Cashless society: Surprising fact proves cash is still king

A cashless society seems both imminent and inevitable, but one unexpected statistic shows Aussies are refusing to submit.

A cashless society seems imminent, but one surprising statistic shows Aussies are bucking the trend.

The decline in the use of cash has been widely reported, with about 13 per cent of payments now made in cash, compared to 30 per cent in 2019. Banks have shuttered about 1600 branches in the past six years alone.

Experts warn Australia will become “functionally cashless” by 2025 — a trend that’s concerned both economists and members of the public alike, given it means Aussies will have less physical control over their money.

But on Thursday, the Reserve Bank of Australia revealed a surprising fact that flies in the face of a cashless society — demand for cash has soared.

The total value of banknotes in Australia grew by 22 per cent, or $19 billion, from March 2020 to a record high in December 2022, the RBA found.

Demand for banknotes has declined slightly since that peak, the RBA said, but “remains close to its historical high”.

So, what are Australians doing with all that cash, since they’re clearly not spending it?

The RBA believes the banknotes are being hoarded, “ likely for store-of wealth or precautionary savings purposes”.

The bank provided further evidence for its theory.

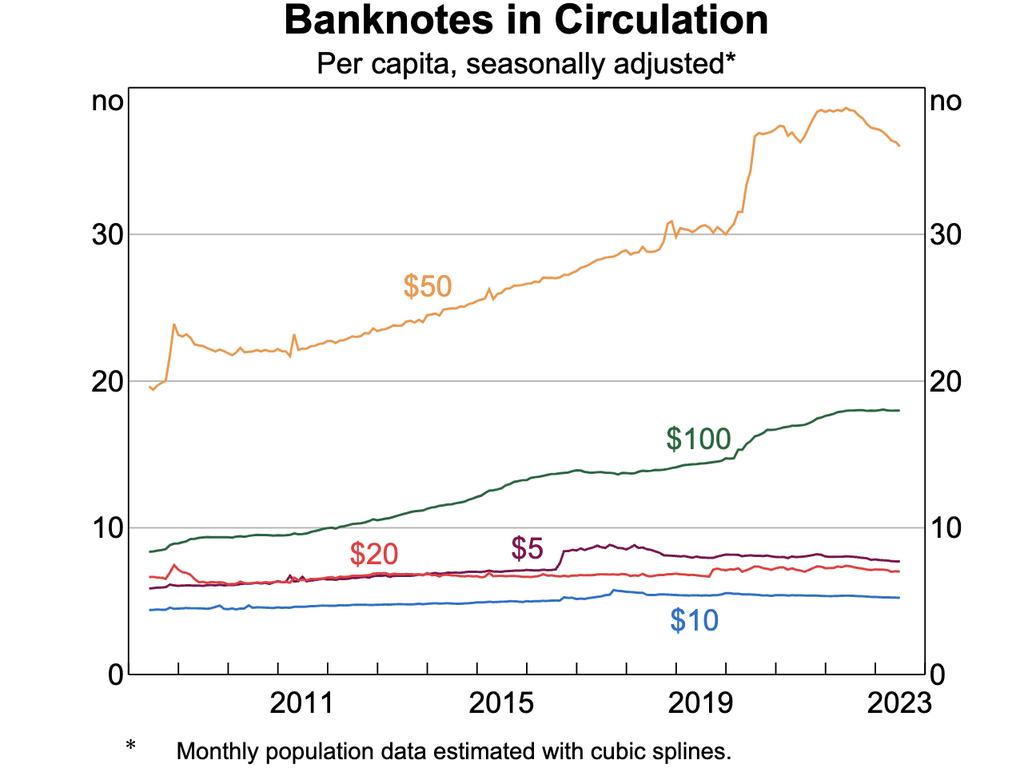

Firstly, it found demand for lower denomination banknotes — $5, $10 and $20 — had grown slowly, by about one per cent per year since 2007.

Demand for $50s and $100s, by contrast, had increased dramatically, by about five per cent per year over the same period.

“Low denominations are typically used for in-person transactions and for merchants to provide change, so subdued demand for these banknotes indicates a reduced use of cash for consumer spending,” the RBA explained.

The increased demand for high-value banknotes, meanwhile, was “consistent with an increased desire in the community to hold banknotes as a precaution or store-of-wealth, especially during times of economic uncertainty”.

Various sources of data were used to estimate how many of Australia’s banknotes were spent legitimately, how many were spent in the shadow economy and how many were destroyed or lost, compared to how many were hoarded.

It estimated, of all the banknotes in circulation in June last year, a staggering 55 to 80 per cent were hoarded.

That’s a total value of between $55 billion and $81 billion in cash, stowed away in vaults or shoved under mattresses.

In comparison, the RBA found just five to nine per cent of banknotes were lost, destroyed or forgotten about, seven to 11 per cent were spent in the shadow economy, and nine to 26 per cent were used for legitimate transactions.

“Hoarding … is the most significant component of banknote demand,” the RBA concluded.