Bankwest under fire after customer couldn’t withdraw cash after an 130km trip round trip

A rural customer has blasted a major bank for refusing cash withdrawals despite the fact he and his wife had to drive a significant distance.

A rural Bankwest customer has blasted the bank for refusing to allow a cash withdrawal despite the fact he and his wife drove 130km to access their nearest branch.

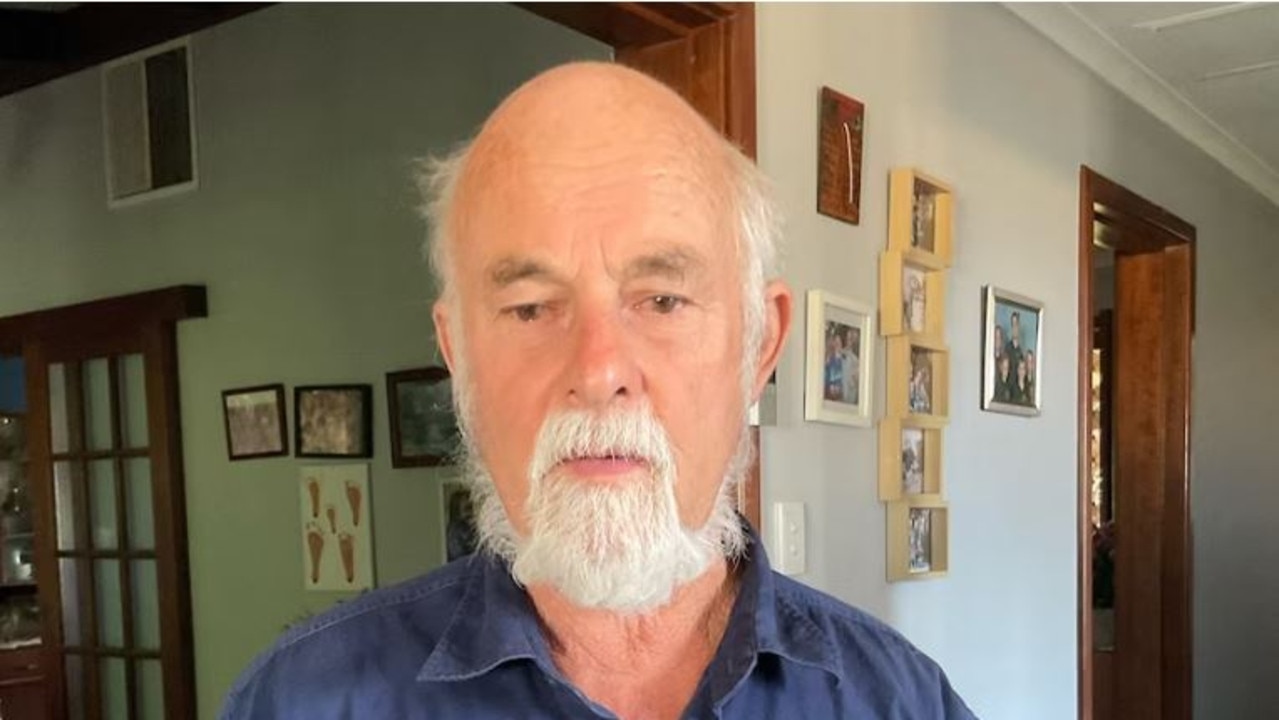

Graeme Reid, a resident of Latham in WA’s midwest told ABC News the bank refused a simple $300 withdrawal despite the over 100km they had to travel to the Wheatbelt town of Dalwallinu and back.

A teller told him they were the third customer that day to make the request and she was unable to withdraw money, directing them to the post office.

Mr Reid said he replied: “If you can’t get money out of a bank you may as well close’” to which the teller responded it “won’t be long before that happens”.

“I was absolutely gobsmacked,” he said.

He said while he could withdraw a limited amount of money from their personal account at the post office with a card and personal identification number, he was unable to withdraw money from his business account.

A Bankwest spokesperson denied the branch was about to close.

The spokesperson told news.com.au that the bank did not have a policy limiting the number of customers able to withdraw cash from a branch instead putting the incident down to a “miscommunication due to an individual colleague”.

“Withdrawal limits are set at $3000 a day per customer, with higher values requiring 48hrs notice to ensure sufficient cash is available to meet the request,” the spokesperson said.

“Bankwest’s partnership with Australia Post also enables customers to access cash services in thousands of local communities cross the country, including at the Dalwallinu LPO at 47 Johnston Street.”

The spokesperson did say that the bank expected to operate fewer branches in future, with 97 per cent of transactions conducted digitally and fewer than two per cent of customers regular branch users.

A Senate inquiry examining bank closures across regional Australia last year revealed more than 2100 Aussie bank branches have closed across the country since 2017, marking a 39 per cent reduction in active branches for major metropolitan areas.

Bosses of the big four banks were also grilled by the rural and regional affairs and transport committee over the alleged failure of Australia’s major banks to measure general business activities, such as signing documents or changing account details, while deciding whether branches should be closed.

In a submission to the inquiry, Australia Post said their Bank@Post service was available at 3500 post offices across the country – 1800 of which were in regional or remote areas.

“Cash remains a vital means of payment for some members of the community; however, maintaining access to cash after a local branch closure can be challenging, particularly when the post office is the only provider of bank services,” Australia Post’s submission states.

“Cash services are expensive to maintain, with compliance obligations placing increased pressure on costs.”

Australia Post chief Paul Graham told the inquiry post offices weren’t designed to handle the kind of cash flow usually handled by banks.

It led to Senator Matt Canavan suggesting a federal bank levy for a universal service obligation for post offices to be contracted to provide those services.

– Blake Antrobus, NCA Newswire