Gold Coast business: Huge problem facing Gold Coast traders

Confidence among the Gold Coast business community has made a turnaround in the first quarter of 2022 but there are tough times ahead. Here’s why

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Confidence among the Gold Coast business community has made a turnaround in the first quarter of 2022 with a survey showing traders have been buoyed by the fact Covid-enforced lockdowns are in the rearview mirror.

A new report by the Chamber of Commerce and Industry Queensland (CCIQ) reveals business owners felt more self-assured between January and March, despite the impact of the Omicron Covid wave, which forced businesses to close and crippled the school holidays. A survey of 41 operators across a range of industries and was done in April to examine business sentiment and activity.

The survey found reasons behind improving business confidence included the winding back of Covid-19 restrictions, the reopening of interstate and international borders and improved pricing for Queensland exports.

It found that business profitability had only marginally improved and that had not yet returned to profitable levels but expected this to change in coming months.

The report said: “Actual growth is anticipated to occur in the June quarter, with expectations for general business conditions, sales and employment all registering strongly.”

Southport Chamber of Commerce president Ariana Margetts shared that sentiment about the opportunity for improvement in the coming quarter.

“It was a better than expected result, especially coming off the December quarter which was quite dismal,” she told the Bulletin.

“Things are looking positive now that we have passed the political instability which comes with a federal election campaign and Covid restrictions have largely passed. However, businesses are now facing a new set of challenges including wage an interest rate increases and while we are out of the Covid restrictions, the prospect of costs going through the roof will be tough to deal with.”

Some of these concerns Ms Margetts flagged were also evident in the report. Major concerns among the businesses surveyed included:

* Direct and indirect loss of trade, physical damage and disrupted supply chains from the southeast Queensland floods.

* The re-emergence of inflation and expected future rises in interest rates which would impact consumer confidence and spending, as well as business costs and contracts.

* The labour shortage of skilled and non-skilled employees exacerbated by ongoing housing and accommodation crisis.

* Continuing supply chain disruptions leading to stock and material shortages, compounded by geopolitical uncertainty, especially in Russia and China.

Industries represented in the data came from service providers, science and technical services, government, transport, accommodation and hospitality.

Down 50 per cent: Huge problem for Coast’s property market

GOLD Coast unit sales have dropped 50 per cent in the past year, with a new report revealing the city’s housing market remains tight.

The city’s long-running lack of available units has only slightly eased in the past three months, according to a new apartment essentials report by property consulting firm Urbis.

The report states there is just 3.3 months of supply remaining if new apartment projects on the Coast were not launched. This is up from 2.3 months of supply earlier this year.

The report reveals 377 units sold in the first three months of 2022, down from 742 during the same period in 2021.

The figures were well short of the 450 units which sold during the March to June quarter of 2021.

Urbis director Lynda Campbell said the market had come off the boil but the slowdown was “not unexpected considering the high levels achieved last year”.

“The key statistic this quarter is the drop in the number of apartments for sale to a record low, which shows the supply side is still failing to keep up with demand, so it’s unclear whether the supply shortage had any bearing on overall sales for the March quarter as the urgency to buy that we saw in 2021 is showing signs of easing,” she said.

“However, there are several large projects coming to the market and we will be watching these sales closely as the market digests rising interest rates and any new initiatives at the federal level.”

2021 was a record-breaking year for the Gold Coast property market, with nearly 2500 units sold.

This was well-above the previous average of around 1100 sales annually, and the previous record of 1600 transactions in 2015.

The slowest year in the last decade was 2017, where just 800 units changed hands.

Ms Campbell said that while the market had slowed, 2022 would still be one of the best years for the real estate market if sales continue at their current rate.

However, she warned growing material costs and supply chain issues would see the rate of development on the Gold Coast begin to slow.

“The obvious concerns surrounding construction costs and supply chain issues means that we do not expect to see as many projects make it out of the ground as in previous years while volatility and viability are managed.”

The report covers January to March, during which these factors contributed to the collapse of leading Gold Coast builder Condev, while developers pushed ahead with a raft of high-density projects surrounding the light rail route.

It revealed the bulk of the sales occurred in towers planned for Southport, Surfers Paradise and Broadbeach, followed by the booming Hope Island where more than 90 units changed hands during the quarter.

Southern suburbs between Mermaid Beach and Coolangatta had their slowest sales quarter in five years, with just 27 sales.

However, the report noted this was because of an extremely limited number of units, with just 67 on the market during the three-month period.

Ms Campbell said the bulk of buyers were looking for a place to live rather than invest.

