‘Omicron effect’ sees Aussie house prices face seismic shift

Australian house prices are facing a seismic shift with “two very different property markets” now forming. And the consequences could be huge.

As 2021 headed towards a close, the winds of change were blowing through Australia’s property market.

Auction clearance rates were falling, housing price growth was slowing down and in Melbourne, property prices recorded their first monthly falls in over a year.

Thinking the worst of the pandemic was behind us, people began putting up the for sale signs, with the volume of new listings surging as more vendors finally felt comfortable letting people into their homes.

Then, as more homes hit the market, the frenzied conditions that we had seen began to cool as potential buyers were given a greater volume of homes to choose from.

The property market was finally settling down.

At the time, some believed 2022 would mark a major test for the Aussie housing market. With the market slowly running out of gas, the pandemic effects on price growth fading and a growing number of predictions of future price falls on the horizon, it was to be the year market normalcy might return.

Then along came Omicron.

The pre-pandemic trend

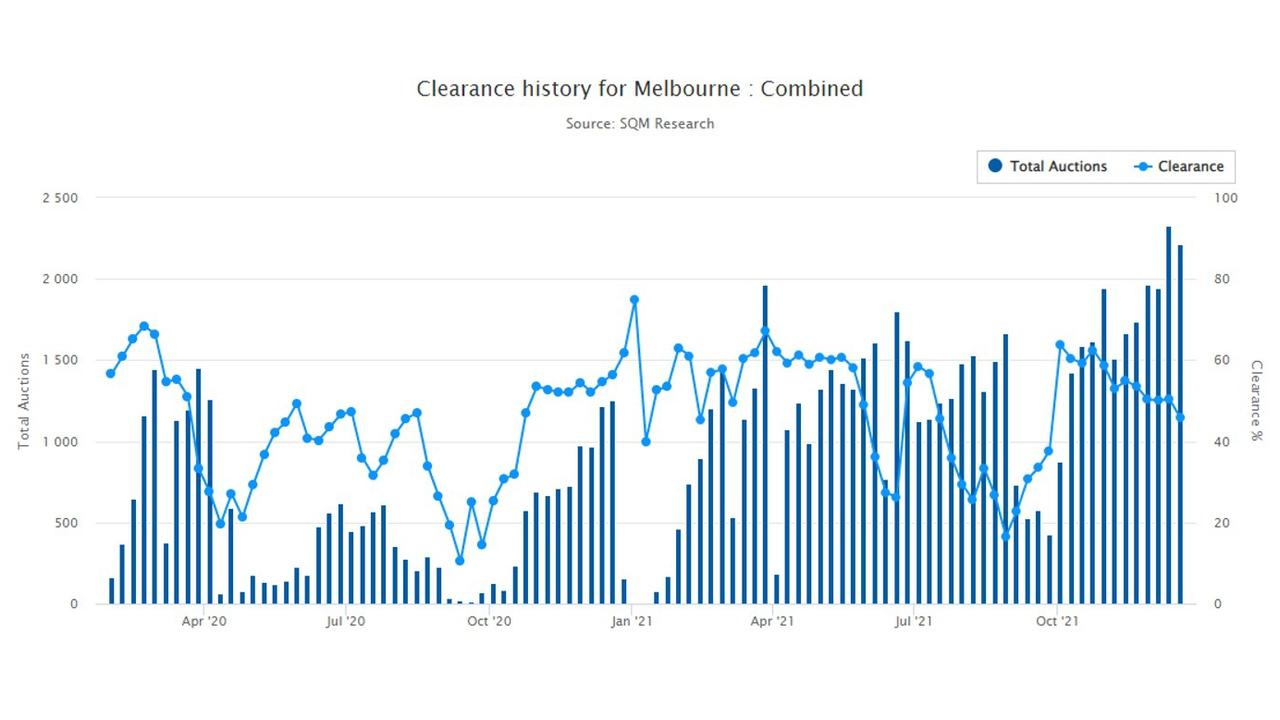

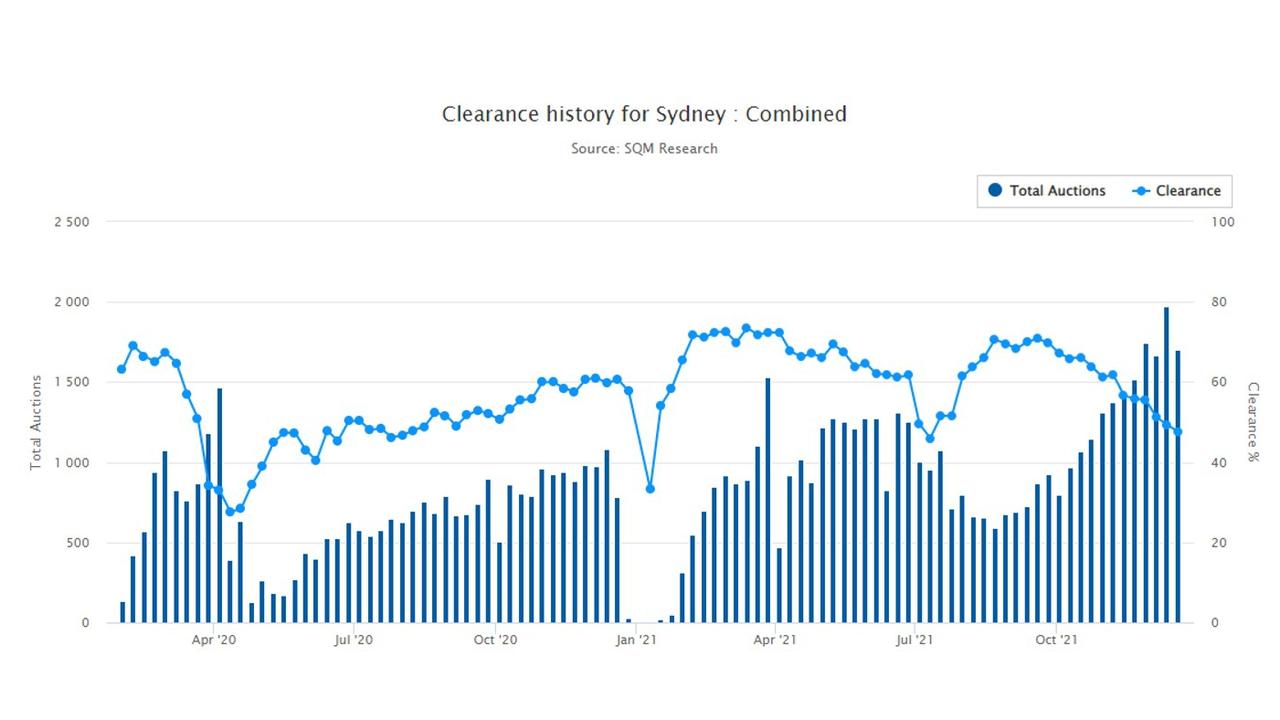

Prior to Omicron sending the nation into shadow lockdown, the auction clearance rates in the nation’s two main auction cities (Sydney and Melbourne) were coming down from the recent highs, according to data from SQM Research.

In Melbourne, they peaked at 63.7 per cent on the weekend of October 3, before falling to 45.8 per cent on the last major auction weekend of the year, December 19.

In Sydney it was a similar story. Clearance rates peaked on September 19 at 70.8 per cent, before falling to 47.6 per cent on December 19.

SQM Research founder Louis Christopher had this to say on auction clearance rates in a recent Twitter thread: “First and foremost, auction clearance rates are a momentum indicator. So while the absolute clearance percentage tells us something, it’s the direction which is just as important.

“I’ll be increasingly bullish on the market if I see clearance rates at 40 per cent and rising. And I’ll be increasingly bearish if clearance rates are at 60 per cent, yet falling.”

This fall in auction clearance rates was heavily influenced by far greater levels of stock coming up for auction.

Between the time of their respective peaks in clearance rates and the final auctions of the year, the number of properties going under the hammer rose by 152 per cent in Melbourne and 95 per cent in Sydney.

