‘Unaffordable’: Qld suburbs where renting is a financial nightmare

Queensland’s crippling rental crisis is officially the worst in Australia, and it is not just the southeast corner that is feeling the heat. RENTAL CRISIS MAPPED

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

- Mike O’Connor: Another day, another disaster

- Hitting Home: Tenant, landlord horror stories

- Analysis: Housing crisis needs urgent action

Queensland’s crippling rental crisis is officially the worst in Australia, with Brisbane recording the sharpest decline in affordability and regional Queensland named the least affordable regional market in Australia.

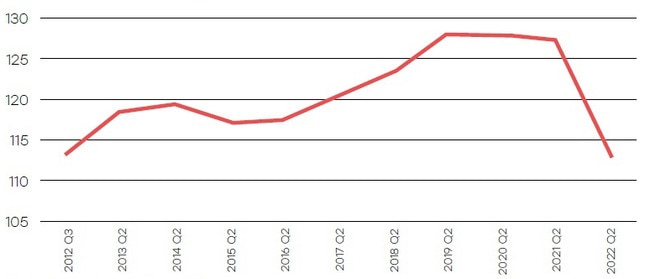

The sobering revelation was revealed in the national Rental Affordability Index (RAI) report, which noted that declining affordability was extending beyond the southeast corner.

The index, which was developed by National Shelter and SGS Economics and Planning, measures housing stress by indicating rental costs relative to household incomes.

It found that the Brisbane suburbs that have experienced a notable decline in rental affordability this year included those in the eastern suburbs, from Yeerongpilly through to Birkdale.

Meanwhile, suburbs on the outskirts of Greater Brisbane, including Woodford, Rosewood, Sandstone Point and Caboolture, declined in affordability by between 10 to 20 per cent over the past year.

Rental affordability in regional Queensland has also reached a historic low point, according to the report.

The downward trend in affordability also continued on the Gold Coast, as well as in Cairns and other regional cities and towns.

‘If you are a single pensioner living in Brisbane spending 53 per cent of your weekly income on rent then life is really tough,” Q Shelter executive director Fiona Caniglia said.

“It isn’t possible to pay for other living costs, and people go without.

“We are hearing from people who are in a state of chronic anxiety about their future.”

For young people on a job seeker payment and rent assistance, the situation is even worse, with the report showing some are spending a staggering 92 per cent of their income on rent.

And it is only going to get worse, with almost 200 properties across the state listed as “break lease” rentals, with many increasing rents at the end of the term.

A Noosaville house is listed for rent for $595, but that will increase to $710 from March – an increase of $115 a week.

The new tenants for a house in Miami will be paying $250 a week more from May, with the rent increasing from $1400 to $1650.

RELATED: Qld rental crisis: ‘Virtually nowhere to go’

The decline in affordability comes at the same time as vacancy rates across Queensland hit record lows in many areas.

The tightest rental markets in Queensland can now be found in Goondiwindi, Southern Downs and the South Burnett, according to the latest REIQ Vacancy Report.

But the biggest decrease in vacancy rates over the last quarter were in Brisbane’s inner city suburbs, Caloundra, Whitsundays and the South Burnett, with each of those markets recording a fall of 0.2 per cent.

Nineteen markets “plateued”, with vacancy rates unchanged from the previous quarter.

“These statistics aren’t just numbers, they tell a story about how challenging it is for people struggling to find a home,” REIQ CEO Antonia Mercorella said.

The RAI report shows that the average rental household in Greater Brisbane has a gross income of $99,428 a year, but after sharp declines in affordability over the past two years, the city was now considered “moderately unaffordable” for the first time.

Helensvale, Broadbeach, Robina and Noosa are now considered “severely unaffordable”, while Maroochydore has become “unaffordable”.

The Community Housing Institute Association report, released last week, also found that 81,000 people in regional Queensland and 71,100 people in Brisbane did not have housing to meet their needs.

Successive natural disasters, record high migration to the Sunshine State, an exodus of investors and traditional rentals going into short-term letting pools have all combined to push the rental market to the brink.

SEE THE RAI INTERACTIVE MAP HERE

The Great Deluge Report by the Climate Council revealed that Queensland has copped approximately $30 billion in damages since the 1970s – about three times the amount recorded by Victoria.

The report said that Queensland suffered about $7.7 billion in social, financial and economic impacts due to the rain bomb and floods earlier this year alone, while Brisbane suffered $1.38 billion in insured losses.

University of Queensland economist Professor John Quiggin said that one in every 25 Australian properties would effectively be uninsurable by 2030.

The rental crisis has forced some renters, many of whom have never experienced such tough conditions to find a home, forced to live in caravan parks, tents and cars, with many others couch surfing to put a roof over their heads.

Floods: Where Qld owners are selling back their homes

Building boom over? Qld new home sales crash