Descon’s Danny Isaac, aka Sami Adib, was bankrupt when granted directorships, builder licences

The head of a besieged development group registered companies and ran a national construction group for seven years while he was bankrupt. Read how it happened

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The head of a besieged development group was an undischarged bankrupt when he registered multiple companies and obtained builder licences in NSW and Queensland - running national construction businesses for seven years while bankrupt.

Insolvency records show Sami Adib, now known as Danny Isaac, was bankrupt from September 5, 2011 until December 24, 2020, but was able to direct companies, obtain loans and insurance bonds worth untold millions and win billions of dollars in construction contracts.

Bankrupt individuals are not eligible to hold Australian company directorships or builder licences.

ASIC has responded to the revelations, saying it had “no way of knowing” Mr Adib and Mr Isaac were the same person and that it took registrations from directors at “face value”.

The regulator said it would investigate the claims.

Mr Isaac was bankrupt for more than nine years before he settled the debts - telling his bankruptcy trustee he was unaware he’d been bankrupt because he had moved interstate.

Company and insolvency documents show Mr Adib left Western Australia - where he was bankrupted and three of his construction companies had been wound up by the courts - before beginning a new east coast life as Danny Isaac.

Mr Isaac is head of the Descon and Adcon groups, which are the subject of numerous current court dispute and statutory debt claims, including one case where he and Descon were being sued for up to $122m.

According to the insolvency records, Mr Adib was declared bankrupt after a successful petition from a Mitre 10 business in WA and remained that way until Christmas Eve of 2020, when the debts were paid in full.

David Hambleton of Rodgers Reidy was appointed the bankruptcy trustee shortly before the bankruptcy was discharged.

Mr Hambleton said Mr Isaac had been “unaware that he was an undischarged bankrupt” and that he’d never been insolvent.

Mr Hambleton said it was not his role to “investigate the personal affairs of individuals”.

“It’s not unusual for bankrupts to have multiple aliases,” he said.

“It was all relatively innocent, I was aware that Mr Adib was a director of a number of companies while he was in bankruptcy.

“There was no evidence he was aware he was an undischarged bankrupt.

“On becoming aware he immediately deposited the funds into my account ready to pay out his bankruptcy.”

Owners of Ultra penthouse fight to evict Descon Group Australia boss Danny Isaac over rent

Mr Hambleton said the initial bankruptcy trustee was the Australian Financial Services Authority, which lost track of him when he moved from Western Australia to the east coast.

“After his estate went into bankruptcy they couldn’t actually find him when he changed states,” he said.

“It was pretty unusual circumstances, it’s not often I get parachuted into an estate that is solvent.

“I found he still had bank accounts in that (Sam Adib) name when I was appointed.”

ASIC records show Mr Isaac is currently a director of 28 companies, to which he was appointed during his period of bankruptcy.

Mr Isaac’s other identity as Mr Adib was revealed by the Gold Coast Bulletin in July, after being included in court documents filed by the ATO, when he pleaded for the masthead not to report his name change.

“It’s very very personal,” he said at the time.

The Bulletin has contacted Mr Isaac for comment on the bankruptcy.

The dynamite revelations have caused outrage among suppliers, subcontractors and others who have peppered the group with millions of dollars worth of debt claims and court cases.

The group hurriedly vacated its head office in Sydney, on the exclusive waterfront at Pyrmont, after it was threatened with a lockout over alleged unpaid rent.

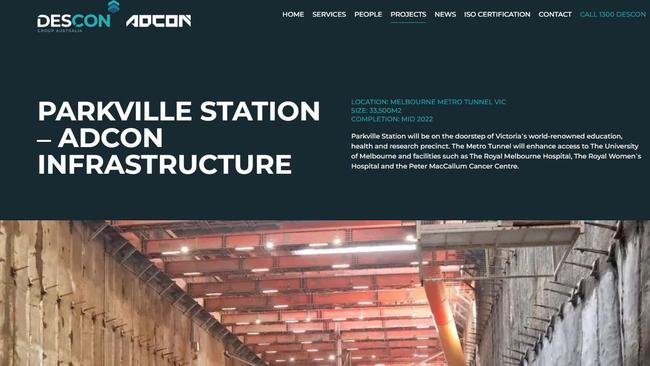

Its projects have included hotels, high-rises and large-scale public works - including the Parkville and CBD North train stations in Melbourne.