“The dominant buyer profile for Gold Coast apartments remains owner occupiers looking for larger apartments,” she said.

“Almost a third of the sales – about 31 per cent – were at price points above $1 million, which reflects the general increase in apartment values.”

RSL ditches plan for new aged care centre

THE RSL has aborted plans hatched five years ago for a waterfront Bundall residential aged-care facility and put the site on the market.

The seven-title holding is at the head of a canal and cost RSL Care $8.85 million in 2017.

The league intended using an existing approval for the 6419 sqm site to develop 57 one and two-bedroom apartments set in buildings of up to three levels.

The aim was to target downsizing retirees, especially in the Sorrento, Bundall, and Benowa area.

The Bundall site, with seven homes on it, was amalgamated by at a cost of $7.31 million in 2015 and held by WH Sorrento, a company owned by Brisbane investment Adviser Dominic Cronk and Burleigh resident Alan Davie.

It was earmarked for an over-70s community called Sorrento Quays but put on the market in 2017.

The holding is adjacent to the Sorrento shopping centre in Bundall Rd and also has frontages to Binda Place and Boomerang Crescent.

Four of the seven houses that were on the land when the 2015 amalgamation took place still are standing.

The RSL is seeking expressions of interest in the property via Colliers agents James Matley, Brendan Hogan and Chris O’Driscoll.

See inside Qld’s most expensive penthouse

A Main Beach penthouse that hasn’t even been built has smashed Queensland’s record price for a high-rise apartment.

An undisclosed buyer is paying $19 million for a two-level skyhome in the Amani tower, with work set to start on the project in Main Beach Pde.

The price tops a state record set only last year in the Dune building, which is underway close to Amani on the same street.

The $16.5 million Dune buy is mooted to have been made by the billionaire who has the Myer retail chain in his sights, Solomon Lew.

The sale in Amani, which will have 15 apartments, equates to $25,675 a square metre.

Kollosche agents Michael Kollosche and Harry Kakavas have handled the Amani sale, which is unconditional.

Mr Kollosche yesterday said the buyer was from the Gold Coast.

“It’s someone who is no stranger to beachfront living,” he said.

Mr Kakavas said the apartment was on floors 11 and 12 of Amani and would span 740sqm.

“It will have five bedrooms, all with en suites, three living areas, a pool, and parking for four vehicles.”

Mr Kakavas said the record sale came as no surprise.

“It’s been achieved at a time when construction costs still are going up, labour is short, and beachfront land is very scarce.

“Over the past 14 weeks Michael (Kollosche) and I have sold 14 beachfront properties for in excess of $170 million, with prices starting at $6.5 million.

Amani is being built on the 787sqm site of the demolished Four Corners low-rise by car dealer Greg Eastment.

He assembled the nine-title building, which also has a Breaker St frontage, at a cost of $17.725 million.

The 17-floor Amani, due for completion in early 2024, comprises three floors with two apartments, six floors with one each, two skyhomes, and the penthouse.

The $19 million sale is shy of the $20 million the Spyre group has achieved for the top apartment in its Glasshouse low-rise in Goodwin Tce at Burleigh Heads.

Penthouses in two yet-to-be-built towers – De-Luxe at Burleigh Heads and Chevron One on Chevron Island – are carrying $22 million stickers.

Beachfront luxury high-rise revealed

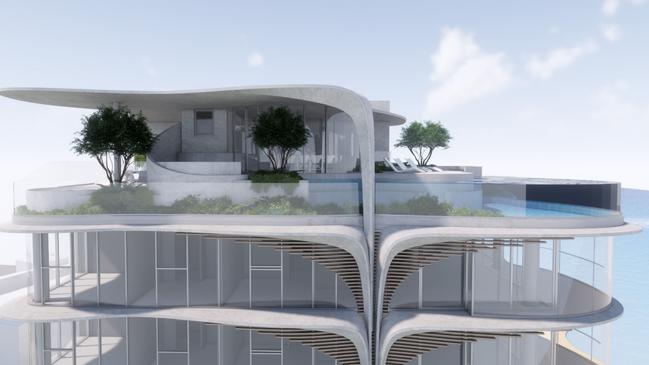

A prominent beachfront site in Broadbeach will be transformed into a 24-storey luxury tower.

Leading developer QNY Group, headed by businessman Anthony Quinn, has filed plans with the Gold Coast City Council to redevelop the Karoola site on the corner of Broadbeach Boulevard and Armick Ave.

According to planning documents, the tower will feature 21 units, 19 of which will be three bedrooms, across its first 20 levels.

