the nation’s unemployment rate, things are still looking quite good.

An economy with every advantage

Despite the challenges thrown up by the pandemic, the economy has been given a truly unprecedented amount of support from the RBA, the federal government and household borrowing.

While the lion’s share of the federal government’s support occurred in 2020 and the first half of 2021, the federal budget deficit is still going to be doing some heavy lifting in the 2021-22 financial year.

Prior to the outbreak of the Omicron variant, it was projected by Treasury that the deficit for this period would amount to $99 billion. However, that may be revised upward significantly as the continued cost to the nation’s coffers from the pandemic becomes clearer.

Households have also thrown the kitchen sink at supporting the economy, but in an indirect sort of way. In the year to June 2021, households borrowed $93 billion against the value of their homes for all manner of things from home renovations to cash injections for small businesses.

According to research from the RBA, the economy also had another major boost since the pandemic began. Their findings concluded that for each $1 housing prices increase, household consumption rose by three cents.

While that may not sound like a lot, when put into the perspective of total housing stock rising by almost $2 trillion since the pandemic began, in theory this underpinned around $60 billion worth of household consumption.

Between all these various factors, the economy has had every possible advantage despite the long term cost of a much greater debt burden for households and the federal government.

The situation on the ground

Looking at the nation’s unemployment data and the list of support for the economy that runs into the hundreds of billions, at first glance it appears that things are going pretty well for the Australian people.

For some Australians that’s true. For households that are enjoying strong wages growth and rocketing asset prices, things have arguably never been better.

But for households closer to the average, things can be a great deal more challenging.

While rising home prices can provide a degree of psychological support for the roughly two-in-three Australian households that own their own home, in terms of household budgets it does little to cushion the blow of a rapidly rising cost of living.

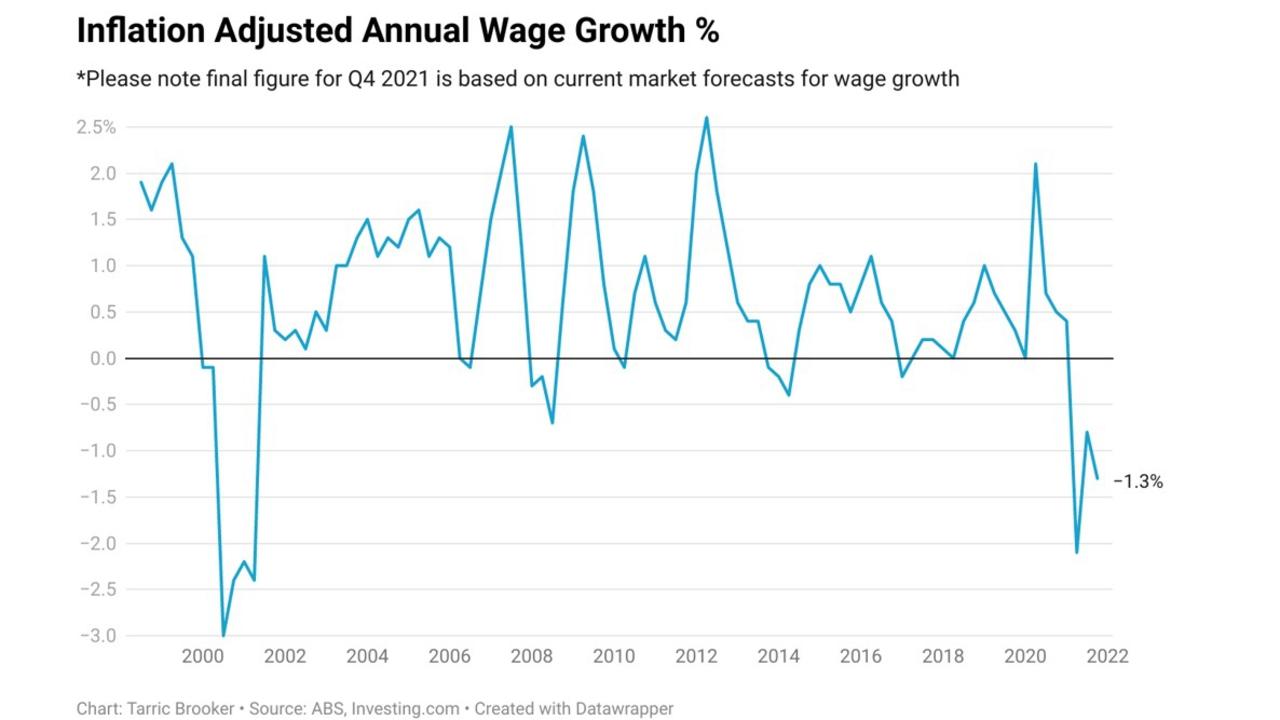

According to figures from the Australian Bureau of Statistics (ABS) – in inflation adjusted terms – households are going backwards at the fastest pace in more than two decades, excluding the initial pandemic driven shock.

In their latest forecasts, the RBA concluded that inflation would continue to outstrip wages growth until June 2023. However, it could take years of wages growing faster than inflation for the purchasing power of households to catch up to where it was just 18 months ago.

You call that an economic boom?

In a famous scene from the film Crocodile Dundee, the title character is confronted by some thugs in New York with a knife, only to pull out a much larger knife and utter his famous catchphrase, “That’s not a knife. This is a knife.”

In the same way that Dundee’s knife made the thugs look small and inferior, so too does the performance of Australia’s economy in years gone by, make the current state of things look weak by comparison.

In the year 2000, the federal budget recorded a surplus worth roughly 2 per cent of GDP and Australians were dutifully paying their mortgages down, rather than withdrawing more than $90 billion a year in cash from their home equity.

If you were to magically impose these same policy and economic settings on the economy after the impact of the Omicron outbreak concludes, it would result in a challenging and protracted recession in relatively short order.

The ‘real economy’

When it comes to measuring the relative strength of the economy, it can all be quite abstract and disconnected from what the average household may be experiencing.

For example, if the population grows by 1 per cent through net overseas migration, it can and historically has flattered headline GDP figures even though households experienced a much less impressive economic reality.

While economists and Treasury continue to rely on measures such as GDP, generally the public experiences the strength or weakness of the economy through lived experience.

That is where the apparent strength of the economy begins to fall down.

Despite the enormous level of support the economy is enjoying, most households are going backwards in inflation adjusted terms.

Yet these are the outcomes that have been achieved even with the largest degree of economic support in Australian history, which continues to provide billions of dollars a week to boost the economy even today.

With budget repair high on the agenda regardless of which of the major parties wins the upcoming federal election, the economic reality experienced by households in the coming years may be quite a bit different to the stimulus driven boom that much of the economy has experienced since the pandemic began.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator