Data shows investors are back buying property with a vengeance

House prices are rising and Aussies are borrowing exorbitant amounts of money. Now we can see who’s really driving up those costs.

Oh my god. The amount of money Aussies are borrowing to buy houses is going up again.

Everyone thought it had peaked. When mortgage interest rates got below 2 per cent in 2020-21, people went borrowing crazy and surely that had to be the top.

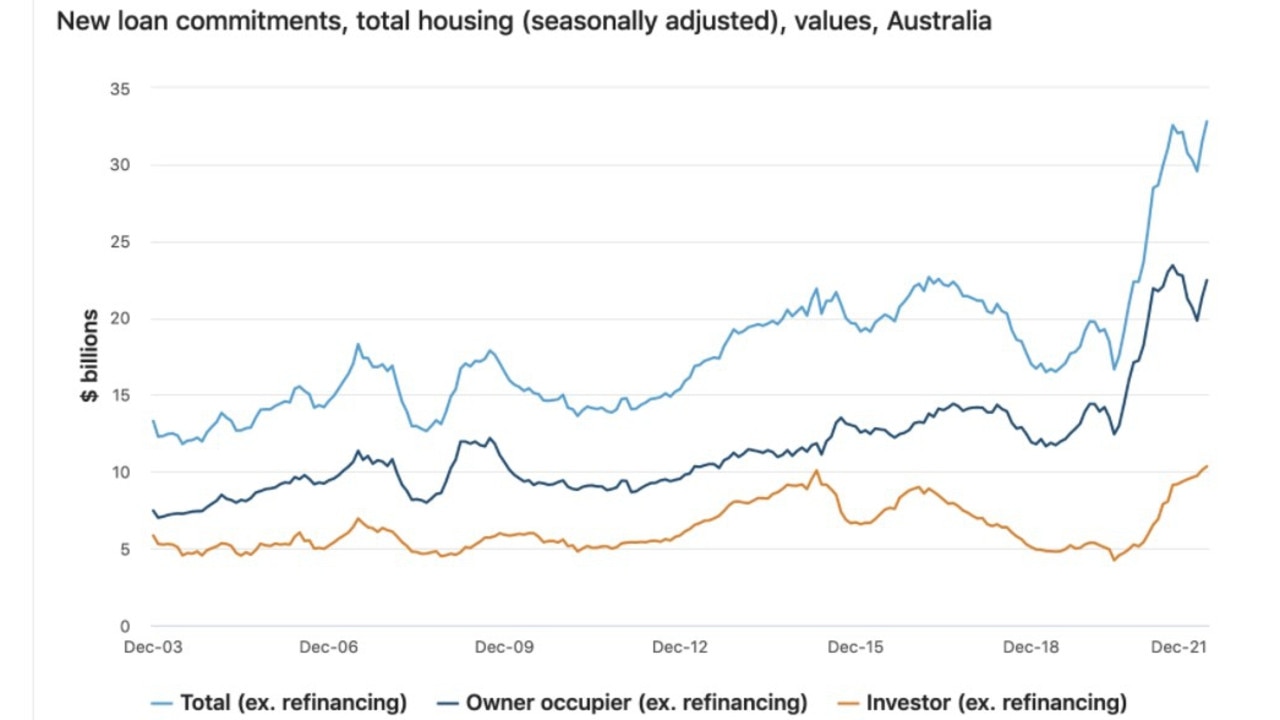

Surely the amount of borrowing would fall after interest rates started edging back up. And it did … for about four months. But now, as the next graph shows, borrowing is back up to record levels.

Every month, people are borrowing over $32 billion to spend on housing, basically double the $16 billion per month we were borrowing in 2018. Why is this happening? The answer is not first homebuyers. House prices are now in crazy territory and that is making those trying to get onto the property ladder despondent.

House prices have gone up a startling amount. The price of a home went up 22.4 per cent in the 12 months to the end of January, according to property data company CoreLogic. That is the highest annual rate of growth since June 1989.

Regional centres are growing faster than capital cities, but that hasn’t stopped capitals from notching up some new records.