A pair of two-level penthouses and a rooftop will be crowned by a communal deck and pool.

Mr Quinn has a long history of development on the Gold Coast and previously told the Bulletin he was excited to have the opportunity to reshape the land.

“I have loved this site for as long as I can remember,” he said. “As a Gold Coast local I’ve known about this exclusive little pocket for a long time and have had ambitions to develop it.

“As far as I am aware, there is no other site like it on the Gold Coast that provides no through thoroughfare, beach amenity with this prime view corridor. Plus, it’s away from the hustle and bustle of Broadbeach, but within walking distance to all amenities giving you a feeling of being removed enough to enjoy the privilege of peace and quiet.”

QNY bought the 511sq m four-unit Karoola site on Broadbeach Boulevard in February for $10m in an off-market sale.

It paid nearly $20,000 a square metre after months of aggressive bidding and competition from multiple local and interstate developers.

The site is home to a two-storey walk-up building with four units and is close to both Broadbeach Bowls Club and Broadbeach Surf Life Saving Club.

The project will go before council’s planning committee this year.

Broadbeach is at the epicentre of the city’s development boom, with billions of dollars worth of towers under construction.

They include The Star’s $400m Dorsett and $400m Epsilon towers, Little Projects’ $250m Signature Broadbeach and the 39-storey Infinity.

Chinese groups selling Vomitron ride site

Three major Chinese groups that have unsuccessfully tried to sell a whole city block on the northern edge of central Surfers Paradise have had a win – selling a near-quarter corner of it.

Brisbane-based Chinese developers have paid $8.53 million for a 2416 sqm section of what is known as the Vomitron amusement ride site – a property once touted as the best site for a second Gold Coast casino.

The portion of the site that has sold fronts Ferny and Cypress avenues and was put on the market in October.

Billionaire Tony Fung’s Aquis group and Chinese companies CCCC International Holding and Tandellen paid $36.5 million for the whole 1.05ha block in 2016.

The buyer of the quarter portion is Horan No. 8, which is owned by Yixin Li and Zheng Wang.

Another Horan entity last year amalgamated a 1214 sqm site at 11-13 Rosewood Ave, Broadbeach, and is seeking approval for a DBI-designed 28-floor tower with 120 apartments.

CBRE’s Mark Witheriff, who marketed the Surfers site with colleagues Daniel Doran and John Nucifora, yesterday said he did not know the buyer’s plans for the land.

Horan No. 8 is part of a group that over the past decade has developed residential projects in Brisbane.

They have included medium-rise apartment buildings at Redcliffe and Contarf.

The Vomitron site was amalgamated in the 1980s for Japanese company Daikyo by property investor John Minuzzo.

It subsequently ended up in the hands of another Japanese group, Orix, which was the 2016 seller.

The block at one point was part of a four-tower masterplanned project.

That venture would have included the site of the former International Beach Resort overlooking the ocean on The Esplanade – land on which the 76-floor Ocean tower is being completed.

$120M high-rise just 60m from popular beach

May 16: A $120 million residential tower planned for a site just 60 metres from Surfers Paradise beach has been designed to address the city’s housing crisis, its developer says.

Brisbane-based developer Siera Group has filed plans with the Gold Coast City Council for an unnamed 25-storey storey building on Enderley Ave.

It will have 54 units which will primarily be a mix of two and three-bedroom units.

Its top level will be taken out with a four-bedroom penthouse.

Siera Group founder, Brent Thompson said the tower had been designed to make a dent in the city’s growing shortage of available units so it could be built easily.

“This is particularly critical at a time when the delivery of projects is becoming more challenging, which we believe will lead to fewer and fewer projects coming to fruition,” he said.

“Despite the perceived level of development activity, we have found there is a genuine under supply of quality, boutique apartments across the Gold Coast, and in particular within Surfers Paradise which continues to see the largest population growth across the region.

“The Gold Coast is facing a major housing shortage with the current vacancy rate of 0.4 per cent highlighting this, and the current pipeline of projects and anticipated supply not enough to meet the current demand let alone future interstate and overseas migration.”

It will be Siera Group’s second Gold Coast project following the unveiling of Tapestry on Chevron Island in late 2021.

Mr Thompson said the project would be aimed at interstate investors.

“Interstate buyers also see the value proposition the Gold Coast offers and, with talk of interest rate increases and the potential impact on property prices, we are already seeing buyers who want to lock in a property for the next stage of their life and cash in on the growth they have seen in their current homes,” he said.

