‘Worst case scenario’: Fears house prices could plunge by 43.5 per cent

With rising interest rates and a potential recession looming, there are alarming warnings about house prices which could be “catastrophic”.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

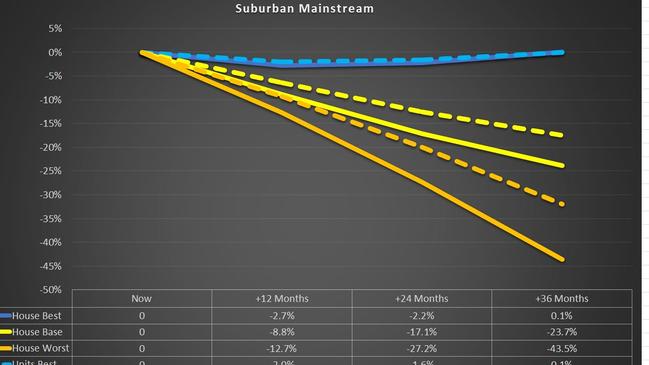

House prices could plummet by as much as 43.5 per cent in 2025 in the “worst case scenario” if the Reserve Bank of Australia continues to push through super-sized rate hikes to tackle the worst inflation in three decades, alarming new analysis has found.

This could mean Sydney’s median house price would fall from its 2022 peak of $1.41 million to just $796,650 – a $613,350 drop in just three years.

Economics research firm Digital Finance Analytics has modelled what could happen to house prices in a worst-case and best-case scenario with rising interest rates, which have gone from a record low of 0.1 per cent to 2.35 per cent in just five months, alongside a potential recession.

It found in the worst case, house prices could fall by 12.7 per cent in 2023, before dropping a further 27.2 per cent by 2024 and plunging as much as 43.5 per cent in 2025.

Wondering what can cause falling house prices? Check out Compare Money's guide >

It would see Melbourne’s median house price fall by $435,000 to a decade-low of just $565,000 after reaching $1 million earlier this year.

The worst case scenario is based on rates rising to above 4 per cent sending mortgages to an average of 7 per cent, inflation remaining high and wages growth stalling due to a recession in Australia.

Digital Finance Analytics principal Martin North said the worst case scenario was relatively unlikely to happen but would be “catastrophic” for many people if it did.

“My own perspective is if you look at the ASX futures, it’s talking about rates at 4.1 per cent in May 2023 and still being above 4 per cent in February 2024. Now that would be pretty concerning as that would represent a mortgage rate of well over 6 per cent and 7 per cent for many people, but I have a feeling that is probably overstating the case,” he told news.com.au.

“The ASX futures has been more accurate than the RBA on interest rates, so if you believe the markets we could be in for a quite significant interest rate shock.

“The RBA knows if rates went that high, it would put tremendous pressure on Australian households and would be well above 2 to 3 per cent buffer from APRA in terms of loan serviceability.”

However, the most likely scenario was far less dire, although house prices were still expected to take a hit.

Buyers’ shrinking budgets

It would see house prices fall by 8.8 per cent in 2023, before dropping again to 17.1 per cent in 2025 and experiencing an even bigger plunge in 2025 to 23.7 per cent.

The base scenario modelling was based on rates rising to 3.5 per cent but no recession.

But Mr North said even in this scenario mortgage rates would still be knocking on 6 per cent for many people.

“That’s enough to put many people off buying as it’s reducing borrowing power considerably and the borrowing power has dropped by 20 to 25 per cent for some householders,” he warned.

“It could go even higher to 30 to 35 per cent and that reduction of credit is enough to drive prices down to the base scenario as the most significant lever of all for house prices is credit availability.”

Best case for house prices

The best case scenario according to the Digital Finance Analytics data is that rates would stay below 2.5 per cent and fall next year, and inflation would ease ahead of RBA expectations, while wages would also jump faster.

This would see house prices fall by just 2.7 per cent in 2023, dropping to 2.2 per cent in 2025 and rising again by 0.1 per cent in 2025.

However, Mr North said this would still be a “shock” as Australians had become used to “dramatic” house price rises.

“There’s still this amazing belief in Australians that property prices double every seven years but I don’t think that’s the case anymore. We are in a new cycle,” he added.

He said there was a 50 per cent change of Australia going into recession, although it was hard to predict as it would be majorly influenced by what happens around the world.

“If recessions are happening in the US and Europe and China goes off boil, our economy is so reliant on international connections, it’s quite difficult to see how we wouldn’t go into recession here,” he said.

What the banks are saying

Westpac has predicted the biggest hike in interest rates forecasting they will hit 3.6 per cent by February 2023, while ANZ has said they will hit 3.35 per cent by December.

The Commonwealth Bank and NAB have the most conservative estimates, predicting rates will reach 2.85 per cent by November.

In terms of house prices, Westpac warned Aussies about an 18 per cent fall in Melbourne and Sydney by the end of next year, which was also forecast by Commonwealth Bank.

However, the rest of the country was a much more sedate drop, of around 8 per cent on average, according to Westpac.

But CBA said house prices will drop by 15 per cent over the next 18 months across the country.

A 15 per cent drop in the median property price would see the value of the average property falling by $150,000.

NAB went even further and predicted house prices in Sydney and Melbourne could fall by 20 per cent or more by the end of next year.

ANZ also released a similar forecast, with capital city prices tipped to drop by 18 per cent by the end of next year before climbing by 5 per cent in late 2024.

Homeowners and buyers

When it comes to homeowners, Mr North recommends they check their rates and shop around.

“People are sitting at 1 to 1.25 per cent above the best rates according to my research, so shop around,” he said.

For those facing financial hardship, he advised them to look at their cash flow and cut costs where possible but also talk to their bank early.

“Banks are required to help when people get into hardship and have various schemes and strategies. The one they are doing at the moment is offering to extend the life of the loan, so if you have 15 years left on your mortgage they will put it up to 25 years,” he said.

“It reduces payments but it means paying a lot more interest for a lot longer and it benefits bank as they don’t have a problem with defaults and more interest earned means more profit for shareholders. Do you really want to lock yourself in? Shop around first before you start extending the life of the loan.”

For buyers he said it might be “sensible to hang off” as further prices slides are predicted but if they do buy, make sure they can afford rises of up to 3 per cent.

He added property investors should just forget it as there is no value in the current cycle.

The cost of rising interest rates

If interest rates keep rising by a full 1 per cent between now and December as predicted by two of the big banks, monthly repayments on a $500,000 loan over 30 years could rise by $318 by Christmas.

This is in addition to the $652 already added to repayments from May, according to Canstar.

Mortgage holders with a larger loan size of $1 million over 30 years could be faced with factoring in an extra $635 by December, taking the potential total increase in repayments from May to a staggering $1939 per month.

Canstar research shows a 0.5 per cent interest rate rise in October could add $157 to monthly repayments based on a $500,000 loan over 30 years.

The Australian Bureau of Statistics’ new monthly measure of inflation showed the pace of price rises hit 7 per cent in July before easing slightly in August, down to 6.8 per cent – meaning more rate rises are likely.

Meanwhile, Wall Street bank Morgan Stanley expects the entire post-Covid housing price boom in Australia to be retraced, now forecasting prices will fall 20 per cent nationally peak to trough.

It says the housing downturn will “easily be the largest in recent history”.

More Coverage

Originally published as ‘Worst case scenario’: Fears house prices could plunge by 43.5 per cent