Impact of border reopening on wages, interest rates and unemployment

Fortress Australia is finally reopening – but the financial impact might not be good news for everyday Aussies.

ANALYSIS

After two years sealed shut, the Morrison Government yesterday announced that Australia’s international border will reopen to double-vaccinated tourists from February 21.

This follows the recent lifting of border restrictions for skilled migrants, international students and working holiday makers, which has seen more than 56,000 international students arrive since late November, alongside the approval of 28,000 Working Holiday visas.

The international border reopening will help the Morrison Government achieve its plan to import at least 200,000 migrant workers into Australia by July.

It will also provide much-needed demand for Australian tourism operators, who are currently suffering from Australians being able to travel abroad without reciprocal travel rights for tourists wanting to travel Down Under.

Businesses to gain, workers to lose

At the aggregate level, having more people in the economy spending and consuming is positive for economic growth.

Businesses will gain from having more consumers to sell to alongside having a bigger pool of workers to choose from: A win-win from their perspective.

The impact on ordinary Australians from rebooting immigration is less positive.

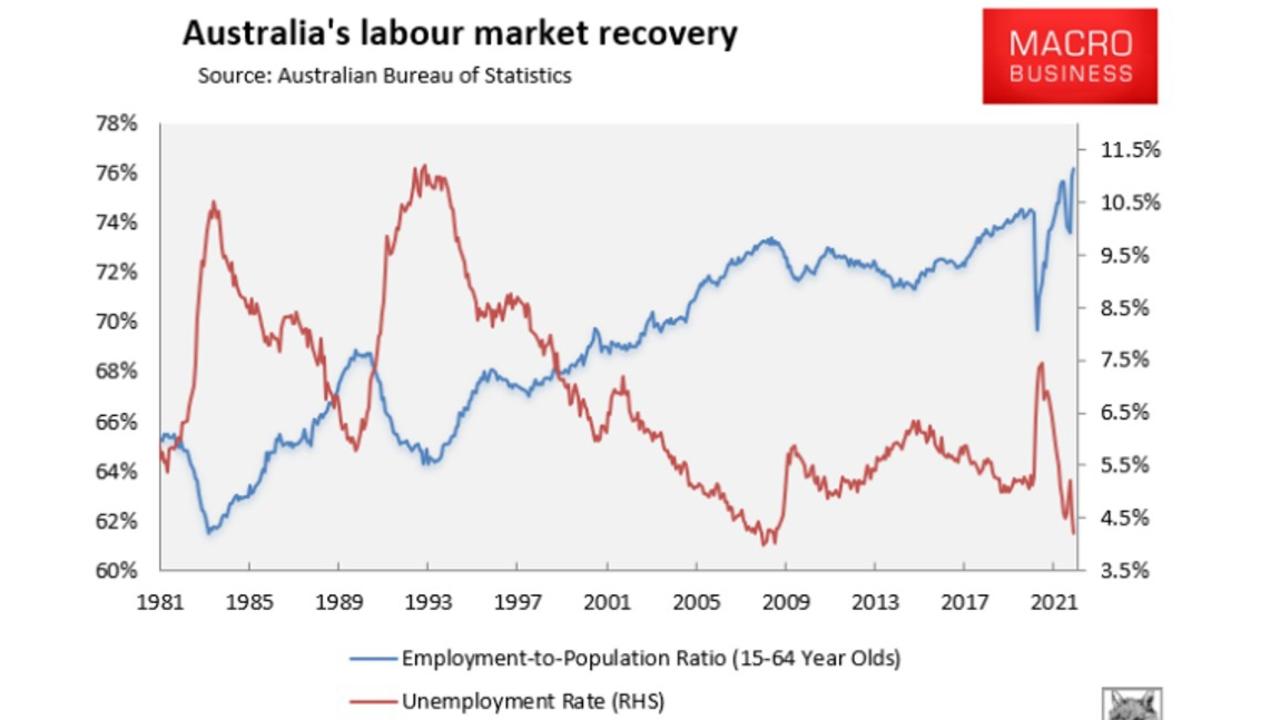

The primary reason why Australia’s unemployment rate has plunged to its near 14-year low of 4.2 per cent is because the nation went from importing 180,000-plus workers every year via immigration pre-Covid to losing tens-of-thousands of migrant workers.

