All Ordinaries index plunged $116 billion as global stock markets are smashed, wealthiest Aussies lose billions

Australia’s four richest people saw their wealth plummet in a matter of hours as the share market took a nosedive amid fears of a global recession.

Some of Australia’s biggest richlisters have lost $12 billion in a matter of hours amid today’s stock market carnage.

Australia’s four richest people saw billions slashed from their personal wealth as the local sharemarket nosedived in response to fears interest rate rises in the US could spark a worlwide recession.

Mining magnate Gina Rinehart ($34.02 billion), Fortescue’s Andrew Forrest ($30.72 billion) and the duo behind Atlassian – Mike Cannon-Brookes ($27.83 billion) and Scott Farquhar ($26.41 billion) were among the hardest hit.

According to the Australian Financial Review’s Rich List editor Julie-ann Sprague, Rhinehart lost an estimated $2.7 billion as her wealth is “pegged to listed iron ore miners”.

Fortescue Metals Group’s share price drop of 8.39 per cent would have also impacted philanthropist CEO Dr Forrest’s wealth, seeing it dip below $28 billion.

Similarly, Atlassian Corporation Plc suffered a 9.53 per cent hit to their share price today, a move which AFR states would have seen both founders lose $1.2 billion each.

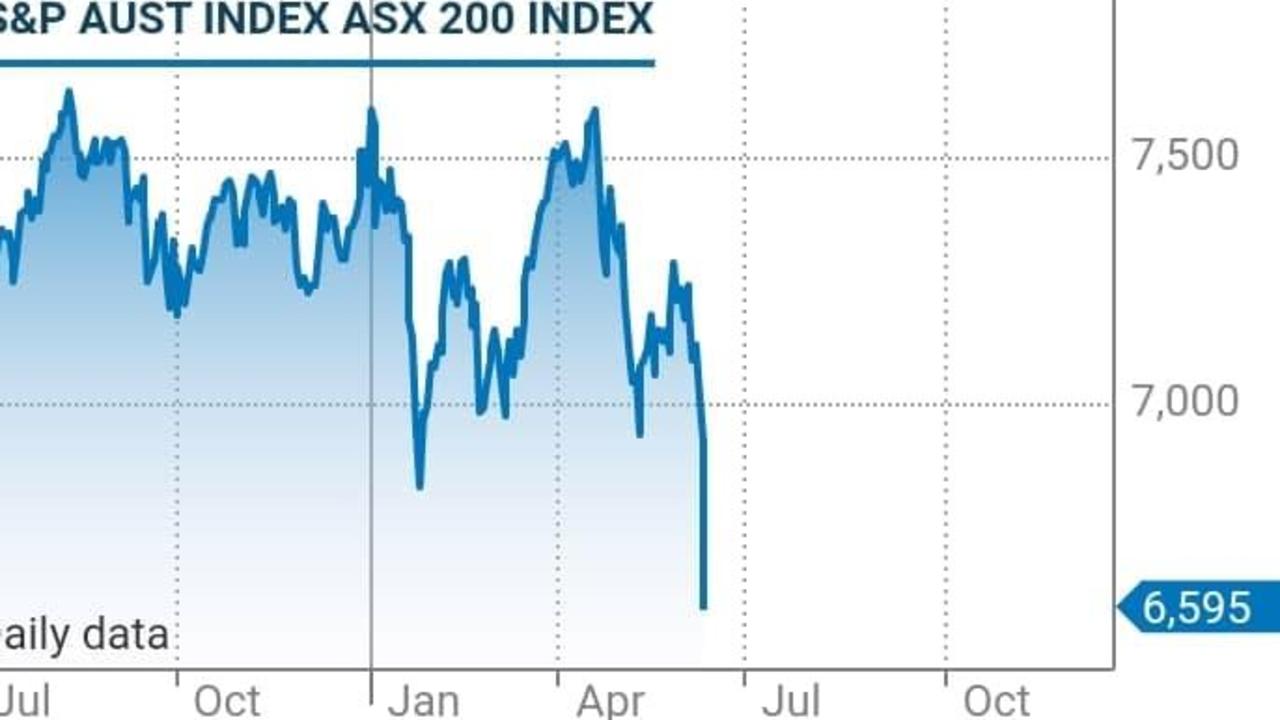

This comes as a massive $116 billion was wiped off the All Ordinaries index, as Australian stocks plunged deeply into the red, with growing fears of a worldwide recession.

Comprised of the 500 largest ASX listed companies, it’s the biggest market fall since March 2020 at around the beginning of the pandemic.

Should the market not recover itself, today could represent one of the biggest one day ASX falls in the last 30 years. The biggest drop was recorded on December 8 in 2008 during the global financial crisis.

Days like today are rare. If the stock market doesn't recover this afternoon it will be a top ten biggest fall in the last 30 years #ausbiz#auseconpic.twitter.com/tkqfqJTZgU

— ☔Jason Murphy (@jasemurphy) June 14, 2022

The large slump was recorded by 11am this morning, with the top 200 companies on the Australian Stock Exchange — which make up the S&P/ASX 200 index — plunging by over 5 per cent this morning.

Bloodbath on the #ASX this morning. #ASX200 -4.92%#AllORDS -5.02%#panic#plunge#marketcrash#stockmarketcrash#sharemarketpic.twitter.com/yJuJvAq6QX

— Eightcap (@Eightcap_aufx) June 14, 2022

By 1.30pm the ASX 200 index had slightly recovered to a drop of 4.7 per cent — which is still much worse than the anticipated 4 per cent drop at the start of the day.

