Morgan Stanley forecasts Aussie house prices to plummet 20 per cent

Morgan Stanley warns the housing downturn in Australia will “easily be the largest in recent history”, with prices forecast to fall a staggering amount.

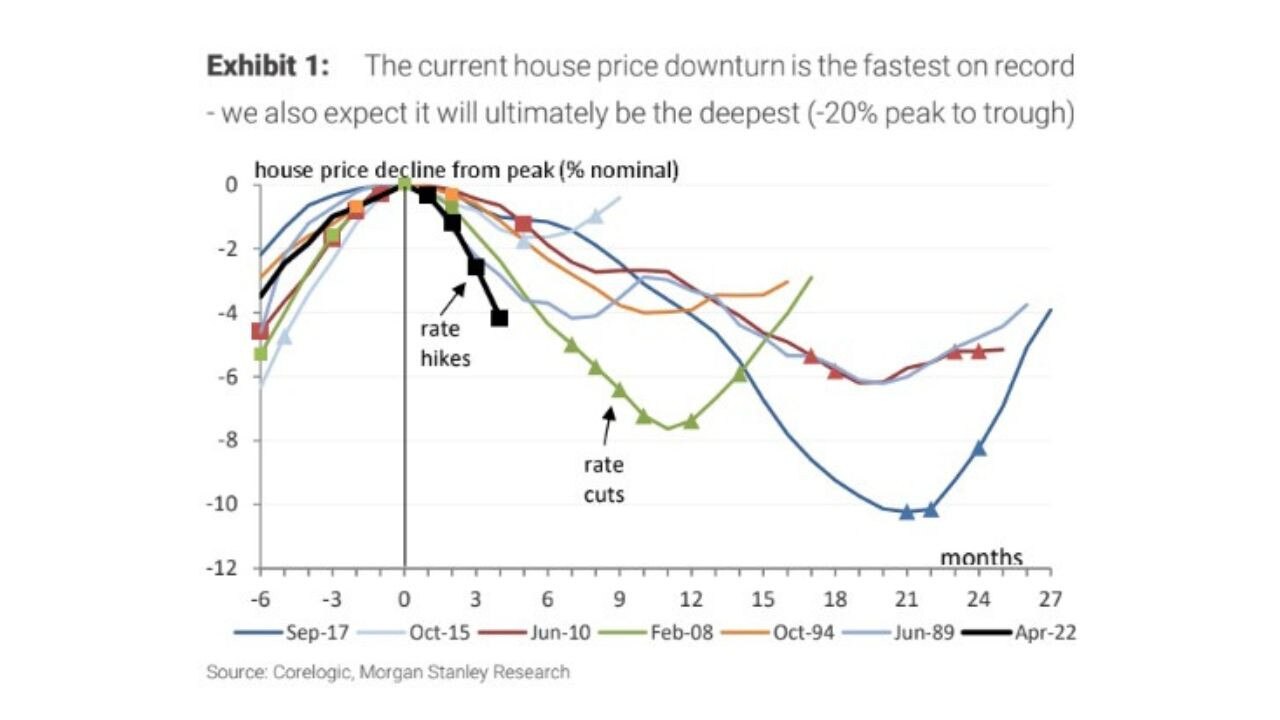

Wall Street bank Morgan Stanley expects the entire post-Covid housing price boom in Australia to be retraced, now forecasting prices will fall 20 per cent nationally peak to trough.

It says the housing downturn will “easily be the largest in recent history”.

In a new Australian research report this week, Morgan Stanley revealed it had revised its forecast from a 15 per cent to a 20 per cent decline in house prices, which, according to the bank, would be the largest nominal price decline in at least the past 50 years.

The bank said the 20 per cent fall would be more than double the size of the previous largest house price correction, which was 10 per cent in 2017-19.

Concerned about falling house prices? Check out Compare Money's guide >

It warned it would be a comparable adjustment to what was seen during the Global Financial Crisis in the US. House prices dropped 19 per cent from 2007-12.

Although, it said, Australia’s adjustment would come with much larger equity buffers and be a much faster correction.

