Australian house prices: Bank economists predict small rise in house prices before dramatic fall in 2023

Predictions are showing that the nation’s booming property market may not last – but the impact it will have in the long term is still up in the air.

Predictions are showing that the nation’s booming property market may not last – but the impact it will have in the long term is still up in the air.

In what could be viewed as a warning sign for Australia, New Zealand is hiking its interest rates.

RELATED: How ‘cash poor’ family now owns over 50 properties

Queensland to be hit by ‘Mexican wave’

The Reserve Bank of New Zealand recently lifted interest rates by 0.25 per cent, in the latest clue that interest rate hikes could be coming to Australia sooner than expected.

And higher interest rates will be a huge dampener on house prices.

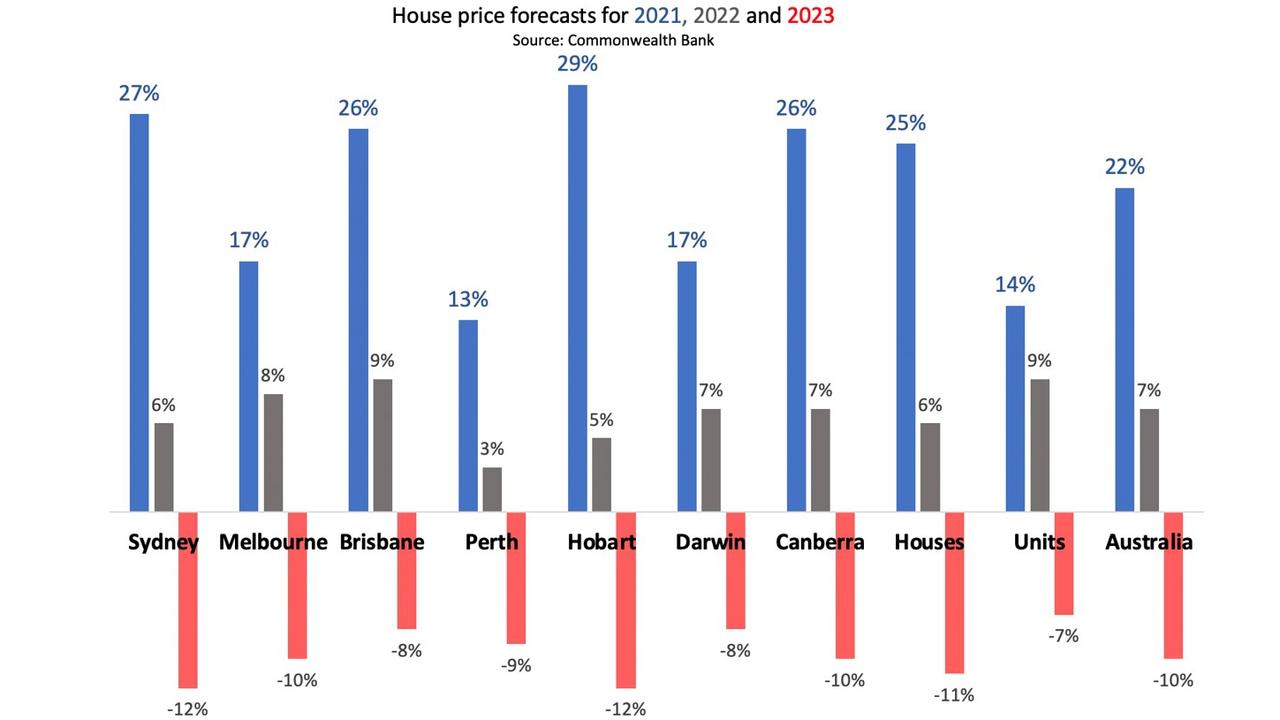

The crazy rate of acceleration in Aussie house prices – as shown in the next graph – is now forecast to come to an end, with a big fall in prices in 2023 across the country.

The Commonwealth Bank of Australia is predicting that house price growth will slow down substantially in 2022 and then actually go backward in 2023.

“Interest rates become a headwind on property prices if they are rising. That is the place we believe we are moving towards over the next two years,” wrote the Commonwealth Bank in a note to clients earlier this month.

“We expect a cooling feedback loop to intensify whereby subduing buyer expectations coupled with general fatigue and a growing anticipation of RBA rate hikes sees prices peak in [July, August, September of] 2022.”

ANZ is predicting the same pattern, albeit at a gentler level. They expect falls of 4 per cent in 2023.

PropTrack director of economic research Cameron Kusher said while prices are continuing to rise, they are doing so at a slower pace.“ The market is still rising at a rapid pace but that pace of growth has decelerated,” Mr Kusher said.

Interest rates are everything

The key issue is interest rates. Everyone expects them to go up. But when? If they rise in 2022, that should pour cold water on the housing market sooner rather than later.

The Reserve Bank of Australia is in charge of setting official interest rates. They have said they don’t expect to hike rates until 2023, or even 2024. But the RBA’s forecasts have been known to change.

