Home buyers face major decrease in amount of money they can borrow under future interest rate hikes

A 2022 rise in the official interest rate might be just speculation for now — but a big shift in the past 90 days may indicate that it may be coming sooner than expected. Here’s what to do to be prepared.

A 2022 rise in the official interest rate might be speculation for now, however in the last 90 days alone there have been increases to almost 3000 fixed rate home loans.

With mortgage rate hikes on the horizon, potential homebuyers could see their borrowing power slashed by tens of thousands of dollars within a matter of months.

RELATED: Houses surge to more than 11 times income

Property market quirks 2022 homebuyers need to know

Family get $250k more for home in a month

The Reserve Bank of Australia will meet Tuesday for the first time this year, but has kept the cash rate steady at 0.10 per cent since November 2020.

Throughout the pandemic, RBA Governor Philip Lowe has repeatedly maintained he didn’t expect increases until late 2023 at the earliest.

But the real estate rumour mill has been in overdrive of late with predictions of an imminent rise.

Westpac recently announced it expected the cash rate to reach 1.75 per cent by 2024. The big bank predicted six interest rate rises – in August 2022, October 2022, March 2023, June 2023, December 2023 and March 2024.

The cost of a rate rise

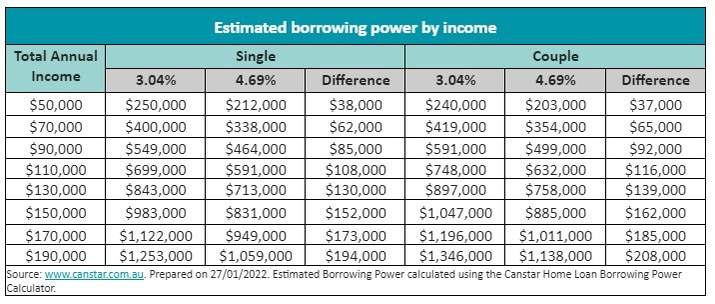

If the cash rate rose by 1.65 per cent – from 0.10 per cent to 1.75 per cent – in just two years, then the average variable interest rate would increase from 3.04 per cent to 4.69 per cent.

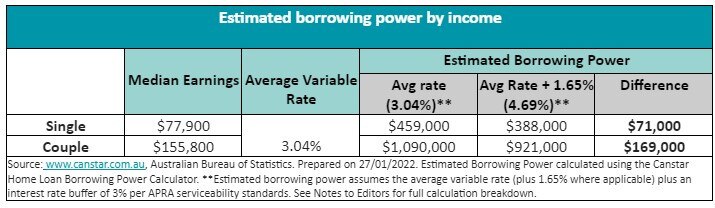

With this in mind, comparison site Canstar analysed the impact of a 1.65 per cent cash rate hike on the estimated borrowing power of singles and couples.

According to their data, singles earning the median annual income of $77,900 would be able to borrow $71,000 less by March 2024 if Westpac’s predictions were correct.

That individual would see their potential home loan fall from $459,000 to $388,000. A couple earning the median combined income of $155,800 would see their borrowing power cut by $169,000, which would drop from a mortgage amount of $1.09 million to $921,000.

Steve Mickenbecker, Canstar’s group executive of financial services, said once the RBA began raising the rate, it would likely continue.

“When the Reserve Bank hits the button on cash rate increases, history shows that it doesn’t stop at one or two hikes, and usually results in at least a 1.5 per cent increase over 18 months or so,” he said.

MORE: Seller set for life after $1m wrong call

What you need to earn to buy in every suburb

“When the Reserve Bank moves the cash rate up you can be sure the banks will move home loan rates up too, meaning higher loan repayments. For borrowers entering the property market or trading up, this also means the capacity of incomes becomes stretched meaning they are forced to borrow less.”

He added that these anticipated rate rises – coupled with APRA increasing the loan affordability buffer from 2.5 per cent to 3 per cent in October 2021 – meant buyers’ budgets would be squeezed.

“Many borrowers only remember interest rates falling. This means a drop in borrowing power will come as quite a shock to buyers already facing the prospect of continuing runaway house prices.”

Lenders aren’t waiting for the Reserve Bank

Research from another comparison site, mozo.com.au, revealed there had been 2835 individual fixed rate home loan increases from 78 providers between November 1, 2021 and January 27 this year.

Mozo spokesperson Tom Godfrey said buyers should be aware that home loan lenders won’t necessarily wait for an official green light before making their own judgment calls on rates.

“No matter when the RBA hikes the official cash rate, the fact is interest rates across a range of personal finance products are rising and consumers need to act to ensure they’re in a position to weather the new high rate environment,” he said.

“From fixing your home loan at a rate that allows you to comfortably meet your repayment requirements, to locking in a low risk term deposit at a decent rate to safeguard your cash reserves, there are steps you can still take to set yourself up to weather higher interest rates.”

Mr Godfrey said even variable rates looked set to increase in the near future.

“As wholesale funding costs continue to increase, we’re likely to see the big banks hike variable interest rates this year regardless of what move the RBA makes. So it pays to stress test your ability to make higher monthly repayments, compare rates and switch to the best value loan you can find.”

How to combat rising interest rates

Although borrowing power is reduced in the wake of higher interest rates, there are tactics prospective buyers can take to boost their chances of homeownership.

“Higher interest rates are bad news for buyers already stretched financially, and borrowers can learn from those who have been through the process to give themselves the best chance of success,” Mr Mickenbecker said.

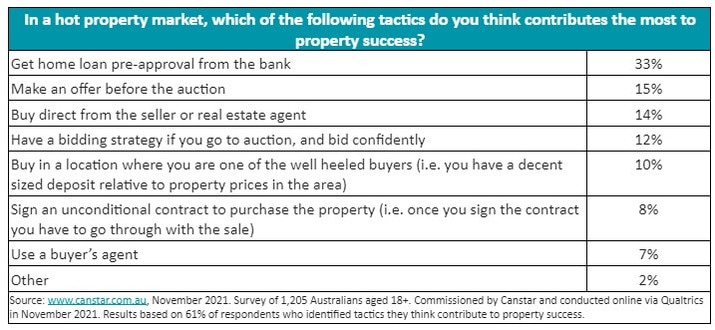

“Canstar’s survey revealed home loan pre-approval is the number one tactic Australians believe contributes to property success. This keeps buyers realistic about their budget and ensures they target the right property, and also gives them the opportunity to talk to a lender about how they might increase borrowing power through moves like clearing other debt,” he said.

“This was followed by avoiding auctions and making an offer before auction or directly with the seller or real estate agent. Competition for properties is intense at the moment, so any homework and research you can do to improve your confidence level is worth the investment.”

Another way first home buyers could combat a potential reduction in borrowing power is to consider the First Home Loan Deposit Scheme. On January 31, the Federal Government released a further 4,651 places under the FHLDS, with as many as 2,326 spots available to non-major banks.

Great Southern Bank’s chief customer officer, Megan Keleher, said the FHLDS has already helped remove the deposit obstacle for thousands of Australians.

“The FHLDS enables them to purchase their home with a deposit as low as 5 per cent, without paying out thousands in lenders mortgage insurance.”

“We see, first-hand, the real and lasting difference this scheme is making to the lives of first-time home buyers who have been able to own their own home sooner,” she said.

“With house prices rising faster than incomes, saving the deposit for a home has become an increasing challenge for more and more first home buyers.”