Halved: QLD’s rental pool shrinks as rents push tenants to brink

The size of Queensland’s rental pool has more than halved in four years, with experts warning that rising prices could make renting out of reach for many tenants by the end of the year.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

The size of Queensland’s rental pool has more than halved in less than four years, with vacancy rates in Brisbane declining even further last month as a result of the ongoing housing crisis.

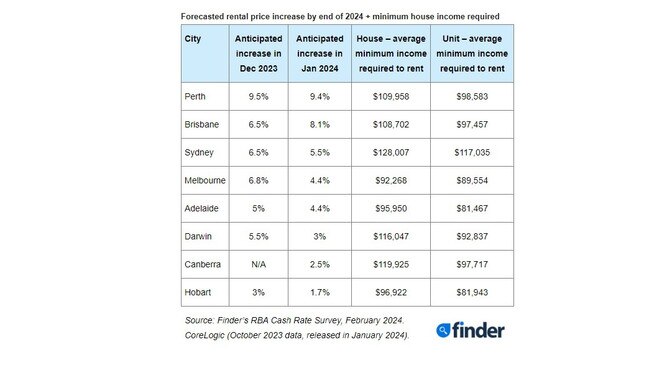

And if a panel of industry experts proves to be correct, the average minimum income required to rent a house in Brisbane could push past $100,000 by the end of the year.

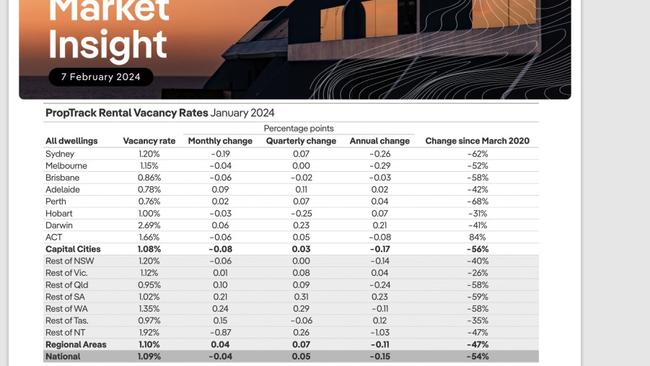

The latest PropTrack Market Insight Report, out today, shows that the share of rental properties vacant and available in both Brisbane and regional Queensland is 58 per cent lower now than it was at the start of the Covid-19 pandemic in 2020.

The tightening comes after Queensland’s population increased by more than 138,000 people in 2022/23 alone, with record overseas migration accounting for 84,000 of those new residents.

Queensland also recorded the biggest influx of interstate migrants over that same period, up 32,255.

By comparison, NSW lost 34,158 residents.

PropTrack economist and report author Anne Flaherty said that with so few rental properties currently vacant, tenants were facing stiff competition.

“This is likely to drive rents higher over the course of 2024, though we expect the pace of growth to slow,” she said.

Brisbane’s vacancy rate dipped another 0.06 percentage points in January to sit at just 0.86 per cent – the third lowest vacancy rate in the country behind Perth (0.76%) and Adelaide (0.78%).

The national vacancy rate declined 0.04 percentage points in January to 1.09 per cent, according to PropTrack.

“Tenants across Australia’s capital cities saw the sharpest drop in vacancy, while conditions eased slightly across most regional areas,” Ms Flaherty said.

“Vacancy across the combined capital city areas was at the second lowest level on record in

January.

“The share of rental properties sitting vacant has been trending down for three years, from 3 per cent in April 2020 to just 1.09 per cent in January 2024.

“There are now 54 per cent fewer homes sitting vacant (nationally) compared to the onset of the pandemic.”

MORE NEWS: How much you need to earn to buy in every Qld suburb

Rental options dwindling in Townsville market

Need a bulldozer: QLD property ‘beast’ survives another cyclone

In regional Queensland, the vacancy rate increased slightly to 0.95 per cent in January.

But several SA4 regions recorded vacancy rates even lower than Brisbane during the last quarter, including the Sunshine Coast (0.58%), Cairns (0.63%), Wide Bay (0.79%), Darling Downs-Maranoa (0.82%) and on the Gold Coast (0.85%).

The extreme supply and demand imbalance has seen both the state and federal governments commit to accelerated home building programs.

But after the Reserve Bank of Australia (RBA) kept rates on hold yesterday, 89 per cent of the 19 panellists surveyed by Finder said they did not believe the target of 1.2 million new homes nationally within five years would be achieved.

Almost 34,000 new dwellings were approved for construction in Queensland last year but that number falls about 14,000 short of the state’s annual target.

As a result, the expert panel is tipping that rents could increase by 8.1 per cent in Brisbane by the end of the year, up from the 6.5 per cent forecast in December.

Should that occur, the average minimum income required to rent a house in Brisbane would hit $108,702, according to Finder.

Finder’s head of consumer research Graham Cooke said tenants on low incomes would bear the brunt of rising rental costs, as they struggled to keep up with escalating prices.

“Many don’t have the extra funds to spare, and are already in over their heads to keep food on the table,” Mr Cooke said.