Luxe casino tower sold out

May 13: Almost 900 residential units at The Star have sold out after a late surge of buyers following the opening of The Dorsett tower.

Broadbeach Island’s first permanent residents will move into the tower’s Star Residences units this month, five months after construction was completed.

Its units, as well as those in the under-construction 63-storey Epsilon supertower, have been sold.

Destination Gold Coast Consortium project director Jaime Cali said sales had remained strong into 2022 despite the property market’s slight cooling.

“High-quality stock across the Gold Coast is low and demand is high,” she said.

“The market has caught up and we’ve seen record growth and resiliency, despite the pandemic.

“So much so apartments in the second $400m tower were quickly snapped up, which means all 879 residential apartments across both towers have now sold.”

Ms Cali said the bulk of sales in the second tower were made in late 2021 and early this year.

“Investors were out in force over the past summer with 80 per cent of the purchasers in the second tower being locals looking for a second investment,” she said.

“Remote and decentralised working arrangements as a result of the pandemic have seen investors attracted to a lifestyle, where they have the convenience of dining and other facilities right on their doorstep.”

The $400m Epsilon tower is under construction and has reached its fifth level.

It is expected to be completed in 2024.

First look at tower next to busy school

A Sydney developer will start work early next year on a 35-storey tower in Broadbeach, about two blocks away from another of its high-rise giants.

Bassar Construction Group has unveiled the council-approved Eternity for a site in Mary Ave it bought for $16.6m.

The tower will have 88 units, including two penthouses.

Bassar is already building Infinity, a 39-storey tower on the corner of Surf Parade and George St.

“The major appeal of (the Mary Ave) site is the unobstructed ocean views because that is what people expect when they visualise their sea change on the Gold Coast,” Bassar co-head Leo Sarris said.

Mr Sarris runs Bassar alongside fellow co-founder Simon Bassil.

The sale, which settled last week, was negotiated by Kollosche agent Simon Worthington.

The firm has been appointed to sell the units, with the project going on the market in June.

The site, opposite Broadbeach State School, is home to two 1970s-era unit blocks.

Construction is expected to begin in early 2023 and run until mid-2025.

Hutchinsons, which is already building the sold-out Infinity, has been appointed.

Mr Sarris said the company was pleased with the building giant’s work on Infinity.

“Aligning ourselves with the right people in the industry has been key to our success on the

Gold Coast to date and we’ve been very deliberate in taking those relationships into our next

project,” said Mr Sarris.

“When you look at the issues we’ve faced as an industry through Covid – be that increases

in material prices and supply issues – you’re always better off working with people that you

know will take the project to completion with you.”

‘Final piece of the puzzle’: Sunland to sell its own headquarters

Leading developer Sunland will sell the giant riverfront towers which house its headquarters – considered the “final piece of the puzzle” for winding down the company in its current form.

The $82m Marina Concourse complex at Benowa has been put on the market by the development company which built the iconic Q1 and Palazzo Versace projects.

Sunland founder Soheil Abedian said the Ross St complex was the company’s last remaining property.

“This is the final piece of the puzzle but we have not closed as a company so we will still have our offices,” he said.

“We have already had a significant response from the market and have no doubt that, even before tenders close, there could be a satisfactory response which would suit Sunland.”

Mr Abedian said the complex’s tenants, which include restaurants, a childcare centre and swimming pool, generated more than $1.1m in revenue each year.

The project is being marketed by Tony and Adam Grbcic from Kollosche Commercial.

It includes both the 2.6ha lake which could be used to build a marina and the 2.8ha towers and neighbouring building.

Existing tenants are the Baildon’s Superfish Swim School, Double Barrel Kitchen, Sunkids childcare centre and developers Sunland Group and HomeCorp Construction.

Adam Grbcic described it as a “blue chip offering with a lot of upside”.

“This is one of the most exciting offerings we have had and there is still land in it which can be developments,” he said.

“There has not been anything like this on the market which offers safe and secure tenures with a prominent location and development potential.” An expression of interest campaign will run until June 9.

The complex was built less than a decade ago and has been the company’s Gold Coast base.

Sunland announced in October, 2020, it would wind down its business operators as early as 2023 once its current projects were completed.

Since late 2019, the company has sold off 10 sites in Queensland, NSW and Victoria, securing $300m-plus.

In October 2021, it sold its long-planned The Lanes shopping retail village project for $45.8m to Sydney-based developer Panthera Group.

The respected development company in January 2021 sold the Greenmount Beach resort to Arium Group, a private company linked to Mr Abedian and his son, Sunland managing director Sahba Abedian.