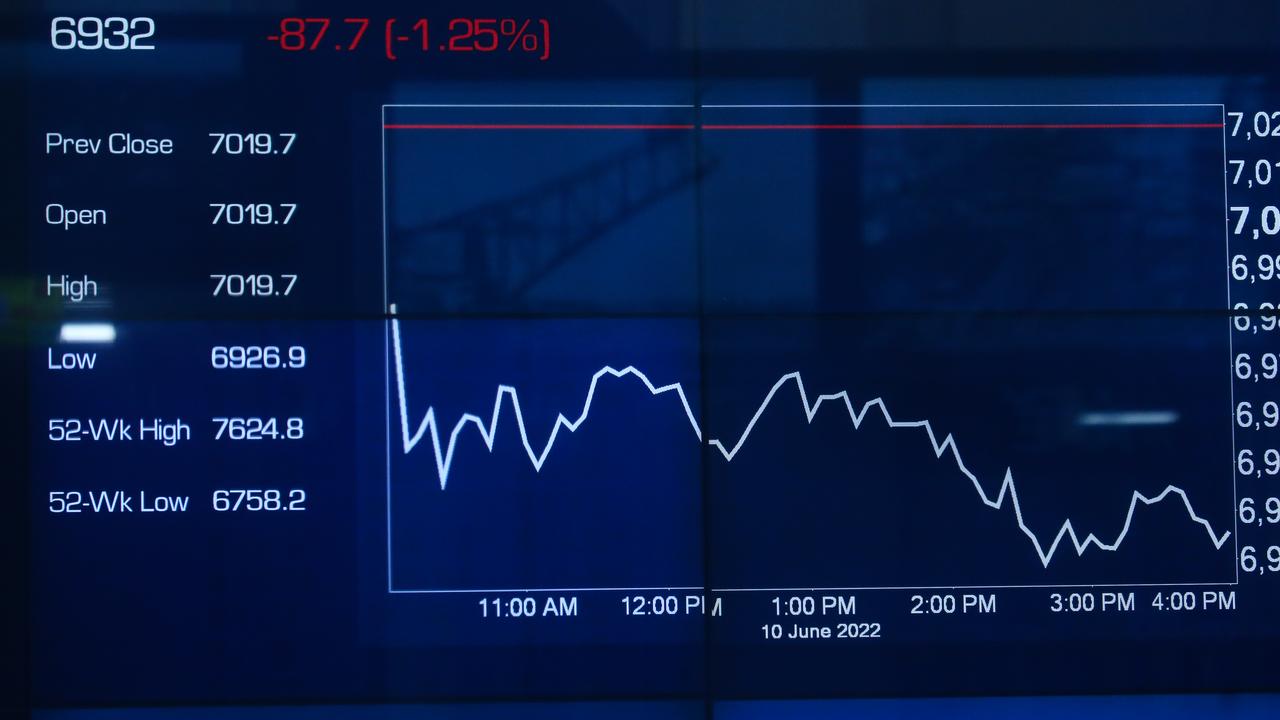

Only two stocks in the ASX 200 didn’t crash in Tuesday’s $108bn stock market wipeout

Today’s $108 billion wipeout on the Australian stock exchange has been rough, but two stocks have emerged miraculously unscathed.

Today’s $108 billion wipeout on the Australian stock exchange has been a bitter pill to swallow for investors and will have likely put a few retirement plans on hold.

Money was pulled out of the market at levels not seen since the dark early days of the Covid-19 pandemic in March 2020, and the pain was felt across almost every type of industry.

However, there were a couple of stocks among the nation’s top 200 companies on the stock exchange that bucked the trend.

Stay up to date with the latest market moves with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

Two big stocks bucking the trend

One of those that hasn’t fared badly is Crown Resorts, which has risen by 0.038 per cent to a 52 week high of 13.06 at 1pm — while the rest of the market has been in free fall.

Investors have been bidding the Crown share price higher in the past few days of trading following an update on its proposed takeover by private equity firm Blackstone.

Crown is in the process of being acquired by Blackstone in blockbuster $8.9 billion move.

According to Crown, the Victorian Gambling and Casino Control Commission and New South Wales Independent Gaming and Liquor Authority have given their approval to Blackstone’s acquisition of Crown.

Another stock that is holding its own is Uniti Group — which provides internet and telecommunication products and services.

Despite the chaos on the market, its share price has seen a 0.41 per cent gain at 1pm today — despite there being no major news or announcements from the company.

And, the wooden spoon for the worst performing stock in the top 200 companies goes to buy now, pay later provider Zip.

The company had already seen its share price collapse in recent months — and it took a whopping hit of 20 per cent by 1pm today. That’s a six-year low and a near 90 per cent fall since the start of the year when it traded at about $4.30.

Bloodbath on the market

Aside from the two outliers, every other company in the top 200 has taken a hit today — with heavy losses across all 11 sharemarket sectors.

The major banks are copping it hard again after the Reserve Bank’s larger-than-expected rate rise last week; ANZ fell 5.3 per cent to $21.84, CBA dropped 4.6 per cent to $89.46, NAB fell 5.2 per cent to $26.61 and Westpac dropped 6.5 per cent to $19.49.

ASX is in free fall... again

— David Taylor (@DaveTaylorNews) June 14, 2022

Miners also posted heavy losses, as fresh Covid-19 outbreaks in China stoked fears of slowing demand for commodities.

BHP fell 6.2 per cent to $43.35, Rio Tinto dropped 6.2 per cent to $108.67 and Fortescue dove 7.7 per cent to $19.81.

Tech stocks were some of the worst hit with the sector plunging by 7.1 per cent after the first hour of trading.

For the 2022 calendar year, the ASX 200 tech index was now down 38.8 per cent.