Three Adcon companies, as well as related Descon Group Australia, hold expired licences in NSW.

Orion Towers off, Hamilton Towers site for sale after $70m deal with Descon Group fails to settle

Mr Isaac himself holds a qualified supervisor certificate in that state and was supervisor of Adcon Formwork before its licence expired last month.

In Queensland, QBCC records show Adcon Qld cancelled its $140m revenue open building licence in March, a month after the QBCC banned it from working in that category for not having a suitable nominee.

Mr Isaac had been the named director and supervisor since January 2014.

Descon, which holds the highest category licence available, for maximum revenue over $240m, obtained its licence in July, 2018.

Mr Isaac is named on the licence as its director and secretary since August 2019 – more than a year before the annulment of his bankruptcy, under the name Adib.

Mr Isaac has also held an individual carpentry licence, graded as a nominee supervisor, since 2014.

Descon has dropped out of billions of dollars worth of Gold Coast construction projects in the past 10 months, including the billion-dollar V&A Broadbeach project in the centre of the tourism hub and the billion-dollar Imperial Square development at Southport, the Gold Coast’s CBD.

Despite the companies’ readily-available and much-publicised financial problems, all three Queensland licences remained active on Friday.

Mr Isaac is being sued by the Deputy Commissioner of Taxation, under the names Isaac and Adib, for more than $3.2m in alleged unpaid tax.

It’s just one of scores of current court cases involving Mr Isaac and his companies, with most centred around payment disputes.

Mr Isaac, 36, was director of six concrete formwork companies when he was known as Sami Adib, ASIC filings show.

Three have been deregistered, while the other three were wound up by the courts and placed into liquidation, the most recent in February 2013.

In March the same year, using the name Danny Isaac, he formed the first of his Adcon companies, Adcon Qld, which is now part of his wider Descon Group.

No one by the name of Danny Isaac had ever been director of a company before that date, and Sami Adib has not been a director since.

A statement from ASIC said it was “not routinely notified” when somebody was made bankrupt, with the onus on an individual to comply with the Corporations Act.

“Currently, when documents are lodged with us, in most circumstances we accept the documents at face value and do not make inquiries about whether the information is accurate,” the statement said.

“Our registration of a company’s notifications does not mean that we validate the information.

“The register is merely a record of company notifications to ASIC.”

ASIC’s statement said it was an offence to lodge false information with ASIC.

“Unless information is brought to our attention, ASIC could not be aware that Mr Adib had changed his name and even if we knew Mr Adib was an undischarged bankrupt, we could not have identified that Danny Isaac and Sami Adib were the same person and that he was automatically disqualified from managing companies as a result of bankruptcy,” the statement said.

ASIC said new and existing directors had been required to obtain a director identification number since last year.

“A director ID is a unique identifier that a director will apply for once and keep forever – which will help prevent the use of false or fraudulent director identities,” the statement said.

“In time, there will be verification against the director ID when a director is appointed but this does not currently happen.

“ASIC will consider the claims that Danny Isaac and Sami Adib are the same person and whether Mr Isaac has been registered as a director or managing companies during the period of bankruptcy in breach of his automatic disqualification due to bankruptcy.”

John Goddard, whose advocacy group Subbies United supports subcontractors stung by builders who don’t pay, said the revelations make a mockery of a system purportedly designed to protect consumers and subcontractors.

“Wow. ASIC and the QBCC obviously haven’t done their job,” he said.

“ASIC are just hopelessly incompetent- they are just too small, overworked, underfunded and outnumbered.

“And I have no time for the QBCC, they’re just utterly useless and of no help.”

The QBCC said it was unable to comment on individual cases due to privacy obligations.

“When applying for a QBCC licence, all applicants are posed a series of questions to establish that they are fit and proper to hold a licence,” it said in a statement.

“Just like when an individual applies for a driver’s licence, when a person provides a statutory declaration to the QBCC, it is a legal document and there are penalties under law if that individual knowingly commits the offence of fraud.

“If the QBCC finds evidence of false information being provided, it will take action which can include contacting other agencies such as the Queensland Police Service.

“The QBCC can also take action when it is determined a person may not be fit and proper to hold a contractor’s licence. This action can include, but is not limited to, suspending or cancelling an existing licence.”