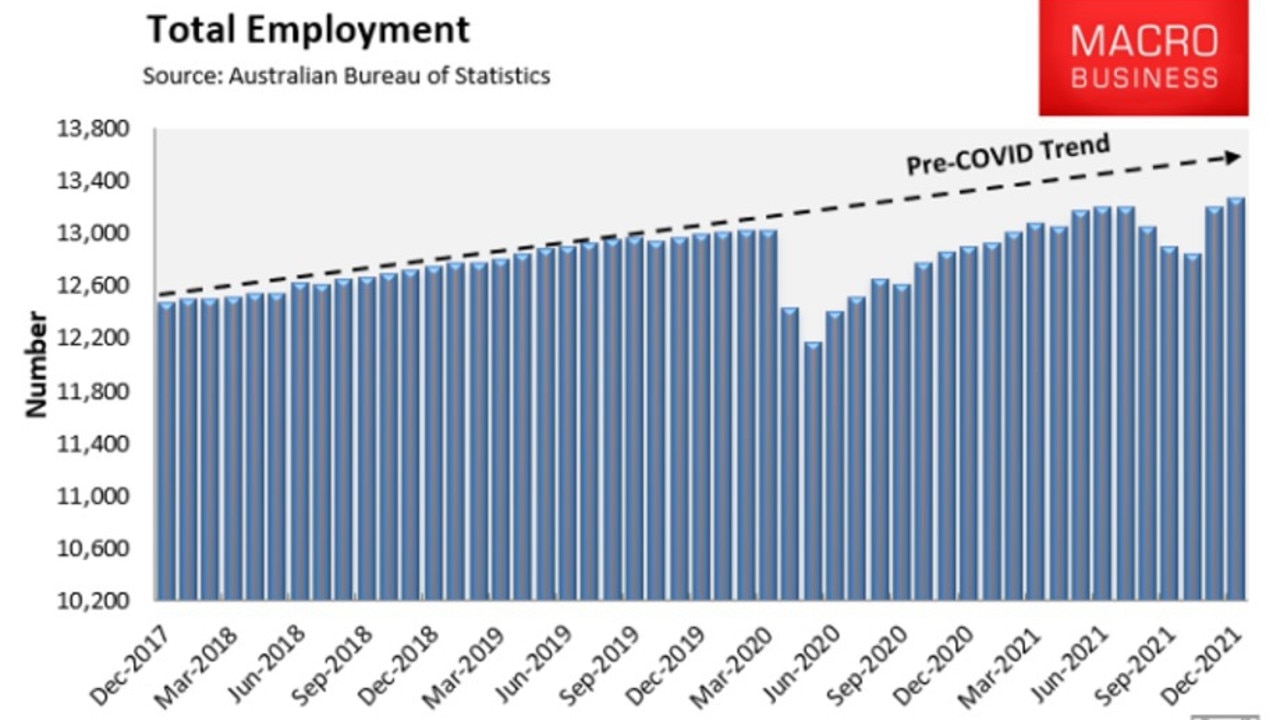

Despite the massive stimulus injected into the economy to mitigate lockdowns, the rate of job creation across Australia is lagging behind pre-Covid levels.

Yet, the resident unemployment and underemployment rates have plunged to their lowest level since 2008, while the employment-to-population ratio has hit its highest level on record.

