Cafes, theme parks, manufacturers and more in Gold Coast business winners and losers of 2024

There’s been triumph and trouble for Gold Coast companies in 2024. Here’s who will be farewelling it with fond memories, and who will be happy to put it behind them.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The year that was brought challenge and opportunity for Gold Coast businesses, with some rising to the occasion, and others falling in a heap.

Rising rents, labour costs and inflation put the squeeze on many of our strongest sectors, offset somewhat by the growing return of international visitors.

Relentless demand for commercial and residential development saw some in that sector reap the benefits, while others counted the cost of contracts which didn’t keep pace.

Here are some of the winners of the year – and some who will be happy to put 2024 in the rearview.

Winners:

Meriton: Meriton’s long-lived billionaire founder Harry Triguboff was awarded the keys to the city in November, capping off a busy year for the apartment developer.

Meriton unveiled a new 74-storey development, Shore, for central Surfers Paradise, in August.

The company’s two-tower Cypress development is already under construction, making room for more than 2500 people across the supertowers of 91 and 76 storeys respectively.

Also under construction on the Surfers Paradise stretch of The Esplanade is Meriton’s $1bn Iconica, which will feature two towers of 78 and 53 storeys and will deliver a further 627 apartments.

Mr Triguboff also launched a more personal sales campaign this year, selling off his long-held Main Beach penthouse after the passing of his beloved wife Rhonda in September.

Coast Entertainment Holdings: The company formerly known as Ardent Leisure enjoyed a stellar year, posting its best earnings since 2016 – despite destructive storms closing its theme parks for much of last year’s Christmas holidays.

SkyPoint achieved record earnings while Dreamworld had its highest YoY increase in ticket sales since 2016.

Competitively-priced annual passes secured CEH a growing share of the local visitation market, with overall visitation growing 14 per cent year on year.

Further boosts are expected as the park rolls out new rides and attractions including the Rivertown precinct, Jungle Rush family coaster and the iconic vintage cars adventure.

Just this month, the theme park operator also confirmed it would end contact between humans and tigers – a move welcomed by animal lovers.

Rebecca Frizelle: The formidable business and sporting leader was named in the Gold Coast Business Excellence Awards Hall of Fame in November.

The Gold Coast Titans co-owner is the second woman – and second Frizelle – to receive the honour, bestowed before a crowd of 600 at The Star Gold Coast.

As well as an ongoing role on the board of the Titans, Ms Frizelle serves on the boards of Racing Queensland, Paralympics Australia, the Brisbane 2032 Olympic Games Organising Committee, LifeFlight Australia and Experience Gold Coast.

She was awarded an Order of Australia in 2020 and appointed Deputy Chancellor of Griffith University in October 2022.

G8 Education: The Gold Coast’s largest ASX-listed company, and Australia’s biggest childcare provider, posted a 53 per cent profit increase despite stagnant occupancy, landing its new CEO a $3m pay packet and shareholders a $28.3m dividend windfall.

Gold Coast-based G8, with 430 centres across brands including Kool Kids, Creative Garden and Community Kids, logged a $56.1m net profit the 2023 calendar year.

Its 2024 calendar year result is due early in 2025.

Craig International Ballistics: This Gold Coast company was awarded a contract to build ballistic protection windows for the $45bn Hunter Class Frigate Program.

Arundel-based Craig International Ballistics will supply the transparent armour for the first three of the six naval warships, which are under construction for the Royal Australian Navy by British group BAE Systems in South Australia.

The contract followed an earlier win for the local company, which received a $30m order for its body armour products from the Australian Defence Force.

SEE Group: This Helensvale-based civil construction and engineering powerhouse was named Gold Coast Business of the Year for 2024.

The company also took out the Family Business category of the awards.

SEE started as an earthmoving firm, and now employs more than 500 people across three main divisions: civil engineering, quarrying and fleet management on the Gold Coast, Sunshine Coast and in Tweed Heads.

Macro Mike: Former bodybuilder Mike Kellett created this business in his Surfers Paradise apartment, using a cement mixer to create his first protein powders.

Fast forward to 2024 and Macro Mike is churning out as many as 15,000 orders a month from its Burleigh Heads factory.

