Can’t afford to buy in Brisbane? Maybe look at NY or Manchester

Brisbane is now one of the world’s least affordable cities to buy a home, with ownership more achievable in places such as Liverpool and New York.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Brisbane has been revealed as one of the world’s least affordable cities to buy a home, with ownership now more achievable in places such as Glasgow, Calgary and Liverpool in the UK and Sacramento, New York and Las Vegas in the US.

Demographia’s annual International Housing Affordability study for 2023 found Brisbane typical house price was 7.4 times the median household income in 2022’s September quarter.

To put that into perspective, it is 7.1 in New York and 4.8 in Liverpool.

A 238sq m three bedroom house in White Plains, New York, that sits on a 753sq m block of land is listed for $750,000USD or roughly $1.112 million.

In the inner Brisbane suburb of Spring Hill, an original 1900s three bedroom cottage recently sold for $1.5 million.

A house in Parkison recently sold for $1.07 million, while a three bedroom unit in Manhattan is listed for $675,000US, or a touch over $1 million here.

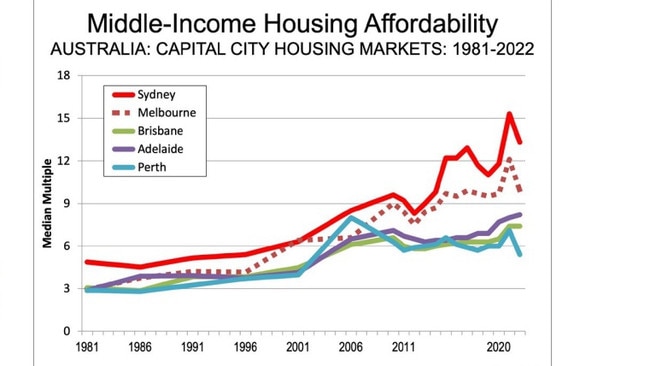

But buying real estate in the River City, which was ranked 78 out of 100, is more achievable than in Adelaide (8.2), Melbourne (9.9) and Sydney (13.3).

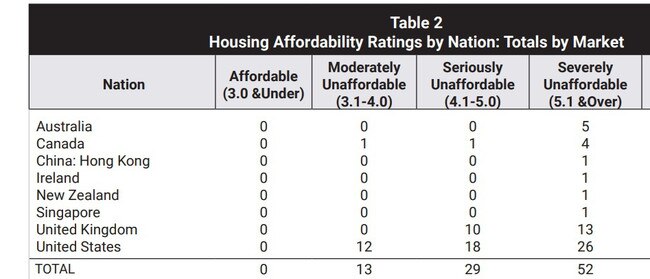

Sydney had the world’s second least affordable median house price at 13.3 times higher than standard household income, with Hong Kong (18.8) the most expensive market.

But the study does not take into account median unit prices, inflation, the cost of living or rents, which have all risen in the past year.

It calculates affordability based on median house prices against median household incomes.

“Australian markets have a median multiple of 8.2, up from 6.9 in 2019,” the report said.

“This is an increase of 1.3 years of median household income.

“All five of Australia’s major housing markets have been severely unaffordable since the early 2000s.”

That will come as no surprise to buyers in southeast Queensland, where median house prices soared during the pandemic property boom.

The latest PropTrack Home Price Index showed Brisbane house prices rose 0.12 per cent in February, but were down 3.49 per cent from their peak in April last year.

But they remain 42.5 per cent higher than they were in March 2020, towards the start of the pandemic.

The median house value in Brisbane is $716,000, with the city’s most expensive suburb, Teneriffe, coming in with a median house price of $3.475 million, up 73.8 per cent in three years.

Some of Brisbane’s more affordable suburbs in Ipswich (Willowbank, Kalbar), Logan-Beaudesert (Kooralbyn), Ipswich and Moreton Bay North (Upper Caboolture) have seen median house values soar more than 100 per cent since 2020, according to the latest REA Market Trends report.

Demographia principal and report author Wendell Cox, a senior fellow at Houston’s Urban Reform Institute, said that as house prices “went through the roof in Australia” more people on low incomes would sign up for social housing waiting lists.

It comes after The Blueprint to Tackle Queensland’s Housing Crisis report, commissioned by the Queensland Council of Social Service, revealed that there are about 300,000 Queenslanders experiencing housing insecurity, with the rate of homelessness surging by 22 per cent since 2017 – far exceeding the national rise in homelessness of 8 per cent.

Areas to the south of Brisbane were struggling most, with one in 10 Logan, Beaudesert and Gold Coast households categorised as homeless or living in housing that is not affordable.

The Demographia report found that Brisbane’s median house prices have increased 5.2 times the rate of inflation since 2020.

Rent crisis: Powerful alliance urges Qld government to take action

‘Hellbent on recession’: Even more homeowner pain predicted

Earlier this month, the Reserve Bank of Australia increased the official cash rate for the 10th consecutive time, with interest rates now at an 11 year high of 3.5 per cent.

“The largest housing affordability differences between major metropolitan areas have developed as urban containment policies have been implemented,” the Demographia report noted.

“Whatever its advantages, urban containment has been associated with huge housing cost escalation relative to incomes --- worsened housing affordability.

“The largest housing affordability losses have been in markets with urban containment.”

AVID Property Group general manager Bruce Harper said the biggest issue in Brisbane was demand outstripping supply.

“And it is the length of time that it takes to rezone land and put in infrastructure to provide areas for new homes,” he said.

“While we have an urban growth boundary, it is adequate to meet our needs in the medium time, but the issue is how long it takes to just get that land released.”