MORTGAGE RED ZONES: The Qld suburbs under extreme financial stress

New research has revealed the Queensland postcodes where homeowners are “mortgage stressed”, with a whole host of suburbs tipped to fall into “red zones” by Christmas.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

New research has revealed the Queensland postcodes where homeowners are “mortgage stressed”, with a whole host of suburbs tipped to fall into “red zones” by Christmas.

A red zone is defined as a postcode with more than 7900 households identifying as suffering from mortgage stress.

There are currently five postcodes that have been identified as “orange zones”, or postcodes with between 5000 and 7899 financial stressed households, in southeast Queensland, according to research by Digital Finance Analytics (DFA).

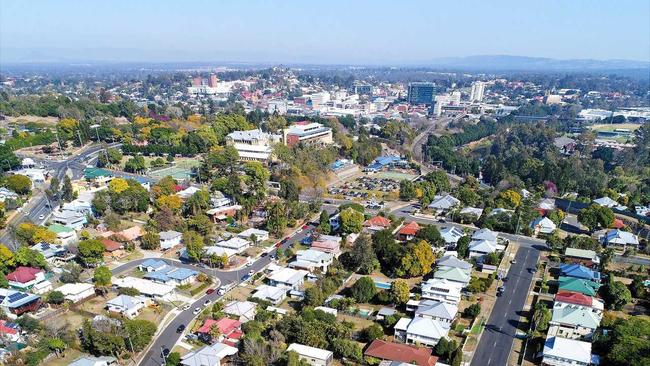

But the postcode of 4350 has the most stressed households, according to DFA founder Martin North.

That postcode takes in 34 suburbs including the likes of Centenary Heights, Toowoomba, Harristown, Kearneys Spring, Mount Lofty, Rangeville and Wilsonton.

Mr North said that of the 47,191 total households within the 4350 postcode, 11,289 identified as being mortgage stressed, the highest in the state.

It is the third most stressed postcode in Australia, he said.

“That’s a lot of people who are stressed,” he said, adding that it was only going to get worse.

SEE THE TABLE BELOW FOR THE FULL LIST

Two NSW postcodes topped the list – 2560 (Leumeah) and 2170 (Chipping Norton).

Also in the top 20 national suburbs for mortgage stress was postcode 4306, which takes in a huge swath of the western suburbs including Ipswich, Amberley, Barellan Point, Benrakin, Blackbutt, Chuwar, Deebing Heights, Fernvale, Karalee, Karana Downs, Kholo, Mount Crosby, Ripley, and Willowbank.

NGU Real Estate Toowoomba principal Robbie Witt said the whole market had changed.

“Two or three months ago, you could put a house on the market and get 20 groups through and 10 offers, but now you get 10 groups through and 1-2 offers,” he said.

“Instead of selling that first weekend, it is now taking several weeks.

“But that sub-$500,000 mark, that’s still going ballistic, and so is quality stock in good pockets, but as a whole, prices have flattened, which had to happen, and borrowers, they just can’t get a loan for what they could just a few months ago.”

Mr Witt said that while he had yet to hear from any owners looking to sell due to mortgage stress, he said it was likely only a matter of time.

He said that for those still looking to buy, it was now a race to beat the next rate rise, which would further reduce borrowing power.

The DFA research reflected mortgage stress as at the end of September, before the latest 0.25 per cent increase was imposed by the Reserve Bank of Australia (RBA) on Tuesday.

The official cash rate is now 2.6 per cent, the highest official interest rate in Australia since July 2013, with inflation at its highest level since 1990.

But it is not just the battler suburbs feeling the heat.

The data shows there are five southeast Queensland postcodes that could become red zones for mortgage stress as rates continue to climb as forecast.

Between 5000 and 7899 households in the postcode of 4034 – Aspley, Boondall, Carseldine, Geebung and Zillmere – are deemed “orange zones”.

Other “orange zone” postcodes include 4305, 4300 and 4152.

Mr North said that while Queensland did not yet have any red zones, or postcodes with 7900-plus households in mortgage stress, it was just a matter of time.

“That’s not to say that there are not a lot of stressed people, there just aren’t as many that are quite as stressed as some other parts of the country, yet,” he said.

“That’s likely because prices in Queensland haven’t historically been as high as some other places, like in NSW and Victoria, and the banks have been a bit tighter on the amount they have loaned as incomes were not as high,” he said.

“But the places where we are seeing the high stress levels, a lot of those can be found in the battler suburbs and the high growth areas, the urban fringes.

“A lot of people who bought in those high growth places recently, they didn’t expect to see rates going up just a month, two months, three months later, and keep going.

“They bought at the top of the market, when rates were at historic lows, but now that’s changed, rates are up, inflation is up, wages are not.”

But the research also shows that there are also plenty of yellow zones, or postcodes with between 3270 and 4999 households feeling the financial pinch.

And those postcodes are spread right across the state, from 4740 (Mackay region) to 4818 (Townsville region), 4551 (Sunshine Coast region) and 4209 (Gold Coast region).

Meanwhile, the least stressed postcodes in the southeast corner, where there are fewer than 264 households under mortgage stress, are centred around suburbs with fewer owner-occupiers, the affordable Bay islands, and the millionaire blue-chip suburbs.

But Mr North said that was not to say there weren’t stressed mortgage-holders, just fewer of them.

“There is always a two to three month delay for rate increases to affect household cashflow so those in difficulty now, that pain will only get worse,” he said.

Mr North added that while it was difficult to compare the current market with times when interest rates were much higher, he said borrowers were “a lot more exposed” now than a few decades ago.

“”Back then when rates were much higher, banks would only really lend two and half times your income but in recent times that’s been 3, 4, 5, 6 times that, so people are way more leveraged now,” he said.

“So we had that huge run up in property prices and now we have rates rising fast.

“Prices will continue to correct but there are a lot of people feeling very exposed right now.”

REA Group director of economic research Cameron Kusher said the problem with asking people if they felt stressed by rate hikes, most would likely say yes.

“Households have accumulated significant savings over the past few years and the best indicator of mortgage stress is default data which remains very low,” he said.

“While that could change based on how fast interest rates have gone up, lenders do try and help people when they are struggling.

“It is not in their interest for someone to default as they lose money and then they have to try and sell in a tougher market.

“Borrowers can have discussions about switching to interest only or extending the life of their loan.

“Regardless, if you are struggling, it is best to have that conversation earlier rather than later.”

Ray White economist Nerida Conisbee said it was not surprising to see growth areas in the mix.

“That’s where you tend to find first home buyers who, traditionally, are at the start of their potential earning power and often have to borrow more,” she said.

“But there are some buffers in place. We know that people saved quite a lot of money during the pandemic and banks were forced to factor in a 3 per cent buffer at least before giving out loans.

“If they did their job, then borrowers should have the capacity to repay their loan.”

Ms Conisbee also urged homeowners to play the long game.

“People do get put off buying a home when rates go up but we also know that those who do own their own home are in a vastly better position financially later in life,” she said.

“When you look at the scale of stress, renters are the ones who are really struggling to pay or even put a roof over their heads.”

MORE NEWS: Qld home buyers: How you lost $100,000+ in five months

5000 days on the market: The Qld properties that just won’t sell

Buy here: John McGrath reveals top Qld suburb picks for 2023

Originally published as MORTGAGE RED ZONES: The Qld suburbs under extreme financial stress