Fears over rare earth minerals ‘cartel’

It’s an industry key to the future of clean energy but there are rising fears that it could turn into a powerful cartel.

It’s an industry key to the future of clean energy but there are rising fears that it could turn into a powerful cartel.

Ahead of the central bank’s impending interest rate decisions, investors on the Australian share market were in an upbeat mood.

Households in one Australian state will receive an upfront $1000 payment on their power bills come July 1.

Aussie shares slumped on the first day of the new month as anxieties mount about US inflation and interest rates.

Aussie stocks edged higher on Tuesday after a slump in retail sales pushed back fears of impending rate hikes.

Australia’s largest mining company is swooping in on a rival coal and copper giant in a transformative $60bn takeover bid.

Mega wealthy Aussies have banded together to beg governments after shock forecasts that leave them wanting.

A 21-year old man who died on a mine in Western Australia’s Goldfields has been remembered as a “wonderful human”.

An Australian gold mine where a miner was killed in a partial collapse last month has admitted it failed to lodge a $4m bond for environmental rehabilitation.

Ahead of consumer price figures for the March quarter, the benchmark notched its second session of gains.

The children of Australia’s wealthiest woman have been denied access to legal documents they want to push their claim for mining assets in a long-running feud against their mother.

A South Australian mining company has boomed in value from $37m to almost $2bn in less than 10 years and the meteoric rise could continue with the company announcing another big milestone.

Markets regained their composure on Monday after an apparent easing in hostilities between Iran and Israel.

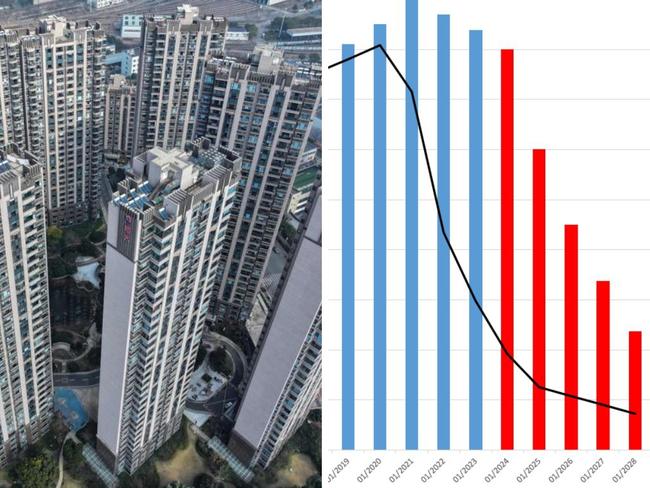

A dramatic change in China is having a profound impact on Australia already – and things looks set to get even worse.

A trade war is hotting up over a critical product that Australia has – with one country beating us to the punch.

The Aussie sharemarket has ended the week lower after investors responded to reports Israel launched air strikes against Iran.

Firmer than expected unemployment data failed to ease concerns that the RBA will hold interest rates steady through to 2025.

The Australian sharemarket edged down slightly on Wednesday, as investors settled into a new narrative on inflation.

With Beijing dominating the rare earths market, the Prime Minister is set to step up investment.

It’s worth $136 billion to the economy annually but Australia’s cash cow looks set to “crash upon every global shore”.

Australian shares slipped on Monday trading as investors price in rising geopolitical uncertainty in the Middle East.

Beijing is spending big in order to “de-risk” itself from Australia in a move that could cripple Aussies.

Softer-than-expected producer price data failed to ease the concerns of inflation-worried investors.

In a startling spray, the Treasurer has challenged the economic understanding of his political foes as he defends a major policy change.

A rally in material stocks helped push the benchmark into the green, as investors awaited fresh inflation data due Wednesday evening.

The Australian share market was up slightly as investors await new inflation data from the US, which will be key to its path on interest rate cuts.

Australia’s largest precious metals mint will celebrate 125 years in operation with the release of five special coins, including a gold coin with a mintage of just 500.

While the benchmark edged only slightly higher, key members on the share market swung wildly in trading on Monday.

Dubbed the “completions crash”, it’s thought to be coming sooner rather than later – and the impact on Australia could be profound.

With the benchmark finishing in the red for three of the past four sessions, the sharemarket dipped 1.6 per cent this week.

Tragedy has struck at two separate worksites within hours of each other.

After a sharp sell-off during Wednesday’s session, the sharemarket unwound some, but far from all, of its losses on Thursday.

After resetting its intraday record, the benchmark edged lower as traders grew skittish.

Two countries have set their sights on taking on Australia’s multi-billion dollar industry. And they’ve got the money to leave our ambitions in the dust.

Ahead of key inflation data at home and abroad, Australia’s share market slipped on Tuesday as investors took profits.

