1400 jobs in limbo as mine fire burns

A fire at a major coalmine has caused hundreds of workers to be sent home and their futures are uncertain.

A fire at a major coalmine has caused hundreds of workers to be sent home and their futures are uncertain.

The Australian sharemarket notched a powerful rebound rally on Tuesday on the back of iron ore and oil price rises and a surge in banking behemoth Commonwealth Bank.

Finance behemoth Commonwealth Bank has released its latest economic health check on the nation and there is one state blowing everyone else away.

The Australian sharemarket fell sharply in a ‘punchy session’ to start the week, dragged down by a selloff in the energy and materials sectors.

Millions of people have been pushed to the brink by rising prices yet a report has revealed Aussie companies made billions from devastating world events.

Roughly 1000 workers face an uncertain future as a major resources company closes a Western Australian mining hub.

One of Australia’s largest mining outfits has announced it will close a large-scale iron ore operation after it was found to be “not financially viable”.

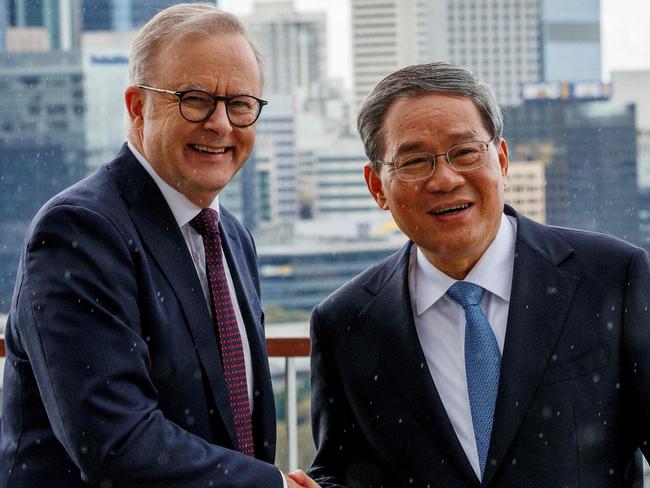

The Prime Minister joined Chinese Premier Li Qiang in Perth on the final day of the high-profile visit, but storm clouds continue to gather over the trip.

The next step for a controversial Australian energy project which would power an estimated 1.8 million homes has been announced.

Wall St hit fresh highs overnight but it wasn’t enough to lift Aussie equities, with the ASX200 drifting lower on extended weakness in China.

The staggering amount Aussie workers are losing in doing unpaid overtime outside their shift hours has been exposed.

Speaking to business leaders, the Prime Minister hit out at the Coalition’s nuclear energy plan that he said delayed “real action” on climate change.

Australia is well positioned to play a key role in an emerging international power struggle. But it would require a very “controversial” move.

Australian mining billionaire Twiggy Forrest has been issued a severe warning over a multibillion-dollar scheme.

The Australian sharemarket fell for its third straight session on Thursday, dragged down by Wall St, inflation fears and a tumble at BHP.

A class action is being prepared against Rio Tinto on behalf of its Australian employees and contractors who were allegedly subjected to sexual discrimination and harassment.

Australian shares slumped on Wednesday after hotter-than-expected CPI numbers renewed inflation fears and narrowed the likelihood of rate cuts this year.

A politician who was named as the mystery woman seen kissing Australian mining magnate Andrew ‘Twiggy’ Forest in Paris has reportedly denied the “baseless” claim.

A clip has emerged of a miner interacting with members of a remote tribe. Activists say the vision exposes the dark side of how electric vehicles are made.

The Australian sharemarket fell lower on Tuesday after weak retail sales data hit discretionary stocks.

Mining giants BHP and Rio Tinto have announced a new green push to transform their massive fleet of haul trucks.

As iron ore continues to pile up at China’s ports despite falling demands, is Australia’s iron export bubble about to burst?

Labor has shelved a major change to gas approval processes, in return for Greens support for its fuel efficiency standards.

Aussie stocks lifted on Wednesday on the back of a mining rally fuelled by bourse heavyweight BHP.

Australian shares dipped lower on Tuesday as investors continue to tread cautiously before a flood of data comes this week.

A former Labor strategist has warned the federal government that without a bold policy vision in the budget voters could ditch the major parties.

Three locomotives and 22 iron ore wagons have been impacted in an autonomous train collision.

Health and workers’ rights advocates are pushing ministers to curtail asbestos, warning it could linger into the next century despite being banned in 2003.

The Aussie sharemarket has remained strong in the wake of a less than ‘hawkish’ interest rates decision by the Reserve Bank of Australia.

It’s an industry key to the future of clean energy but there are rising fears that it could turn into a powerful cartel.

Ahead of the central bank’s impending interest rate decisions, investors on the Australian share market were in an upbeat mood.

Households in one Australian state will receive an upfront $1000 payment on their power bills come July 1.

Aussie shares slumped on the first day of the new month as anxieties mount about US inflation and interest rates.

Aussie stocks edged higher on Tuesday after a slump in retail sales pushed back fears of impending rate hikes.

Australia’s largest mining company is swooping in on a rival coal and copper giant in a transformative $60bn takeover bid.

Mega wealthy Aussies have banded together to beg governments after shock forecasts that leave them wanting.

A 21-year old man who died on a mine in Western Australia’s Goldfields has been remembered as a “wonderful human”.

An Australian gold mine where a miner was killed in a partial collapse last month has admitted it failed to lodge a $4m bond for environmental rehabilitation.

