Australian bank shuts branches to go ‘almost solely digital’

A major Aussie bank has announced the closure of a slew of branches as it urges its customers towards an “almost solely digital” future.

A major Australian bank has shut another three branches in its pursuit of an “almost solely digital” future.

Bankwest, which serves 1.1 million customers across Australia, this month announced the closure of three branches in WA — the only state where it still has a physical presence.

Bankwest in Armadale, Perth, closed its doors on January 18.

Now, a further two branches have closed — Maddington in Perth’s southeast and Kununurra on the WA-NT border.

Man forced to drive 130km for cash

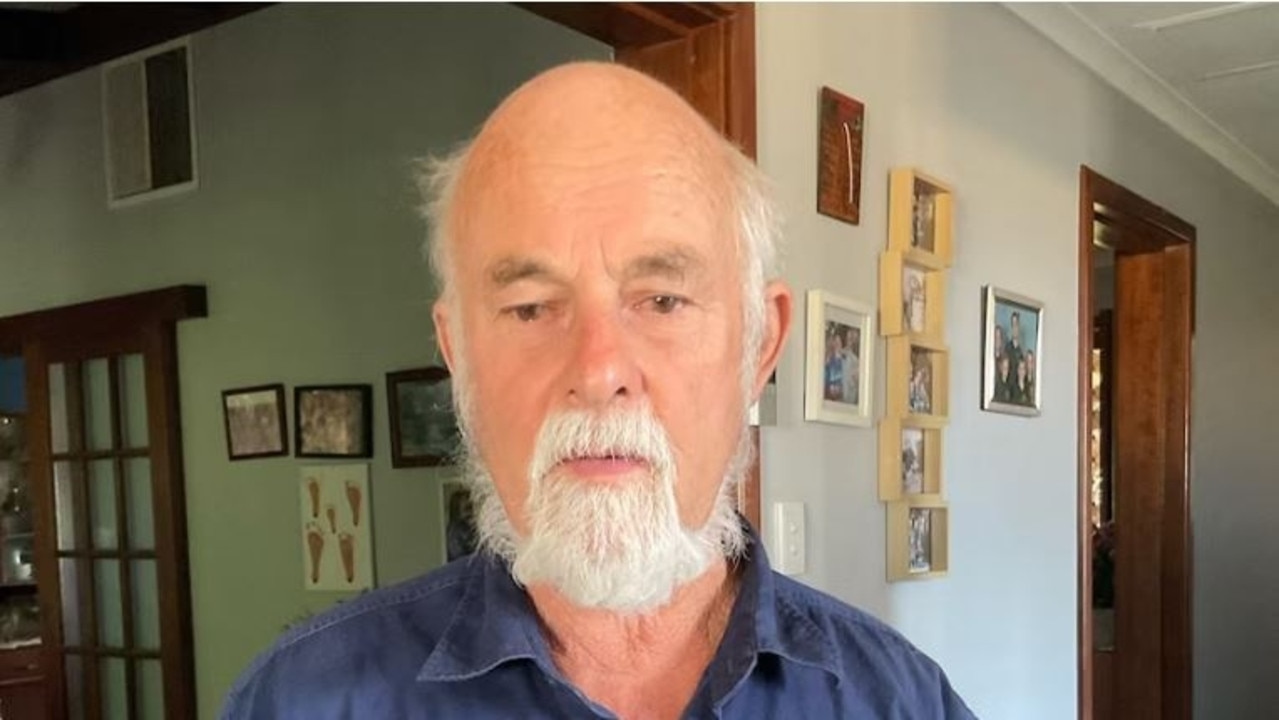

Last week, a Bankwest customer was outraged after being told he could not withdraw cash from his nearest branch, despite driving 130km to get there.

WA man Graeme Reid and his wife, who live in Latham, a rural town about 300km northeast of Perth, embarked on the 130km round trip to their nearest Bankwest branch in Dalwallinu to withdraw $300 last week.

But Mr Reid’s wife was told she was unable to withdraw the cash and instructed to use the post office instead.

“I said, ‘if you can’t get money out of a bank you may as well close’ and she [the teller] said, ‘Well, we haven’t been told we’re going to close, but I guess it won’t be long before that happens, it’s what banks are doing now’,” Mr Reid told the ABC.

‘Almost solely digital’: Which Bankwest branches have closed?

The bank, which is owned by Commonwealth Bank of Australia (CBA), sparked outrage in 2022 when it announced the closure of all 14 of its east coast locations.

Then in July last year, Bankwest announced it would close a branch in Subiaco, Perth. The following month, three more branches were closed — Baldivis, South Perth and Osborne Park.

In August, Bankwest’s general manager of personal banking Scott Spittles said the bank’s strategy was “to grow as a digital and broker-first bank for home buyers”.

Speaking to a senate inquiry into branch closures in regional Australia, Mr Spittles claimed over the counter transactions had declined by around 44 per cent in the past three years, while digital payments now account for 97 per cent of transactions.

The bank’s parent company, CBA, has pledged not to shut any more branches until 2026 but Bankwest did not make the same commitment.

“Strategically, Bankwest is moving to predominantly and probably over time almost solely digital only,” CBA CEO Matt Comyn told the inquiry.

“For those who value and would like face-to-face services and in-branch services those will be scarcer for Bankwest customers over time.”