The company last month collaborated with Unilever-owned Streets on a branding deal for Golden Gaytime flavoured products which flew out the door.

iCoolsport Australia: Southport-headquartered iCoolsport Australia, a global ‘pioneer’ in ice-bath technology, had its equipment used at the Paris Olympics.

The business had its beginnings in 2004 when sports medicine scientists at the Australian Institute of Sports and micro refrigeration experts teamed up to manufacture six fully automatic mobile ice bath systems for the Athens Olympics.

iCoolsport’s products have been used by teams, clubs, stadiums and individuals at almost every major sporting event including the FIFA World Cup in Qatar where it supplied 144 pools and 50 machines.

The company, which took out the Gold Coast Business Excellence Manufacturing Award for 2024, has set its sights on the 2032 Brisbane Olympics.

Losers:

Luke Hemmings: If you looked at Whitefox Recruitment’s massive billboards and bus ads, you’d be forgiven for thinking the company’s CEO was having his best year yet.

Indeed, the Whitefox website claims its boss was “awarded HR CEO of the Year 2023 and Legal Recruiter of the Year 2024”.

What the website doesn’t mention is that Hemmings – a colourful businessman with up to a dozen aliases – was in 2024 slapped with fraud charges worth more than $540,000.

Mr Hemmings, who has denied wrongdoing, has also been known as Dene Broadbelt, Dene Musillon, Harrison O’Connor, Harrison Eyles, Nic Lloyd and Clay O’Connor.

Whitefox’s Gold Coast operation took over the Facebook page and Google listing that had belonged to Mr Hemmings’s failed Canberra-based recruiting agency, Coceptive Recruitment, which went into liquidation owing $760,000 in 2021.

The case is due back in Southport Magistrates Court in January.

Descon/Adcon: The estimated debts of failed national builder Descon Group, and its related Adcon companies, soared towards $400m in 2024, making it an unenviable contender for the largest construction group collapse in Australia’s history.

More than 10 companies in the Descon and Adcon groups are in administration or liquidation, with their combined reported debts topping $390 million – eclipsing the $250 million Probuild collapse in 2022 and the $169 million failure of PBS Building in 2023.

The group’s director Danny Isaac, aka Sami Adib, has been in Dubai since October 2023 as creditors including the ATO line up to bankrupt him – again. The next hearing on his bankruptcy case is scheduled for the Federal Court in Brisbane in March 2025.

The Star Entertainment Group: It could have been a stellar year for this gaming giant – with the (waaaay overdue) opening of its $3.6bn Queen’s Wharf in Brisbane and strong sales in its residential towers at Broadbeach.

But with a pressure cooker of $200m in fines, tanking revenue, a shareholder revolt and a revolving door of executives, life at The Star did not live up to its name in 2024.

Despite a stay of execution on its Queensland casino licence, its future is still very much in the balance.

The Star Gold Coast lost well-liked CEO Jess Mellor in April and her replacement Mark Mackay, hired in September, lasted less than 100 days before quitting the post in December.

Shares in the company look set to close at less than half the 53c they began the year with, hanging around the 20c mark as the new year approaches.

It’s difficult to imagine the heady days of 2016 when they topped $5.

Speculation remains rife that a carve-up of the company’s assets is a matter of when, not if.

Hospitality, retail and entertainment businesses: With international visitor numbers remaining sluggish and cost of living pressures biting at consumers’ discretionary spend, small businesses had already been on tight margins.

So it was too much for many Gold Coast cafes, restaurants, bars and retailers when the pandemic hangover hit, and the ATO called in debts it had been ignoring for the past two years.

Scores of small businesses either folded completely or appointed administrators to help them navigate looming insolvency.

Among the near misses - who continued to trade - were The Henchman Miami; Black Hops Brewing; The Pink Flamingo; Outland Denim; Pink Hotel and Eddie’s Grub House; Artesian Hospitality Group; and Matt Hollywood

Those who closed down for good included Matt Ward Productions; Pretty Handsome cafe; Espresso Moto; Frida Sol Mexican; and Hunky Dory.