Ahead of consumer price figures for the March quarter, the benchmark notched its second session of gains.

The children of Australia’s wealthiest woman have been denied access to legal documents they want to push their claim for mining assets in a long-running feud against their mother.

A South Australian mining company has boomed in value from $37m to almost $2bn in less than 10 years and the meteoric rise could continue with the company announcing another big milestone.

Markets regained their composure on Monday after an apparent easing in hostilities between Iran and Israel.

A dramatic change in China is having a profound impact on Australia already – and things looks set to get even worse.

A trade war is hotting up over a critical product that Australia has – with one country beating us to the punch.

The Aussie sharemarket has ended the week lower after investors responded to reports Israel launched air strikes against Iran.

Firmer than expected unemployment data failed to ease concerns that the RBA will hold interest rates steady through to 2025.

The Australian sharemarket edged down slightly on Wednesday, as investors settled into a new narrative on inflation.

With Beijing dominating the rare earths market, the Prime Minister is set to step up investment.

It’s worth $136 billion to the economy annually but Australia’s cash cow looks set to “crash upon every global shore”.

Australian shares slipped on Monday trading as investors price in rising geopolitical uncertainty in the Middle East.

Beijing is spending big in order to “de-risk” itself from Australia in a move that could cripple Aussies.

Softer-than-expected producer price data failed to ease the concerns of inflation-worried investors.

In a startling spray, the Treasurer has challenged the economic understanding of his political foes as he defends a major policy change.

A rally in material stocks helped push the benchmark into the green, as investors awaited fresh inflation data due Wednesday evening.

The Australian share market was up slightly as investors await new inflation data from the US, which will be key to its path on interest rate cuts.

Australia’s largest precious metals mint will celebrate 125 years in operation with the release of five special coins, including a gold coin with a mintage of just 500.

While the benchmark edged only slightly higher, key members on the share market swung wildly in trading on Monday.

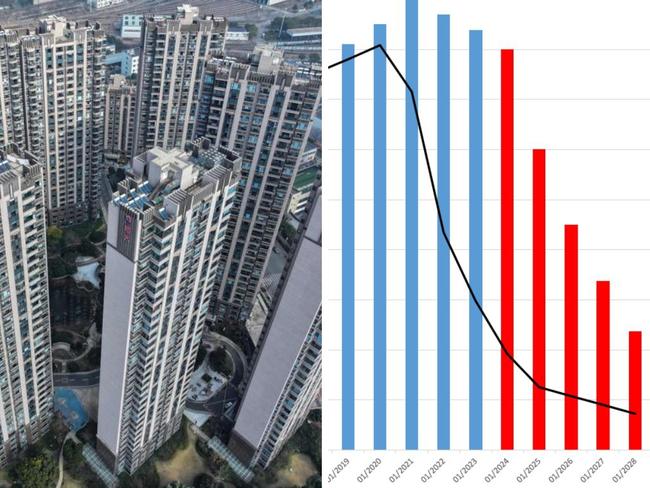

Dubbed the “completions crash”, it’s thought to be coming sooner rather than later – and the impact on Australia could be profound.

With the benchmark finishing in the red for three of the past four sessions, the sharemarket dipped 1.6 per cent this week.

Tragedy has struck at two separate worksites within hours of each other.

After a sharp sell-off during Wednesday’s session, the sharemarket unwound some, but far from all, of its losses on Thursday.

After resetting its intraday record, the benchmark edged lower as traders grew skittish.

Two countries have set their sights on taking on Australia’s multi-billion dollar industry. And they’ve got the money to leave our ambitions in the dust.

Ahead of key inflation data at home and abroad, Australia’s share market slipped on Tuesday as investors took profits.

Ten of 11 sectors on the ASX ended the day in the green, with rate-sensitive real estate stocks and positive sentiment around Chinese growth propelling the uplift.

Australia’s number one export may be on its knees but there are two investments that are skyrocketing – although everything still remains uncertain.

Lower gold and oil prices weighed on the Australian sharemarket on Friday, but overall the ASX 200 ended the week 1.3 per cent higher.

The ASX booked a ‘relief rally’ on Thursday on the back of a US Federal Reserve meeting that maintained its outlook for three rate cuts in 2024.

Australia’s energy market operator has sounded the alarm over a long-term forecast, warning that one industry is in “steep decline”.

The Australian sharemarket has edged lower after a day of choppy trading as cautious investors await the all-important US Federal Reserve meeting.

Australia’s surging mining giants pushed the ASX higher on the day the Reserve Bank left the cash rate unchanged.

The future of two Australian industries are in the balance as China flexes its muscles over an issue that is not going away.

Australia’s biggest company has just made a big call on its ambitions and it could influence corporates everywhere.

Ahead of the Reserve Bank’s second meeting for the year, the share market edged higher on Monday even as property stocks lost ground.

Australia’s biggest earner faces an uncertain future which could see $30 billion wiped almost overnight.

Aussie equities fell on Friday, as iron ore dragged and investors grappled with hotter-than-expected US inflation data.

A union boss has claimed the two miners who became trapped underground should not have been “doing that task in that mine”.

Low but rising unemployment and plunging commodity prices could mean less room for cost of living relief come the May budget.

Snapping a two-day winning streak, Australian shares sank on Thursday.

Victorian Premier Jacinta Allan promises she did not get all her views on nuclear power from The Simpsons and Mr Burns’ radioactive power plant.

Original URL: https://www.news.com.au/finance/business/mining/page/5