Qld home buyers: How you lost $100,000+ in five months

Buyers have seen hundreds of thousands of dollars wiped from their budgets in just five months, with data showing just how many more suburbs are now out of reach.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Buyers have seen hundreds of thousands of dollars obliterated from their budgets in just five months, with new data showing that first home buyers are facing the very real prospect of being priced out of a whopping 850 house suburbs across Queensland.

Analysis by PropTrack shows that a buyer with a $500,000 budget in April, now has a borrowing capacity of just $401,597 --- $98,403 less.

The latest REA Market Trends report shows that there are 264 suburbs across Queensland with a median house price below $382,000, and it is slim pickings in the populated southeast corner.

MORE NEWS: Interstate investors snub Qld market, set for major selloff

5000 days on the market: The Qld properties that just won’t sell

10,000 regional spots open for homebuyers with 5pc deposit

In Brisbane, the only house suburbs where first homebuyers with a borrowing capacity of $382,000 could afford to buy are in the Bay islands.

In the Moreton Bay region, only Brendale and Kilcoy are options at that price point, with Ipswich offering the greatest selection of suburbs.

On the Gold Coast, there are just two suburbs, Stapylton and South Stradbroke, while it is game over for anyone wanting to buy a house on the Sunshine Coast, however, there are more places to buy for those willing to purchase a unit.

But borrowing power will only get worse if the Reserve Bank of Australia (RBA) hikes rates again on Tuesday, with that budget dwindling to $382,699 (from $500,000) if another 0.5 per cent increase comes to fruition.

Should that 0.5 increase happen, the maximum borrowing power of all would-be buyers will have slumped 23.46 per cent.

PropTrack economist Angus Moore said banks approved or denied loans based on the 3 per cent serviceability criteria, as set by the Australian Prudential Regulation Authority (APRA), plus any increases to interest rates.

“A general rule of thumb is that with every 0.5 per cent increase in interest rates, borrowing capacity goes back about 5 per cent,” he said.

“We know that most people don’t borrow at the maximum capacity but each rate increase does make borrowing more expensive.”

Mr Moore said that while house prices had begun to fall nationally, those falls were much less than the increasing cost of borrowing.

He said house values had not yet seen the full impact of the “brisk tightening” by the RBA.

Meighan Wells, director of buyers agency Property Pursuit, said the downward pressure on buyers borrowing capacity was significant.

She said one first home buyer client who had a budget of $750,000 earlier this year, was now trying to buy with around $600,000.

“But prices haven’t come back as far as borrowing capacity has,” she said.

“It is really tough. We have so much going on including a rental crisis.

“Buyers are having to move quickly just to beat the next rate rise.”

Buyers with a maximum borrowing capacity of $750,000 in April – before the monthly rate hike nightmare began – can now borrow about $602,396.

Those same borrowers are now priced out of 648 suburbs across Queensland – up 180 since the rate hikes began.

That borrowing capacity will plummet to $574,048 if rates increase a further 0.5 per cent.

There are 129 house suburbs across Greater Brisbane with a median house price below $574,000.

But even those with a healthy six figure budget have taken a hit.

Buyers with a $1 million budget in April now have a borrowing capacity of $803,194 – a drop of $196,806.

If the cash rates rise another 0.5 percentage points to 2.85 per cent, that borrowing capacity will shrink to $765,397, a $234,603 reduction.

To put that into perspective, an entire three bedroom house in Toolooa, south of Gladstone, is listed for $225,000 and a three-bedroom house in Innisifail has been reduced to $220,000.

Just five months ago, a budget of $1 million could get a house in Mount Gravatt East (Brisbane), Golden Beach (Sunshine Coast), Varsity Lakes (Gold Coast), North Ward (Townsville) and Palm Cove (Cairns).

Now, those same buyers will be shopping in Upper Coomera (Gold Coast), Baringa (Sunshine Coast), Craiglie (Cairns), Belgian Gardens (Townsville) and Thagoona (Ipswich).

Those on a $1.5 million budget in April could see $351,904 wiped from their borrowing capacity since April if the RBA hikes rates by 0.5 per cent on Tuesday, while for those with a $2 million budget just five months ago could soon kiss goodbye to a whopping $469,205 in potential borrowings.

Finder head of consumer research Graham Cooke said there was “no good news for borrowers”.

“While our RBA economist survey for October is still live, early results indicate that more than half of the panel are predicting another 50 basis point rate increase,” he said.

Mr Cooke said that those shopping at the bottom rung of the housing market ladder would find home ownership even harder to achieve, with every rate increase “seriously” hampering their ability to borrow.

“For the housing market, this means that the decline in sales volumes and prices is likely to continue for some time,” he said.

“There is some potential good news for borrowers in prices falling, but the increasing cost of credit means those lower prices cost more to access.

“While there is no good news for borrowers, there is for savers – with old fashioned savings accounts roaring back into fashion.”

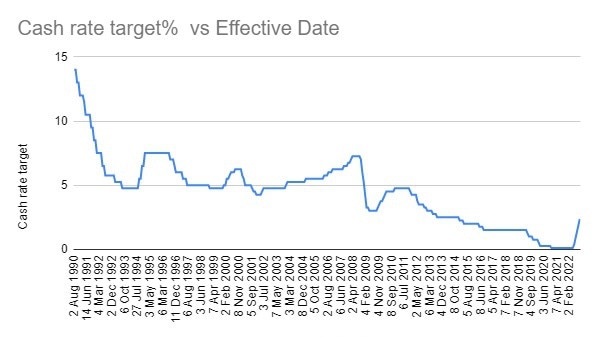

Propertyology head of research Simon Pressley said it was “not all doom and gloom”, tipping that rates could go down again as early as 2024.

Mr Pressley said the nations biggest property boom was between 2002 and 2008, when interest rates were “through the roof”.

“Borrowing capacity back then was far more impacted, but people still transacted,” he said.

Mr Moore said the long term solution to housing affordability – for buyers and renters – was more stock.

“The good news for buyers in Brisbane is that the total stock has picked up and competition has eased compared to the same time last year,” he said.

“It is still well down compared to pre-pandemic but there are signs of improvement.”