Ten of 11 sectors on the ASX ended the day in the green, with rate-sensitive real estate stocks and positive sentiment around Chinese growth propelling the uplift.

Australia’s number one export may be on its knees but there are two investments that are skyrocketing – although everything still remains uncertain.

Lower gold and oil prices weighed on the Australian sharemarket on Friday, but overall the ASX 200 ended the week 1.3 per cent higher.

The ASX booked a ‘relief rally’ on Thursday on the back of a US Federal Reserve meeting that maintained its outlook for three rate cuts in 2024.

Australia’s energy market operator has sounded the alarm over a long-term forecast, warning that one industry is in “steep decline”.

The Australian sharemarket has edged lower after a day of choppy trading as cautious investors await the all-important US Federal Reserve meeting.

Australia’s surging mining giants pushed the ASX higher on the day the Reserve Bank left the cash rate unchanged.

The future of two Australian industries are in the balance as China flexes its muscles over an issue that is not going away.

Australia’s biggest company has just made a big call on its ambitions and it could influence corporates everywhere.

Ahead of the Reserve Bank’s second meeting for the year, the share market edged higher on Monday even as property stocks lost ground.

Australia’s biggest earner faces an uncertain future which could see $30 billion wiped almost overnight.

Aussie equities fell on Friday, as iron ore dragged and investors grappled with hotter-than-expected US inflation data.

A union boss has claimed the two miners who became trapped underground should not have been “doing that task in that mine”.

Low but rising unemployment and plunging commodity prices could mean less room for cost of living relief come the May budget.

Snapping a two-day winning streak, Australian shares sank on Thursday.

Victorian Premier Jacinta Allan promises she did not get all her views on nuclear power from The Simpsons and Mr Burns’ radioactive power plant.

A video about female apprentices entering the mining industry has been met with backlash by men. Women have a powerful message for the haters.

Local shares rose on Wednesday, led by retail and bank stocks, after a positive lead from Wall Street.

Australia’s future was riding on one decision from Beijing – and it’s not gone our way. The country’s cash cow may have just died.

Beleaguered miner Core Lithium has announced two key resignations, as mining operations remain shelved at its flagship project.

The Australian market was quiet as investors waited for key US inflation data, which will provide fresh insight on where the Fed Reserve moves on rates.

Australian miners are watching nervously as China’s next move determines their future – and Australia’s.

A careful long-term plan orchestrated by China leaves Australia especially vulnerable to a three-pronged “planetary crisis”.

As one Aussie industry teeters on the edge there’s a ray of hope that could see the Australian economy transformed.

Buoyed by a bumper session for Australia’s largest retail bank, the benchmark set a record close on Thursday.

Under pressure from soaring interest rates, elevated inflation and mortgage costs, households have cut back on spending for non-essential items like cars and coffees.

A crash looks imminent as a terrifying “completions cliff” looms which will change the face of Australia.

Shares slipped for a second straight session on Tuesday as consumer stocks weighed on the benchmark index.

Shares slipped on Monday as iron ore miners sank and fears intensified of a weaker-than-expected GDP reading in the final three months of 2024.

Ahead of key GDP figures to be released later this week, the Treasurer has issued a stark warning.

China is about to seal Australia’s fate. Their next move will have a profound impact on whether we hit an economic slump.

The world is facing catastrophic change, costing billions, and Australia is in the line of fire.

The local share market was off to a record breaking start in March, as fresh highs on Wall Street and positive manufacturing data from China bolstered the benchmark.

Despite fresh inflation data showing consumer prices held steady in January, the share market edged lower on Wednesday.

The commodity is meant to be the answer to the green revolution but it’s on the brink of collapse and Australia is in the firing line.

The golden goose of the Australian economy is taking a hammering and it could spell big trouble for everyday Aussies.

With profit season nearing its end, the share market advanced for a fourth straight session on Tuesday.

As the price of many minerals plummet – leaving Australia vulnerable – there could be one very fruitful solution.

A push by the Coalition to develop nuclear energy generation in Australia has been slammed by mining magnate Andrew “Twiggy” Forrest.

The collapse of three of Australia’s biggest money spinners leaves the country very vulnerable to China’s every move.

Australians have had their first real wage increase since 2021, with full time workers seeing an extra $81 a week in their bank account.

The benchmark ASX 200 fell 0.74 per cent midweek, with a slump in mining stocks and ‘mixed results’ from supermarket giant Woolworths.

ASX has experienced its second day of gains, as the energy sector sees a boost following the changes in the core lithium and nickel industries.

Chris and Bec Judd could be hundreds of thousands of dollars worse off after a company they invested in hit the wall.

It was a mixed day for the Australian sharemarket, which was down overall for the week.

Original URL: https://www.news.com.au/finance/business/mining/page/6