Apartment buyers: Not only were they grappling with uncertainty over whether their builders would be around long enough to finish their projects, but off-plan buyers had more stress coming their way in 2024.

Buyers of thousands of apartments under construction, who signed contracts before an unexpected pandemic property boom, were at risk of losing them thanks to a single line in their contracts with developers.

Sunset clauses have always allowed either party to cancel a contract if construction has not completed by an agreed date, but 2024 was the year apartment developers started using them to destructive effect.

The clauses create a lucrative incentive for developers to cancel pre-sale contracts and resell apartments at far higher prices.

New Queensland laws for the sale of land were introduced in November 2023 – requiring written consent from a buyer before a contract can be terminated, or a Supreme Court order – but the amendments did not extend to apartments.

Among the projects where buyers are on shaky ground is Midwater at Main Beach, where prices have swelled by 88 per cent cent since more than 100 buyers signed up in 2021.

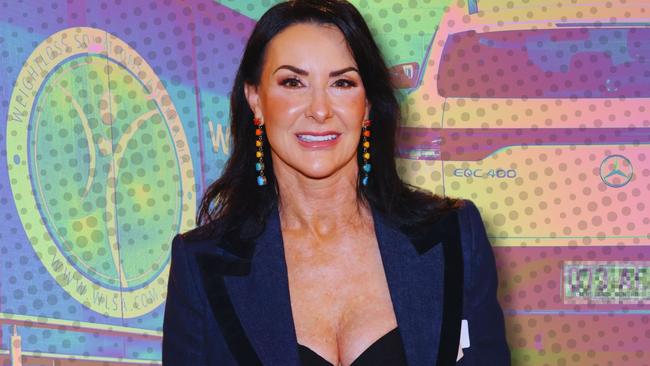

Weight Loss Solutions Australia: Debts of almost $3 million were unearthed by liquidators of two companies behind Gold Coast business Weight Loss Solutions Australia – with more likely as other companies in the group falter.

Felicity Jane Cohen, 59, CEO of Weight Loss Solutions Australia, oversaw the series of company collapses which left creditors millions of dollars out of pocket.

Weight Loss Solutions Australia facilitates bariatric surgeries and other slimming procedures from its headquarters at Varsity Lakes.

Staff of WLSA are owed more than $360,000 in unpaid superannuation and entitlements, with multiple former employees coming forward to talk about their struggles with the company.

A WLSA patient finally received a refund for her cancelled surgery more than a year ago, only after her story was published in the Gold Coast Bulletin.

Beau Hartnett: You can’t make a list of losers without mentioning the Gold Coast lawyer

who wildly overcharged an elderly client, continued to invoice her after she died, then went after her kids for more money.

When he’d exhausted his appeals, Hartnett claimed he was broke and entered a personal insolvency agreement while avoiding bankruptcy.

The deal meant an elderly man owed almost $600,000 by Hartnett would see less than three cents for every dollar despite the latter living in a $3.25m mansion with $9.5m in declared interests in trusts.

In 2024, his behaviour led to a Federal investigation, after the Gold Coast Bulletin brought it to the attention of the Inspector General in Bankruptcy.

Despite ongoing court action and the insolvency, the Queensland Law Society allowed him to keep practising law, despite his certificate being on hold.

He was finally struck off the register in December after voluntarily withdrawing his application to renew his certificate.

The Federal Court case is scheduled for a three-day hearing from January 28.

Furniture chain customers: Johnny’s Furniture, which had 15 stores in three states, left hundreds of unhappy shoppers without products or refunds.

The company, with stores in Brisbane, Melbourne, Sydney and the Gold and Sunshine Coasts, went into administration owing money to lenders, staff, customers, the ATO, related parties and other government revenue offices.

Documents lodged by administrator Shumit Banerjee of Westburn Advisory revealed director John McDonald had been negotiating with another furniture chain, Home Sweet Home, on a possible joint venture.

Home Sweet Home Group, which had more than 10 stores throughout regional NSW, itself went into administration in 2021.

Meanwhile HSH boss Daniele Maisano was caught embellishing his CV with what appeared to be inflated claims of academic and sporting prowess.

The entire profile was removed after the Bulletin contacted Mr Maisano for a response and he did not respond to questions.