And in this case, they may even be pouring on a little sugar, because expectations of low interest rates work almost as well as low interest rates in boosting the economy, which is what they’re trying to do.

So when should we expect interest rates to actually go up?

To get a hint, look to New Zealand. Interest rates have gone up. The Reserve Bank of New Zealand lifted rates by 0.25 per cent. That is a sign that the era of super-low interest rates is over in that country, and make their interest rates more than seven times higher than ours (0.1 per cent vs 0.75 per cent).

Like Australia, New Zealand has had some crazy house price rises, and like Australia, it is getting a bit uncomfortable about that. It has also experienced a bump in inflation. Also like Australia, house price falls are forecast. The Reserve Bank of New Zealand expects house prices to fall over there for the next two years.

Ask the market

Interest rates will go up if inflation rises, and if wages go up. This is why watching consumer price inflation and the wages index is vital to understanding the Australian economy these days. Wages have shown a little bit of strength recently, and consumer price inflation is higher than expected.

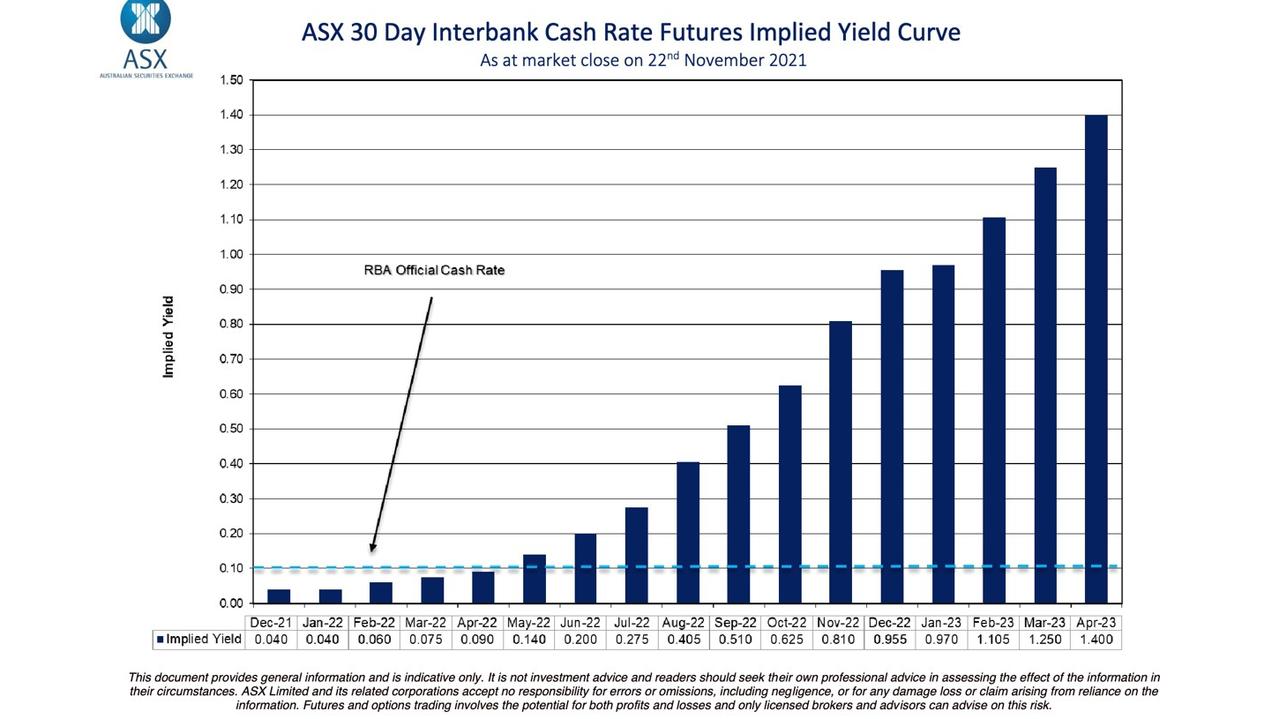

So is it possible interest rate rises will come sooner than the RBA says? That’s what the market is forecasting. Look at the next graph and see what the market expectation is for the official interest rate at various points in the future.

The blue bars show the expectation. They are higher than 0.5 per cent by September 2022, suggesting the market believes the RBA will hike interest rates to over 0.5 per cent by then. That’s just 10 months away.

Mr Kusher said the rate of growth in property prices could slow to somewhere between 5 per cent and 9 per cent nationally next year.

He noted the Australian Prudential Regulation Authority and the Reserve Bank of Australia were closely watching the growth in housing credit.

“Price growth has already started to slow but I think the RBA and APRA would have very little tolerance for an acceleration in credit growth which would lead to faster price growth and they would introduce macroprudential curbs fairly quickly were it to happen,” Mr Kusher said.

Mr Kusher agreed price falls were possible in 2023, although a lot could change between now and then.

“With a rapid deceleration in price growth expected in 2022 it is reasonable to expect that could end up resulting in price falls in 2023,” he said.

Originally published as Australian house prices: Bank economists predict small rise in house prices before dramatic fall in 2023