“Three of the eight capital cities are now recording a median house value over the $1 million dollar mark [excluding flats, units and apartments] – Melbourne’s median house value surpassed $1 million for the first time in January, while it was the second month in a row Canberra’s median house value passed $1 million,” states CoreLogic.

Spell it out

We should spell it out: Higher borrowing leads to higher house prices. If the people at an auction have approval for a $900,000 loan, they can spend a lot more on a house than if they have approval for a $600,000 loan. And if multiple people at the auction all have approval to borrow a lot of money, you will see a bidding war.

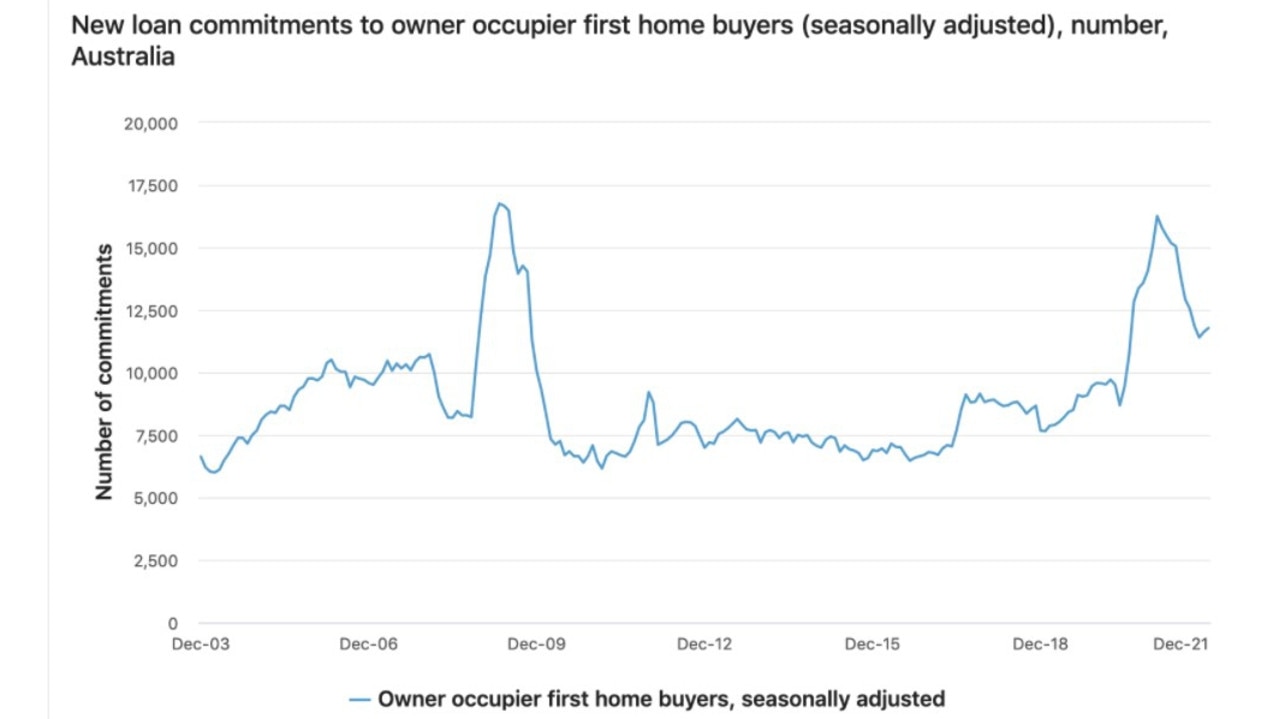

Who is winning those bidding wars right now? As mentioned, it is not first homebuyers. Brand new data from the Australian Bureau of Statistics shows us just how quickly they have dropped out of the running. As the next graph shows, first homebuyer activity peaked in January 2021, and is now much lower (although not as low as it was pre-pandemic). It is not the bright-eyed young couples pushing up the amount of borrowing.