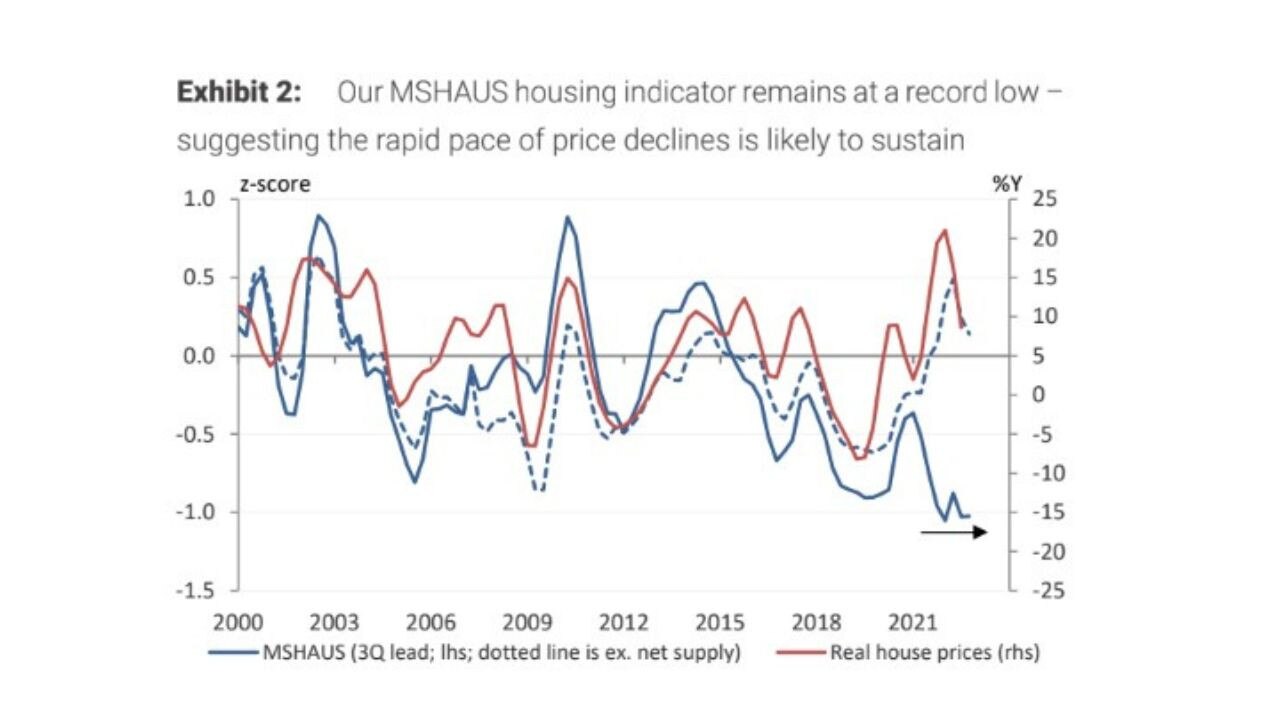

“The housing upswing over 2020/21 was one of the largest on record – increasing 25 per cent from the trough in September 2020 to the peak in April 2022,” the report authors wrote. “However, the reversal since May has been just as quick, with prices falling 4 per cent nationally in four months – the fastest start to a housing downturn on record.”

They said “the clear swing factor” for both the upswing in prices and current reversal was interest rates.

