Brisbane home prices record stunning sprint to year-end record high

Brisbane’s red-hot housing market has capped off a stunning full year of growth — defying a broader dip in prices across the nation’s capital cities for the first time in 2023.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Brisbane property prices have hit a fresh record high, capping off a stunning year of growth with home values soaring 10.45 per cent across all dwellings over the past 12 months.

PropTrack’s Home Price Index, released today, shows the Sunshine State capital defied a broader dip in prices across the nation’s capital cities in December for the first time in 2023.

Brisbane’s median value climbed another 0.27 per cent last month to $783,000 last month, while combined capital city prices fell 0.09 per cent.

The report confirmed contined upwards market pressure, as strong demand and a housing shortage outweighed the impact of 13 cash rate hikes through 2022/23.

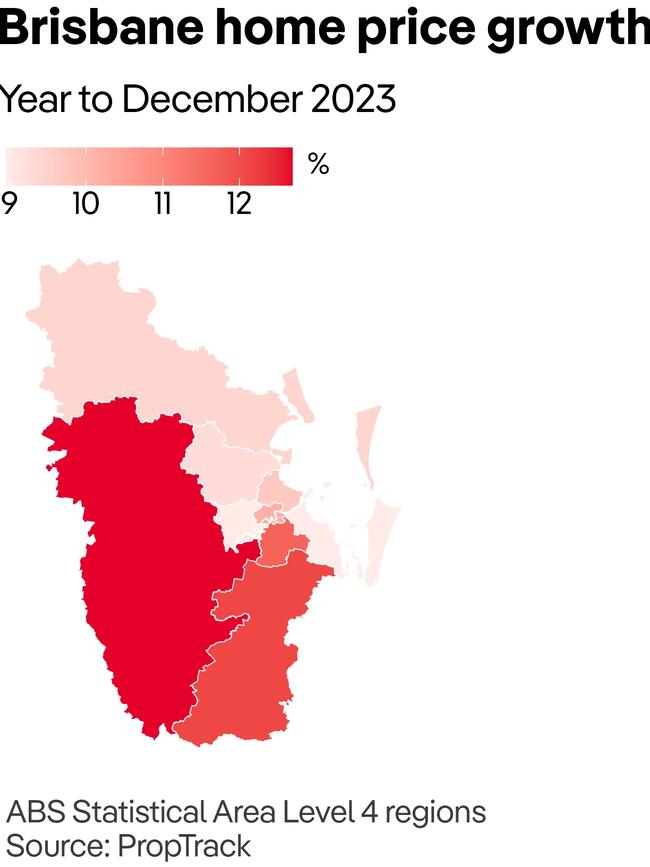

Ipswich was Queensland’s top-peforming region, with a typical house there now priced at $615,000 — up 12.69 per cent from last year.

Prices in Logan/Beaudesert soared 12.1 per cent to $666,000, while home values hit $1.015m in South Brisbane.

The Gold Coast and Brisbane Inner City regions posted annual growth of 10.64 and 10.17 per cent respectively.

MORE NEWS

The Qld homes bought and sold by celebrities in 2023

Revealed: The next boom suburbs to watch in Brisbane, regional Qld

The two housing issues experts got wrong this year

Greater Brisbane home prices were now a staggering 57 per cent higher than before the pandemic, just behind Adelaide which had the highest cumulative growth since March 2020 of all capital cities at 58.8 per cent (median $707,000).

PropTrack economist Eleanor Creagh said price gains would likely tip over into the new year.

“Home prices have been remarkably resilient in 2023, withstanding an additional five interest rate rises over the year to date,” Ms Creagh said.

“Supporting price growth this year has been a limited supply of homes for sale, a slowdown in the delivery of new housing stock, and robust buyer demand.

“The factors that drove price growth in 2023 are likely to support a further expansion in prices over 2024. These include strong buyer demand, population growth, relatively limited stock for sale, and a more stable interest rate environment,” she said.

It comes as households feel the impact of repayments soaring from historic lows during the Covid boom, hitting 4.35 per cent in November.

Online comparison site Finder figures show that as cash rate hikes hit last year, the average variable home loan’s interest went from 4.29 per cent in January to 5.74 per cent by December.

Contrasted against an 80 per cent loan for a house bought at the start of the year, the figures show Brisbane owners handed $3432 over to the banks more than they would have if rates hadn’t changed.

And the hip pocket pain will continue into the new year, with monthly mortgage payments for the city’s typical house ending the year $537 above where they started.

Australian Bureau of Statistics (ABS) data shows the household savings ratio had steadily declined over the 12 months ending September, reaching its lowest level since December 2007.

“While there’s no question many mortgage holders have been doing it tough, to date, there has only been evidence of a modest increase in distressed listings. There are signs, however, that households are cutting back in other areas to cope with higher repayments.

“The interest rate environment looks set to be more stable in 2024, however the possibility of another rate hike can’t be ruled out if inflation proves sticky,” Ms Creagh said.

Australian Bureau of Statistics (ABS) data shows the household savings ratio had steadily declined over the 12 months ending September, reaching its lowest level since December 2007.

“While there’s no question many mortgage holders have been doing it tough, to date, there has only been evidence of a modest increase in distressed listings. There are signs, however, that households are cutting back in other areas to cope with higher repayments.

“The interest rate environment looks set to be more stable in 2024, however the possibility of another rate hike can’t be ruled out if inflation proves sticky,” Ms Creagh said.

Regional Queensland markets also posted a new peak, with prices across all dwellings up 0.27 per cent in December, or 8.47 per cent higher than last year, retaining its position as the nation’s strongest post-Covid performer.

Nationwide, PropTrack forecast prices to rise between two and five per cent across the combined capital cities, though growth was expected to vary widely by city.

Perth and Adelaide were tipped to lead the gains in 2024, followed by Brisbane, Ms Creagh said.

The prediction was backed by valuer Anna Porter, of Suburbanite, who said the three cities shared drivers for a solid investment market over the coming 12 months.

“These markets are underpinned by strong employment growth, housing affordability and strong rental returns still attracting investors and homebuyers alike to these markets,” Ms Porter said.

Despite rising prices, first-home buyers could still find entry-level property, while employment and lifestyle opportunities attracted families and retirees.

“The demand from all cross sectors is driving prices up and this doesn’t look like it will slow – even if the RBA try to put pressure on it,” she said.

“My top tip when considering these markets is to stay within 45 minutes to the city and only look at established properties, nothing off the plan…distance from the CBD is a key player in the Adelaide, Brisbane and Perth markets as people don’t commute an hour to work like in Sydney and Melbourne as they simply don’t have to.”

PropTrack’s data showed houses slightly outperformed the unit sector through 2023, with Brisbane house prices up 10.57 per cent annually to $879,000, compared to 9.74 per cent growth for apartments (median $580,000).