There have been heavy losses across all 11 sharemarket sectors and just two stocks on the entire benchmark rose — Uniti and Crown. Even those two stocks rose by a fraction of a per cent.

Stream more finance news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

The major banks are copping it hard again after the Reserve Bank’s larger-than-expected rate rise last week; ANZ fell 5.3 per cent to $21.84, CBA dropped 4.6 per cent to $89.46, NAB fell 5.2 per cent to $26.61 and Westpac dropped 6.5 per cent to $19.49.

Miners also posted heavy losses as fresh Covid-19 outbreaks in China stoked fears of slowing demand for commodities.

BHP fell 6.2 per cent to $43.35, Rio Tinto dropped 6.2 per cent to $108.67 and Fortescue dived 7.7 per cent to $19.81.

ASX is in free fall... again

— David Taylor (@DaveTaylorNews) June 14, 2022

Tech stocks are some of the worst hit with the sector plunging by 7.1 per cent after the first hour of trading. For the 2022 calendar year, the ASX 200 tech index was now down 38.8 per cent.

Buy now, pay later providers are also being hit hard with Zip — which had already seen its share price collapse in recent months — dropping more than 18 per cent in the opening hour. That’s a six-year low and a near 90 per cent fall since the start of the year when it traded at about $4.30.

One investor managing more than $1 billion said investors had assumed “battle stations” and warned the market had “further to fall”

“Friday was a game changer,” the institutional investor told the Financial Review. “That was a bad print and the market has rapidly adjusted.”

Why is the market plunging?

Wall Street copped it hard over the weekend and again overnight seemingly amid panic that the Federal Reserve will lift interest rates far faster and higher than previously expected.

The fear is that if interest rates go up too quickly, it will drastically reduce the ability of the public to spend money on other things, leading to a recession next year.

The Australian stock market meanwhile has been closed for three days because of the long weekend and it has opened to a bloodbath this morning.

This follows on from a horror day on Wall Street overnight because of rising inflation, which has rocketed to 8.6 per cent in the United States and sparked a massive sell-off around the world.

Global equities, oil prices and bitcoin all plunged on heightened recession fears triggered by runaway inflation.

The Dow plunged more than 800 points before recovering some ground. Overall the S&P 500 sank 3.4 per cent as investors panic on fears the Federal Reserve will hike interest rates even faster.

Overall the S&P 500’s top 10 companies have lost more than $1 trillion in market capitalisation in four days, MarketWatch reports.

Big technology companies Apple, Microsoft and Amazon took the biggest hits overnight but the pain was widespread, with just five of the index’s 504 stocks gaining. At one point in the day, every S&P 500 stock was in the red at the same time.

The index of the biggest companies in the US is down 21.3 per cent in the first 112 trading days of 2022, the worst start to a year since 1940.

Aussie tech giant Atlassian went into the red -9.5 per cent, Tesla -7.4 per cent and Apple -3.5 per cent.

The S&P 500 is down 21.3% in the first 112 trading days of 2022, the worst start to a year since 1940. $SPXpic.twitter.com/JuDX9if3bO

— Charlie Bilello (@charliebilello) June 13, 2022

All this means pain for the Australian Stock Exchange.

“The hangover from a higher-than-expected US inflation reading is continuing to cause scissoring pain throughout the markets, as it extinguishes the hope the US Federal Reserve might be able to take its foot off the pedal on interest rate rises,” noted AJ Bell investment director Russ Mould.

Horror start to the week

US and European stocks had already tumbled Friday following the inflation data, with Asia following suit Monday.

European stock markets extended pre-weekend losses, while London took a hit also from data showing the UK economy contracted in April for a second month in a row.

Wall Street opened sharply lower, with the blue-chip Dow down around two per cent and the tech-heavy Nasdaq falling around three per cent.

World oil prices, whose surge has contributed massively to soaring inflation, slid abound one per cent as the high cost of living increases recession expectations.

The possibility of more Covid restrictions in China’s biggest cities also weighed on crude futures as the country is a major oil consumer.

Fresh coronavirus outbreaks in Shanghai and Beijing have seen authorities reimpose containment measures.

Bitcoin crash

Bitcoin tumbled to an 18-month low under $24,000 as investors shunned risky assets in the face of the vicious global markets sell-off.

The unit took a heavy knock also from news that cryptocurrency lending platform Celsius Network paused withdrawals, citing volatile conditions.

“It is not very surprising to see such a strong downturn as we have noticed an increased correlation over the last few years between traditional stocks, which have also tanked recently, and the cryptocurrency market,” noted XTB chief market analyst Walid Koudmani.

Patrick O’Hare, analyst at Briefing.com, said the carnage in the crypto market “is compounding worries about growth prospects due to the reduced wealth effect that also incorporates falling stock and bond prices.”

Recession fears

Investors were left surprised Friday when data showed US inflation jumped to 8.6 per cent in May, the fastest pace in more than 40 years, as the Ukraine war further fuelled energy and food prices.

The reading has led to fervent speculation that the Fed will now be contemplating a single interest-rate lift of 75 basis points at its meeting this week.

With the central bank forced to be more aggressive, there is heightened concern that the US economy could be sent into recession next year.

“The market is now thinking much more about the Fed driving rates sharply higher to get on top of inflation and then having to cut back as growth drops,” said SPI Asset Management’s Stephen Innes.

The US dollar, however, gained versus major rivals, benefiting from its status as a haven investment and expectations of aggressive interest-rate hiking from the Federal Reserve.

The US currency struck a 24-year peak against the yen before retreating, while it broke above 78 Indian rupees for the first time. It jumped one per cent versus the pound.

— with AFP