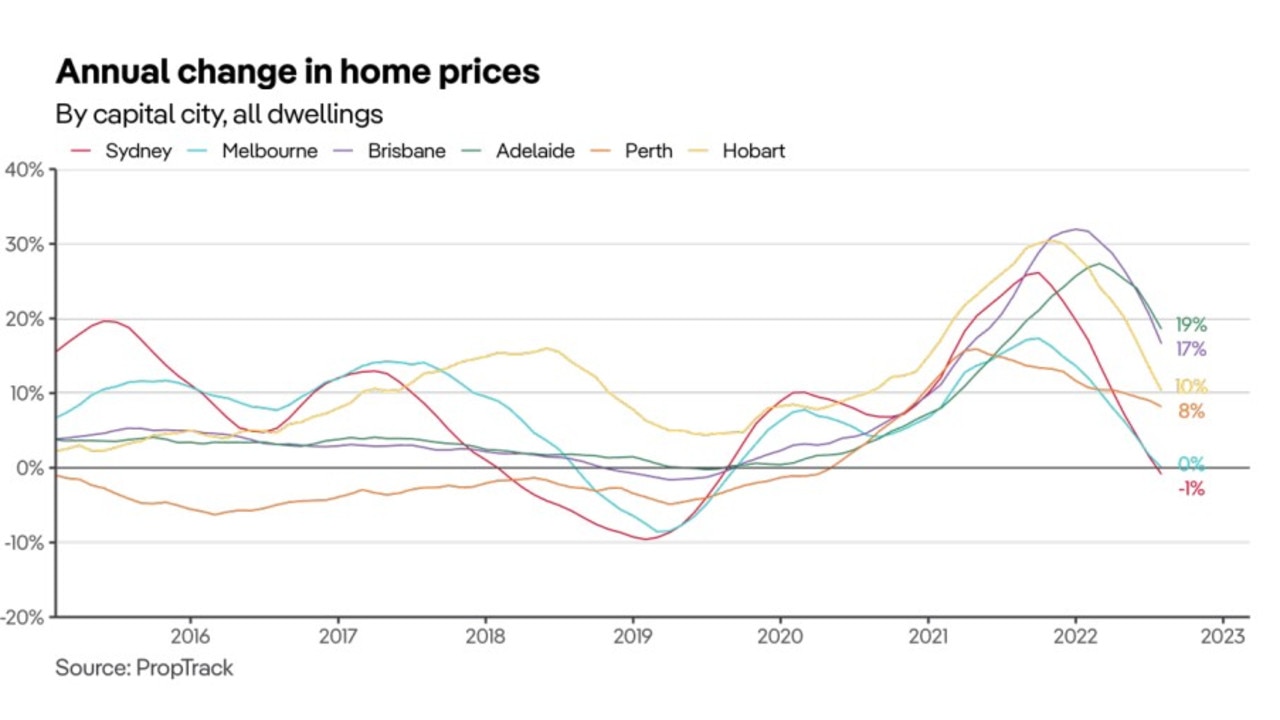

The report said Sydney “clearly” looks the most vulnerable to price correction as it has the highest sales prices in the country and therefore the most sensitivity to interest rate changes.

“Melbourne also has relatively high prices, but should benefit more from a reversal in migration flows – having seen significant international and interstate outflows during Covid,” it said.

Of the other cities, Brisbane was noted as “exposed” to big declines.

Apartments are expected to be more resilient than detached houses during this downturn.

Interest rates to keep rising

House prices are expected to continue to fall into next year as the Reserve Bank of Australia hikes the cash rate.

There was a fifth consecutive rise in September, which brought the rate to 2.35 per cent. That’s a seven-year high.

RBA governor Philip Lowe said again: “The Board expects to increase interest rates further over the months ahead.

“The Board is committed to returning inflation to the 2–3 per cent range over time. It is seeking to do this while keeping the economy on an even keel,” he said in a statement.

The annual inflation rate hit 6.1 per cent in the year to June and is expected to tip 7.75 per cent by the end of the year.

Dr Lowe has said he wouldn’t be surprised if Australian house prices fall by an average of 10 per cent.

Morgan Stanley said its forecasts were “clearly much more cautious” than that.

Current housing market

National home prices fell 2.7 per cent from their peak to August and have retraced all their early 2022 gains, according to PropTrack’s latest Home Price Index.

It will release its newest report this weekend.

“Regional areas have recorded their largest quarterly price falls in a decade, but we continue to see the biggest price falls in Sydney and Melbourne, with Sydney prices now below their level a year ago, and Melbourne unchanged,” the August report said. “All capitals are now below their price peaks, with Adelaide recording its first monthly price fall this year.”

More Coverage

However, this does not mean people have stopped selling. Despite prices falling, market activity picked up in August ahead of the typically busy spring season.

New listings nationally on realestate.com.au were 9.9 per cent higher month-on-month in August, capping off the busiest winter for new listings in five years.

PropTrack economist Angus Moore explained: “While market conditions have changed, the fundamental drivers of demand remain strong, with unemployment very low, wages growth expected to pick up over this year, and international migration increasing.”