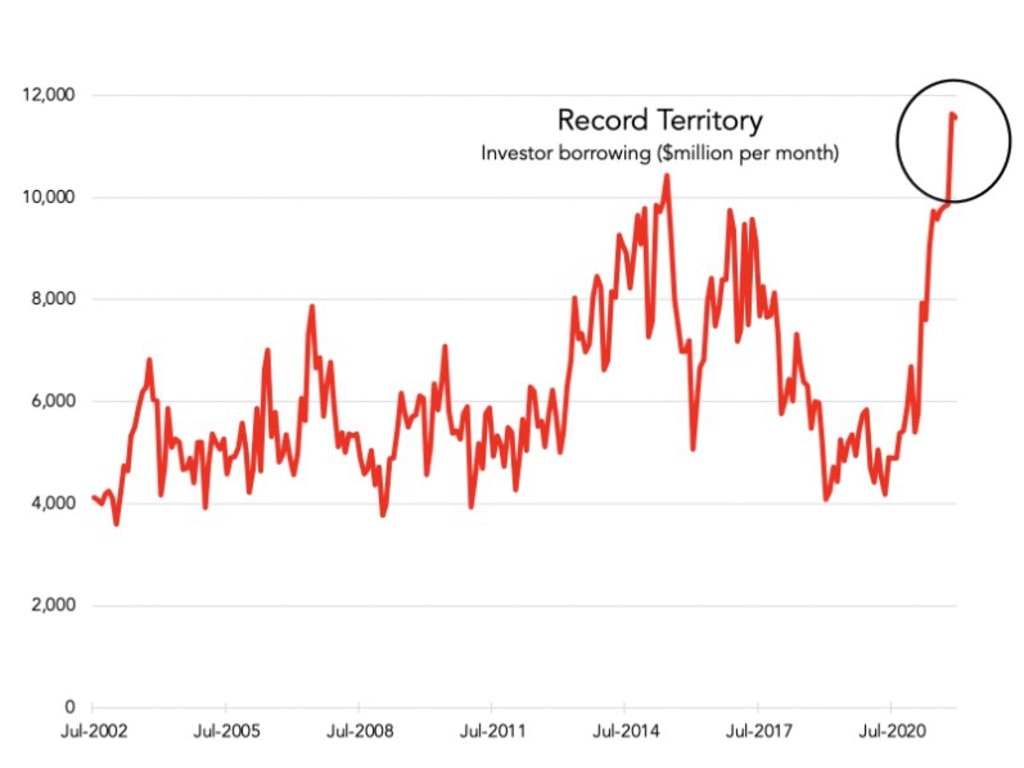

Instead it is investors who are back in the thick of it, as the next graph shows. They are borrowing far more money than ever before.

It is surprising to see investors having such a comeback. The comeback may make sense in Brisbane and regional areas, but investors are also throwing money at properties in Melbourne and Sydney, where rents have actually fallen and are quite a bit lower than they were before the pandemic began. In those cities, investors will collect pitiful rents given the amount they need to spend to buy a property.

Investors are betting either they will get enough capital gain to make the investment worthwhile, or there will be a return of international students, backpackers and temporary workers who will need somewhere to live and push up rents.

If that happens, the housing market could get even tighter and prices could accelerate further. Which makes what the RBA does next even more important.

When does the Reserve Bank lift rates?

The RBA engaged in some weird and unusual monetary policy during the pandemic – basically creating money and using it to buy various types of government bonds. It also cut official interest rates to practically zero. The order in which it undoes these policies will be as follows: first it will stop the weird stuff, and once that is done, then it will lift official interest rates.

So don’t expect a lift in official interest rates straight away. But that doesn’t mean that mortgage interest rates won’t rise when they stop buying bonds. After all, part of the reason it created money and bought those government bonds is that doing so helps reduce various interest rates, including mortgage interest rates.

At its meeting on Tuesday, the RBA agreed to stop its bond-buying program, which was previously buying $100 billion worth of government bonds. That will send ripples through the economy and financial markets, with the likely result that mortgage interest rates creep upward.

Australia’s enormous mortgages are going to cost more and more to pay off, and that’s without even taking into account the actual hikes in official interest rates which will happen most likely late this year or early next year. You’d think the upsurge in housing lending can’t continue to set new records after rates rise.

It could be a turning point in the market, and indeed, Commonwealth Bank says there is a chance house prices peak this year. It will be a hard lesson for property investors if, as soon as they buy, interest rates immediately rise and the price of the house they bought falls.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.