The mood all changed

In recent weeks the nation has faced some major challenges as a result of the Omicron variant impacting businesses and supply chains.

In this, real estate agencies have not been spared.

According to property market insider Edwin Almeida of Ribbon Property Consultants, some agencies have seen as many as 80 per cent of their staff off work due to contracting Covid-19 or isolating due to being a close contact.

In terms of the broader market, Almeida believes that the Omicron variant may prove a seismic shift in the market’s fortunes, at least in the short term.

“The ‘Cron effect’ as I like to call it has really created two very different property markets and has completely flipped sentiment from where it was when the auction season ended last year,” Mr Almeida said.

“On one hand the owners of freestanding homes are increasingly concerned about letting people into their homes for inspections and are holding off listing their properties. At the same time the effects of the pandemic continue to drive strong demand for houses.

“Apartments are another matter entirely. Listing volumes continue to remain strong and overall this subset of the market may face a much more difficult time.”

When asked about his outlook for housing prices in the year ahead, Mr Almeida said Sydney house prices could once again rise by double-digit percentages if the virus continues to remain a major issue, particularly with the reopening of international borders to wealthy foreign buyers looking to purchase high-end Australian homes.

The year ahead

How things will evolve from here remains largely up to Omicron.

I other words, the future of the property market is highly uncertain, given the degree of influence the virus will have.

If Omicron passes relatively quickly and Australians once again feel comfortable putting their homes under the hammer in record numbers, as they were towards the end of last year, the trend of declining sentiment in the market may yet resume.

However, if Omicron remains a factor stopping homeowners from listing their properties and if other potential variants impact sentiment during winter, the property market may see another increase in prices due to a relative shortage of stock.

Ultimately, if the nation does face further challenges from the pandemic over the coming year, it may once again be property owners who benefit, while those without homes will face an even steeper uphill battle against both the virus and the home deposit they need to save that is forever just out of reach.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator