Now’s the time to be brave on tax reform – CEOs call for new approach

The Australian’s 2024 CEO Survey reveals a radical tax rethink is the one big area of reform needed. Business is paying the price as states scramble to fill the revenue shortfall.

Wesfarmers chief executive Rob Scott says the way the federal and state governments carve up the tax pool is not suitable for a modern, growing economy and fundamental reform is needed to get Australia on track.

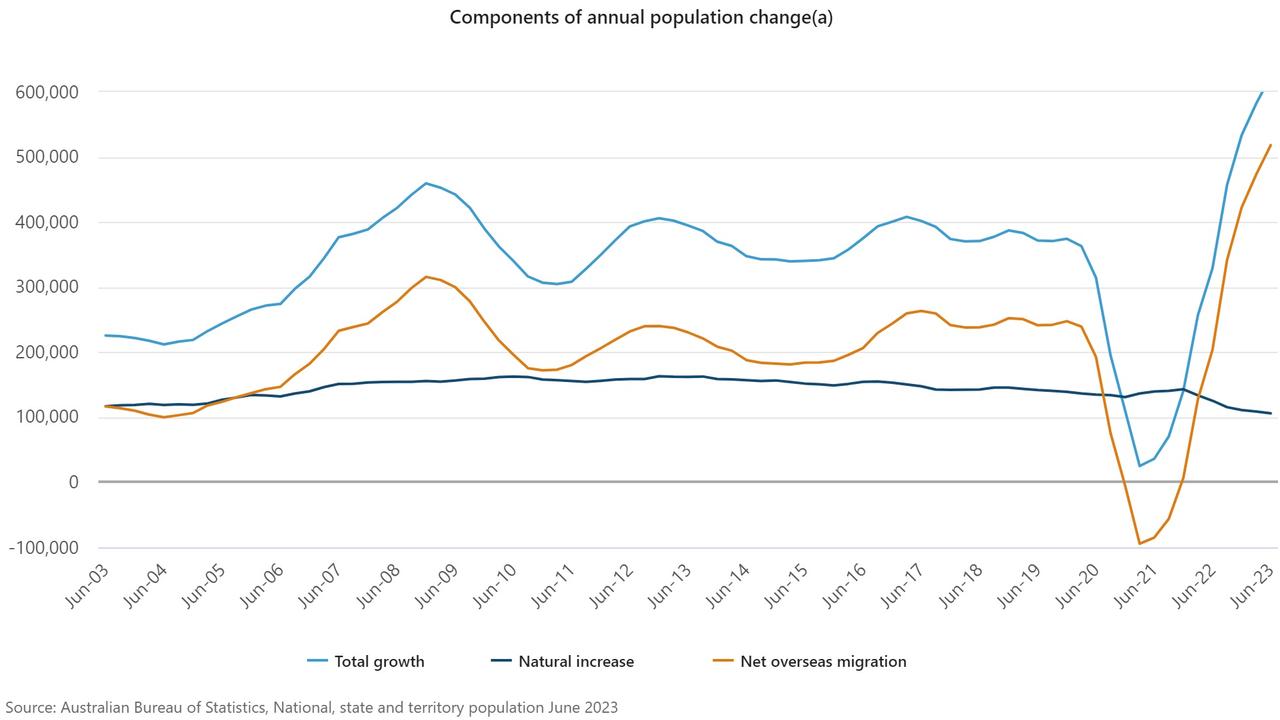

While all the growing tax take is going to Canberra, business is increasingly being targeted by cash-strapped state governments to make up the shortfall to help pay for the migration boom. And this usually meant inefficient taxes that undermined private investment, said Mr Scott, whose Wesfarmers business spans retail, industrial and healthcare.

Tax and growing pains from migration emerged as a major area of concern among business leaders who nominated their big ideas for economic reform in The Australian’s 2024 CEO Survey. More than 70 chief executives laid out their case for reform to get Australia moving again and lift the nation’s sagging productivity. Some bosses raised the worrying reregulation of industrial relations as weighing on growth, while others said planning problems were adding to the nation’s housing crisis. So too, a critical shortage in skills training and education were holding back the economy. The CEOs’ comments represent the most comprehensive snapshot of the mood of corporate Australia going into the new year.

Wesfarmers’ Mr Scott put tax reform back on the agenda. His comments come as planned cuts to infrastructure spending and other transfers have sparked furious reaction from states over the cost of funding migration.

The Wesfarmers boss said the way the Commonwealth and states distributed the tax pool was anchored in the last century and not fit for modern Australia. Fundamental reform was needed to encourage private investment.

“The vertical fiscal imbalance means that state spending is more than twice their tax revenue, so states keep drawing on some of the most inefficient and damaging taxes, such as payroll tax and stamp duty, to raise revenue,” said Mr Scott. “At a federal level, our taxes are disproportionately focused on workers and companies, and create a disincentive for investment.”

To drive meaningful change a federally funded productivity payment scheme that encouraged states to undertake tax and regulatory reforms would deliver a dividend of growth investments and jobs, he said.

Paul Jenkins, who heads legal major Ashurst, said fundamental tax reform had significant potential to drive productivity improvements in the Australian economy. Reform also had the potential to facilitate the economy’s transition away from an overreliance on resources.

“Tax reform should be comprehensive and not piecemeal to ensure it improves Australia’s productivity growth and delivers fair structural changes. This tax reform agenda is well-known, but for it to succeed, it requires bold leadership not only from politicians, but also business and community leaders,” he said.

KPMG chief executive Andrew Yates pointed out the recent migration surge had exposed the lack of a co-ordinated housing policy between the commonwealth, states and local governments. At the same time, he urged wholesale tax reform and spending restraints to bring the budget back into balance over an economic cycle.

CEO Survey 2024

Citi Australia chief Mark Woodruff said tax reform should be an aspiration for the government heading into the next term.

“The high reliance on income tax makes it harder for Australia to increase the participation rate – particularly of women – at a time when we need more people in the labour force,” Mr Woodruff said.

In other areas, National Australia Bank chief Ross McEwan said housing pressures could have long-term negative implications for Australia.

“It’s a disgrace that there are more than 175,000 people across the nation waiting for social housing alone,” Mr McEwan said.

“All levels of government urgently need to collaborate on simpler and faster regulations, while freeing up land suitable for building.

“There also needs to be more targeted government support for social and affordable housing and more innovative construction methods to meet supply targets, such as modular housing.”

Bunnings boss Mike Schneider said addressing housing supply to meet a growing population should be regarded as a national priority.

“Everyone deserves a home to live in – it’s central to a sense of belonging and wellbeing.

An ambitious housing agenda not only addresses this need but also supports the economy through local builders, tradespeople and material suppliers,” Mr Schneider said.

“Progress nationally in housing will serve as a prime example of the benefits of broader policy alignment across states and territories, which we’d like to see more of.”

Meanwhile Macquarie chief Shemara Wikramanayake pointed to reform in skills and education to drive slowing productivity levels.

“Better alignment and diversification of international student intakes to address critical skills gaps also strengthens long-term regional relationships between countries,” Ms Wikramanayake said. Telstra chief executive Vicki Brady said more could be done to leverage digital technologies to boost efficiency through the economy.

The development of the necessary skills within the workforce and a supportive investment environment would set up Australia for longer term growth, Ms Brady said.

BHP chief executive Mike Henry said that future policy reform should be based around making Australia more competitive. “Australia’s economy is well positioned to benefit from the megatrends reshaping the global economy: decarbonisation, electrification and population growth,” Mr Henry said. “But we have to compete with other nations that are moving with increasing pace to attract global capital and new investment.”

Running with this theme, the BHP chief said an environment of fiscal and regulatory certainty was the base needed to ensure confidence and encourage new investment to flow into Australia.

The BHP boss also nominated improved permitting that “maintains strong protections and provides certainty, consistency and predictability” for major investments.

For Kevin Gallagher, who heads gas major Santos, top of the reform agenda should be “restoring investor confidence in Australia – especially in the engine room of the economy, which is still the resources sector and will be for a long, long time”.

This investment was needed more than ever to support the energy transition, he said – and this included using the best and most economic technology available.

Originally published as Now’s the time to be brave on tax reform – CEOs call for new approach