Homes half built, huge debts: Qld insolvencies reach record levels

Small businesses have been crushed and building sites abandoned amid a construction crisis now the worst in 15 years. MAPPED LIST OF COLLAPSES

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Queensland streets are littered with the shells of half built homes and high rises as collapsed builders abandon work sites in the worst 12 months for the construction industry in 15 years.

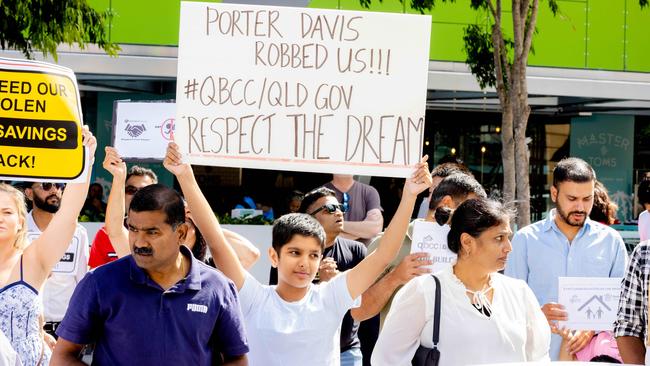

Thousands of homeowners, subcontractors and suppliers across Queensland have been devastated by the failures.

Soaring costs, prices and interest rates, record demand and cowboy operators have been blamed for the wreckage, which coincides with a crisis-level housing shortage.

The number of Queensland construction businesses that have gone bust is up by a staggering 194 per cent in the past two years.

Among the casualties is a young nurse, whose Gold Coast home is achingly close to completion but can’t be sold or lived in after the collapse of Skyfield Homes.

The unpaid subbies won’t sign off on their work and no other company is willing to finish the home - one of 50 left in limbo by the same builder.

A young medical worker, who saved nearly $50,000 for a deposit on an off-the-plan apartment, now fears she’s been priced out of the market forever after her builder collapsed.

She is just one of 60 buyers in that Gold Coast project.

Around the state, home buyers are juggling rent with bank payments for homes that are unfinished - or in some cases not even started.

Also counting the costs are the state’s subcontractors - usually small and medium family businesses - repeatedly left with the bulk of unsecured debt when a builder goes under.

Efforts by regulators are failing to stem the flood, with fudged financials and a lack of meaningful enforcement blamed for emboldening unscrupulous operators.

Liquidators say despite insolvent trading occurring in “virtually all” building company failures, corporate regulator ASIC has never prosecuted a director for the crime.

At a state level, the QBCC is under fire for not doing enough to ensure builders are prevented from taking on more work than they can handle, risking the livelihoods of homeowners and subcontractors when they inevitably collapse.

Liquidator reports indicate the industry is rife with operators willing to fudge financial statements to keep failing builders licensed.

In his 40 years as a liquidator, Michael Caspaney of Menzies Advisory said he’d never seen the industry in a worse state.

“It’s really in a bad way at the moment, it’s a perfect storm for builders,” he said.

The Skyfield victim, who asks to be called Sherry, can’t hold back her tears as she provides a tour of what was to be her family’s waterfront dream home at Helensvale.

The two-storey home, surrounded by headhigh weeds, is close to completion – but not close enough to live in.

The last of the subcontractors, left unpaid by the collapsed builder, have refused to sign the paperwork needed to occupy or insure the house. Other builders won’t take on the job. Unable to move in and unable to sell, Sherry’s family is stuck.

While insolvencies across all sectors are at record levels, the construction sector is growing at a faster rate, now representing 27 per cent of all company failures nationally, compared to 17 per cent 10 years ago.

Construction is Queensland’s second largest industry behind health care, employing almost 10 per cent of the state’s working population, according to the ABS.

The number of construction companies falling over snowballed to 465 last financial year in Queensland – up from 281 a decade ago.

Mr Caspaney, liquidator for Skyfield and collapsed giant Cullen Group among many others, said the combination of a labour shortage, inflation and poor financial management had contributed to the maelstrom.

