’Hellbent on recession’: Economists predict more pain for Aussie homeowners following RBA rate hike announcement

Aussie homeowners are being warned to brace for a peak cash rate of 4.1 per cent – the highest in 15 years – as more than one third revealed they struggled to pay their mortgage.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Aussie homeowners are being warned to brace for a peak official cash rate of 4.1 per cent – the highest in around 15 years – as more than one third revealed they struggled to pay their mortgages last month.

The Reserve Bank of Australia (RBA) hiked the official cash rate by another 0.25 percentage points today to 3.60 per cent – the 10th consecutive rate hike.

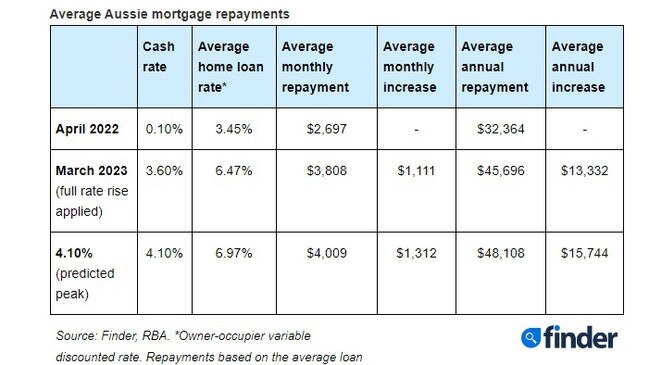

That means the average homeowner is now paying around $45,696 in repayments each year, up $13,332 in 11 months.

RELATED: Where sellers made $1m+ profit in two years

Why now is the time to buy an investment property

‘Crazy, opportunistic’ Brisbane rents now worse than Melbourne

“The RBA seems hellbent on engineering a recession,” Craig Emerson of Emerson Economics said.

A Finder survey of economists and experts has warned that even more rate hikes are likely on the way, with 78 per cent predicting that the official cash rate will peak at a punishing 4.1 per cent by June.

If that rate is realised, average home loan repayments will have increased by around $15,744 a year, or roughly the cost of three round-the-world plane tickets, a years tuition at some private schools or a new Kia Picanto.

Finder’s head of consumer research Graham Cooke said it was bad news for homeowners already doing it tough.

“Australians with the average loan size of around $600,000 will be forking out over $13,000 more per year on their mortgage (at 3.6%) compared to what they were paying a year ago,” he said.

“While homeowners deserve a break from the relentless increase in pressure, we can expect even more hikes from the RBA this year.”

A whopping 36 per cent of Aussie homeowners said they struggled to pay their mortgage in February, according to Finder’s Consumer Sentiment Tracker.

ABS data also showed that new home loans for owner-occupier and investors fell 30 per cent and 27 per cent respectively in December 2022 compared to December 2021, with more pressure expected to be heaped upon already stretched renters.

Mr Cooke said the nation had seen mortgage costs go up faster than rental costs.

“This could mean there is a lag yet to hit the already heated rental market,” he said.

Almost half of Aussie renters (43%) said they struggled to pay their rent in February, according to Finder’s Consumer Sentiment Tracker.

“With fewer Australians buying homes, coupled with the inflow of international students and foreign workers, the demand for rental properties will increase, putting significant pressure on landlords to increase rental prices,” Mala Raghavan from the University of Tasmania said.

Australia’s top 10 cheapest rental suburbs are currently Newborough (Victoria, $180 for a unit), Andamooka and Peterborough (SA, $200 for a house), Moe (VIC, $200 for a unit), Deniliquin (NSW, $250 for a unit). Whyalla (SA, $220 for a unit), Beresford (WA, $220 for a unit), Murray Bridge (SA, $225 for a unit), Charleville (QLD, $235 for a house) and Stanthorpe (QLD, $235 for a unit).

Vacancy rates sit at just 0.8 per cent in Brisbane, 1.2 per cent in Melbourne, 1.3 per cent in Sydney, 1.3 per cent in Darwin, 0.5 per cent in Adelaide, and 0.7 per cent in Hobart.

The latest PropTrack Market Insight report revealed that the number of rental listings below $400 a week had gone into free fall across the country as demand outstripped supply and landlords increased rents.

MORE: Lone wolf unit owners banned from holding buildings hostage

Where to buy to become a millionaire in 10 years

Play School star’s bargain buy on Moreton Bay island

Since March 2020, the number of listings for both units and houses nationally have fallen from 42.5 per cent to 17.6 per cent.

PropTrack senior economist Eleanor Creagh said the “substantial tightening” had quickly rebalanced the housing market, with prices falling from peak levels in most parts of the country.

“Prices nationally fell for nine consecutive months and are now sitting 3.90 per cent below their March peak, despite bouncing 0.18 per cent in February,” she said.

“Sellers in market now are benefiting from low competition with other vendors, as buyers vie for available stock.

“The constrained level of properties available for sale has concentrated buyer demand and is “putting a floor” under home prices to a degree.

“Now the cash rate is sitting at 3.60 per cent … maximum borrowing capacities have dropped by around 30 per cent.

“The significant reduction in borrowing capacities implies further price falls.”

But they are unlikely to off-set the record gains in equity during the pandemic property boom meaning borrowers will have to contend with historically higher median prices and drastically reduced borrowing capacities.

CreditorWatch chief economist Anneke Thompson warned that the latest rate hike would also take many borrowers – both personal and business – well past their lenders’ serviceability test and will be a serious drag on both consumer and business sentiment.

“While the Australian economy is certainly one of the brighter spots when we think about the global economy, there is no doubt that businesses will find trading conditions far more challenging this year than last,” she said.

“On the bright side, it does appear that inflation has peaked.”

In announcing the lates rate hike, RBA governor Philip Lowe said it would be some time before inflation is back to target rates.

“The monthly CPI indicator suggests that inflation has peaked in Australia,” he said.

“Growth in the Australian economy has slowed, with GDP increasing by 0.5 per cent in the December quarter and 2.7 per cent over the year.

“Household consumption growth has slowed due to the tighter financial conditions and the outlook for housing construction has softened.

“Wages growth is continuing to pick up in response to the tight labour market and higher inflation.”

Mr Lowe said the Board recognised that monetary policy operates with a lag and that the full effect of the cumulative increase in interest rates was yet to be felt in mortgage payments.

He said the priority was to return inflation to target of between 2-3 per cent.

It was 7.8 per cent in the December quarter.

“The Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that,” he said.