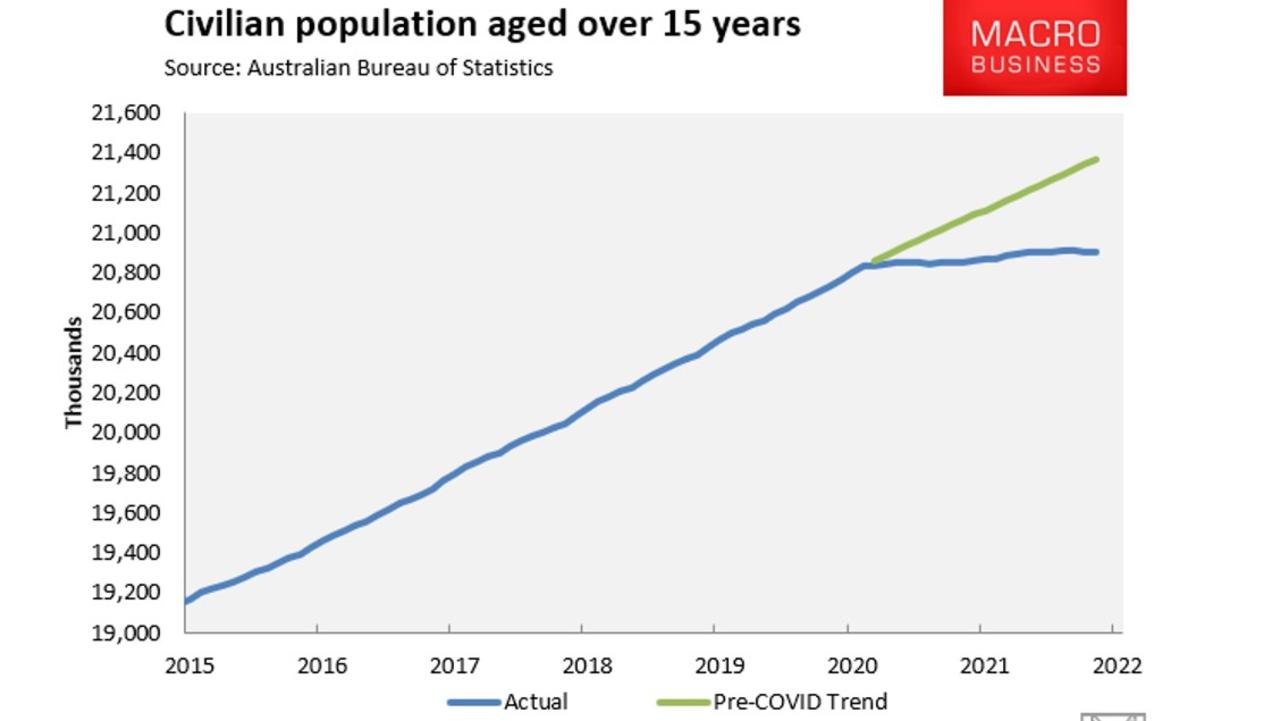

The reason why Australia’s labour market has become so tight, despite lacklustre jobs growth, is because labour supply went from growing strongly to stagnating over the pandemic, thanks to the reduction in foreign workers.

Had the pre-Covid level of immigration continued through the pandemic, there would be roughly 460,000 more workers in the Australian economy. In turn, Australia’s unemployment rate would be much higher than it currently is.

It stands to reason, then, that returning to pre-Covid levels of immigration will once again grow the labour supply, resulting in higher unemployment.

Higher immigration also means lower interest rates

Reserve Bank governor Phil Lowe has repeatedly stated that wage growth needs to lift above 3 per cent (from 2.2 per cent currently) before it will trigger sustainable inflationary pressures. Lowe also said that the RBA believes the unemployment rate needs to fall below 4 per cent to achieve stronger wage growth, and that it won’t move to increase interest rates until actual wage growth in excess of 3 per cent is observed.

Thus, the RBA’s monetary policy is now inextricably linked to the nation’s immigration policy.

If immigration is quickly rebooted, and the Morrison Government achieves its 200,000 migrant worker target by July, then labour market pressures will ease, the unemployment rate will rise, and wage growth will slow (other things equal). In this scenario, there will be less pressure on the RBA to raise interest rates.

This is effectively the scenario that Australia faced last decade when annual immigration ran strong, unemployment remained elevated and wage growth stagnated.

On the other hand, if immigration fails to rebound as much as expected, then Australia faces a tighter labour market, lower unemployment, higher wage growth and higher interest rates.

There are broader distributional impacts to consideration as well.

The main beneficiaries from high immigration are those that have already hoarded assets and capital, namely the entrenched wealthy and corporate interests. Think big business, the property industry and the education-migration industry.

On the flip side, for Australians, an open border allowing high immigration will turn the economic recovery into the same losing equation that they faced during the last business cycle. They will suffer lower wage growth, higher house price inflation and crush-loaded public amenities.

Leith van Onselen is Chief Economist at the MB Fund and MB Super. Leith has previously worked at the Australian Treasury, Victorian Treasury and Goldman Sachs.