“A legacy of Covid and the Ukraine war is that prices went through the roof – one guy told me roof trusses went up 40 per cent in a month,” he said.

“There’s so much demand for people that want a new house, but the industry doesn’t have the ability to service that demand.”

The industry’s viability is also crippled by its own structure – maligned in government inquiries and commissions stretching back at least a decade.

In a pyramid topped by big lenders, developers and large construction companies, the actual work is funded in advance by subcontractors, the bulk of which are small to medium family businesses.

When a big builder goes bust, unsecured subbies are almost always the hardest hit.

The State Government passed new laws in 2018, requiring builders to set up a designated trust account to protect money meant for subcontractors for every building project over $1m.

But rollout of the measures stalled, with full implementation not set to take effect until October 2025, leaving subcontractors exposed in the event of a builder collapse.

Housing, Local Government and Planning and Minister for Public Works Meaghan Scanlon said the government was committed to the trust accounts.

“We continue to monitor and work on these reforms, with industry telling us they want a phased rollout to deal with market pressures and the ongoing development of software to assist with compliance,” she said.

John Goddard, founder of support group Subbies United, said the delay was a “cop-out” by the Government that had likely cost subcontractors and suppliers “hundreds of millions”.

Mr Goddard said builders were using money from developers as cash flow instead of paying subbies, and the accounts could solve the problem.

“These trust accounts are an absolute must for any job, not just for projects over $1 million – even for a house,” he said.

“The software already exists, it’s no big deal - the only builders who don’t want them introduced are the ones who don’t have the cash flow.”

Compounding the problem is evidence from liquidations that big building companies had been fudging their financial records in order to keep their QBCC licences – effectively enabling them to trade while insolvent.

“The problem for many of these companies is that they shouldn’t have had a licence,” Mr Caspaney said.

“The figures that are being submitted to the QBCC for the minimum financial requirements MFR) are made up so they comply.

“One company, I won’t mention its name, put $500,000 in the bank so they could meet their MFR, but two days later the money went back to wherever it had come from.

“There’s no way some of those companies would have passed their MFRs if they had told the truth.”

A statement from the QBCC said it “actively monitors compliance with these financial requirements”, describing its system as “robust”.

The regulator said it could not comment on specific cases but was able to request monthly management accounts, undertake financial audits and take action on licences when it was concerned about a builder’s finances.

“If the QBCC believes the information is false or misleading, and it has been verified by a qualified accountant, we have a number of actions we can take, including issuing a warning, excluding the individual from providing annual reporting or reporting them to their accounting body,” the statement said.

“Since the MFR legislation was introduced in 2019, there have been 15 accountants excluded by the QBCC for providing misleading information.”

There is currently only one accountant in Queensland who is currently banned.

Ms Scanlon said the QBCC had sufficient powers to suspend and exclude people who falsified information.

“I expect the QBCC to exercise those powers appropriately,” she said.

Also geared against subbies is a quirk in the insolvency process which means they often have to repay money they did receive for their work – even when they’re owed more money – if it’s decided they “should have reasonably known” the builder was going broke when they were paid.

The clawback system, known as preferential payments, will see subcontractors stung in the GCB Constructions collapse repay as much as $72 million between them.

Preferential payments feature in nearly all construction liquidations, sometimes costing subbies tens of thousands in legal bills on top of money lost in the collapse itself.

Mr Goddard, a victim of “dozens” of liquidations himself, said he now advised subbies not to chase late payments in writing, as it could be used as proof they knew the builder was in trouble.

“The laws are archaic, they’re too old for current commercial industries like the building industry,” he said.

Shadow Housing Minister Tim Mander did not answer questions on project trust accounts or the QBCC.

“As part of its Securing Our Housing Foundations plan, the LNP has committed to reintroducing a Productivity Commission if elected,” he said in a statement.

“The LNP will boost building industry productivity by tasking the Productivity Commission to identify ways to remove red tape, increase productivity, while protecting safe work sites, well paid workers and honouring contracts.”