New home sales slump in Qld as rate hikes bite hard

New home sales in Queensland have tanked, with the Sunshine State recording the biggest drop in Australia during the October quarter. And it may only just be the start.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

NEW home sales in Queensland have tanked, with the Sunshine State recording the biggest drop in Australia during the last quarter.

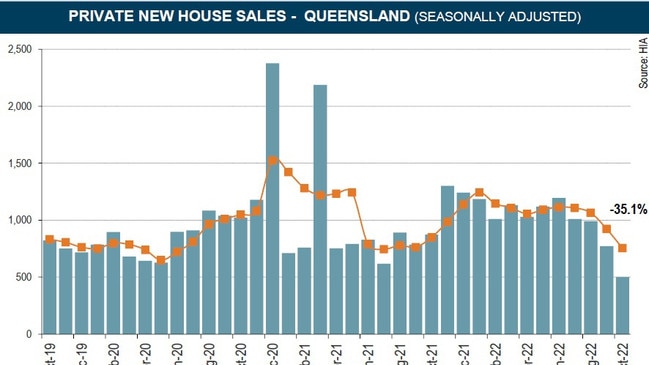

The HIA New Home Sales report – a monthly survey of the largest volume home builders in the five largest states – has revealed that new home sales slumped 35.9 per cent last month, and 31.9 per cent over the quarter, compared to the previous quarter.

Since the same time last year, new home sales in Queensland fell 11.3 per cent.

MORE NEWS: Qld rental crisis: ‘Virtually nowhere to go’

Interactives: Aerial images reveal pace of change in Qld’s fastest growing suburbs

Adrian Portelli gives away Gold Coast mansion after The Block bidding war

By comparison, new homes sales in the October quarter, compared to the previous quarter, fell 22.8 per cent in Victoria, 19.6 per cent in NSW and 9.1 per cent in Western Australia.

NSW recorded the biggest decline in October, down 36.9 per cent, according to the report.

South Australia was the only state to see an uptick in new homes sales during the quarter, rising 18.8 per cent, but declining 13.9 per cent in October.

HIA chief economist Tim Reardon said that sales of new homes nationally dipped 22.8 per cent in October as the weight of increases in the cash rate slows building activity.

“Sales of new homes had already fallen 15.8 per cent nationally in the three months to the end of September, due to the increases in the cash rate starting in May 2022,” he said.

“The increase in interest rates is compounding the rise in the cost of new home construction and further reducing the capacity of borrowers to finance the build of a new home.

“But it is very clear, even before the October and November increase in the cash rate started to impact on sales, that this building boom is coming to an end.”

Mr Reardon said that the fastest increase in the cash rate in almost 30 years would see detached home building activity slow to its lowest level in a decade by 2024.

He warned that if those rate rises did not ease, the Federal Government’s goal to build one million homes within five years would be “very difficult”.

And that’s not the news that buyers, or renters in particular, will want to hear as the state grapples with arguably its worst rental crisis in living memory.

The latest REIQ Vacancy Report, released on Wednesday, revealed that there was now “virtually nowhere to go” in some parts of Queensland, with vacancy rates dropping to just 0.1 per cent in three regions – Goondiwindi, Southern Downs and the South Burnett.

And it is not much better in Maryborough or the Tablelands, where the vacancy rate is 0.2 per cent.

There were just five regions with vacancy rates above 1 per cent – Noosa (1%), Gladstone (1%), Isaac (1.1%), Mount Isa (1.3%) and the Bay Islands (4.3%), which was the only region to fall above the healthy rage of between 2.6 and 3.5 per cent.

REIQ CEO Antonia Mercorella said it was unlikely vacancy rates would see any significant shifts in the foreseeable future due to complex supply and demand constraints.

She said that the State Government had identified that Queensland had 55,000 fewer rental dwellings than expected based on historical trends and forward projections.

“We know there are various obstacles which have been holding back our state’s housing supply and pathways to home ownership,” she said.

“This is what needs to be rectified in order to restore some balance to the market and address the true cause of the crisis – while also finding remedies for the symptoms.”

The HIA report shows that new home sales in Queensland peaked in December 2020 and again in March 2021, but they have been falling sharply since July.

At the same time, several developers have shelved projects in recent months, while a host of building firms have gone bust due to rising construction costs and trade shortages.

But Mr Reardon said that while there had been sharp declines in new home sales, there remained a significant volume of home building under way, and many homes were still yet to commence construction.

“This will ensure that work on the ground remains strong through 2023,” he said.

But he added that other leading indicators were showing signs of deterioration, with owner occupiers and investors “retreating from the market”.

“The full effect of the latest November 2022 increase in the cash rate is not likely to flow through to new home sales fully, until June 2023,” he said.

“And given the longer-than-usual lags in this building cycle, the RBA’s rate hikes to date will similarly take longer than usual to affect the broader economy.

“These treacherous lags will force the RBA to wait longer to see the easing in price pressures that it desires.

“This could result in them weighing too heavily on household finances and jeopardising the housing industry’s future soft landing.”

The RBA will meet again on December 6, with the official cash rate now 2.85 per cent.

Higher than expected inflation figures have many economists tipping another rate hike before Christmas.