Now’s the time to be brave on tax reform – CEOs call for new approach

The Australian’s 2024 CEO Survey reveals a radical tax rethink is the one big area of reform needed. Business is paying the price as states scramble to fill the revenue shortfall.

Wesfarmers chief executive Rob Scott says the way the federal and state governments carve up the tax pool is not suitable for a modern, growing economy and fundamental reform is needed to get Australia on track.

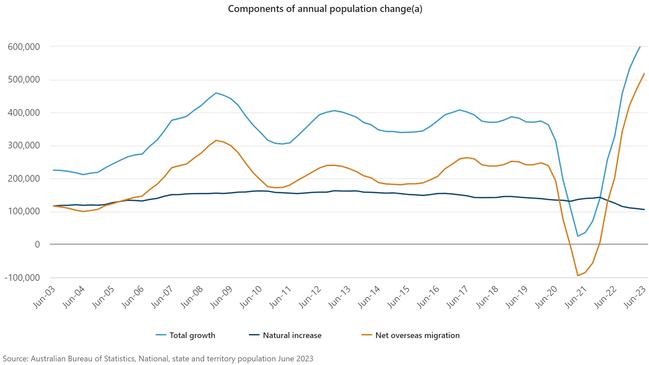

While all the growing tax take is going to Canberra, business is increasingly being targeted by cash-strapped state governments to make up the shortfall to help pay for the migration boom. And this usually meant inefficient taxes that undermined private investment, said Mr Scott, whose Wesfarmers business spans retail, industrial and healthcare.

Tax and growing pains from migration emerged as a major area of concern among business leaders who nominated their big ideas for economic reform in The Australian’s 2024 CEO Survey. More than 70 chief executives laid out their case for reform to get Australia moving again and lift the nation’s sagging productivity. Some bosses raised the worrying reregulation of industrial relations as weighing on growth, while others said planning problems were adding to the nation’s housing crisis. So too, a critical shortage in skills training and education were holding back the economy. The CEOs’ comments represent the most comprehensive snapshot of the mood of corporate Australia going into the new year.

Wesfarmers’ Mr Scott put tax reform back on the agenda. His comments come as planned cuts to infrastructure spending and other transfers have sparked furious reaction from states over the cost of funding migration.

The Wesfarmers boss said the way the Commonwealth and states distributed the tax pool was anchored in the last century and not fit for modern Australia. Fundamental reform was needed to encourage private investment.

“The vertical fiscal imbalance means that state spending is more than twice their tax revenue, so states keep drawing on some of the most inefficient and damaging taxes, such as payroll tax and stamp duty, to raise revenue,” said Mr Scott. “At a federal level, our taxes are disproportionately focused on workers and companies, and create a disincentive for investment.”

To drive meaningful change a federally funded productivity payment scheme that encouraged states to undertake tax and regulatory reforms would deliver a dividend of growth investments and jobs, he said.

Paul Jenkins, who heads legal major Ashurst, said fundamental tax reform had significant potential to drive productivity improvements in the Australian economy. Reform also had the potential to facilitate the economy’s transition away from an overreliance on resources.

“Tax reform should be comprehensive and not piecemeal to ensure it improves Australia’s productivity growth and delivers fair structural changes. This tax reform agenda is well-known, but for it to succeed, it requires bold leadership not only from politicians, but also business and community leaders,” he said.

KPMG chief executive Andrew Yates pointed out the recent migration surge had exposed the lack of a co-ordinated housing policy between the commonwealth, states and local governments. At the same time, he urged wholesale tax reform and spending restraints to bring the budget back into balance over an economic cycle.

CEO Survey 2024

‘Now’s the time to be brave on tax reform’

The Australian’s 2024 CEO Survey reveals a radical tax rethink is the one big area of reform needed. Business is paying the price as states scramble to fill the revenue shortfall.

‘This will be the test’: bosses brace for slowdown

The nation’s chief executives have warned that successive rates hikes are biting. The economy is resilient but Australia faces a major challenge ahead, they tell the 2024 CEO Survey.

Three is the new five-day week in the nation’s offices

Australia’s bosses have spent the year stepping up efforts to bring staff back into the office more often. However, workers still have the upper hand.

Super funds under pressure to focus on strategy

Superannuation funds will come under pressure to come up with policies to assist Australians moving into retirement, industry leaders have told The Australian’s 2024 CEO Survey.

CEOs call for an energy revolution

Australia faces a worrying energy gap and as a nation we need to throw everything at the solution, top bosses have told The Australian’s 2024 CEO Survey.

AI will make us all richer: CEOs

The much hyped technology is one of the few levers chiefs can pull to dramatically increase output as the economy slows in the face of higher interest rates.

Radical IR changes to fire up inflation, CEOs warn

Workplace changes will do little to lift the nation’s prosperity, business leaders tell The Australian’s 2024 CEO Survey.

Cyber shock threat keeps CEOs awake at night

Bosses and industry leaders are almost unanimous in what they consider the biggest external threat to their business, according to The Australian’s 2024 CEO Survey.

CEO Survey 2024 part 1: AGL, BHP to Bunnings

The Australian surveyed asked the nation’s CEOs their views on inflation, energy and opportunities for their businesses in 2024. From AGL, BHP to Bunnings. These are their full responses.

CEO Survey 2024 part 2: Cbus Fortescue to IAG

The Australian surveyed the nation’s top CEOs on inflation, energy and opportunities ahead for 2024. From Cbus Super to Fortescue to IAG, these are the responses from C-I companies.

CEO Survey 2024 part 3: Judo, Kmart to Rio Tinto

The Australian surveyed the nation’s CEOs on inflation, energy and opportunities for 2024. From Judo and Kmart to Rio Tinto. These are the responses for J-R companies.

CEO Survey 2024 part 4: Safety Culture, Santos to Zip Co

The Australian surveyed the nation’s top CEOs about inflation, energy and opportunities ahead in 2024. From Safety Culture, Santos and Zip Co. These are their full responses.

Citi Australia chief Mark Woodruff said tax reform should be an aspiration for the government heading into the next term.

“The high reliance on income tax makes it harder for Australia to increase the participation rate – particularly of women – at a time when we need more people in the labour force,” Mr Woodruff said.

In other areas, National Australia Bank chief Ross McEwan said housing pressures could have long-term negative implications for Australia.

“It’s a disgrace that there are more than 175,000 people across the nation waiting for social housing alone,” Mr McEwan said.

“All levels of government urgently need to collaborate on simpler and faster regulations, while freeing up land suitable for building.

“There also needs to be more targeted government support for social and affordable housing and more innovative construction methods to meet supply targets, such as modular housing.”

Bunnings boss Mike Schneider said addressing housing supply to meet a growing population should be regarded as a national priority.

“Everyone deserves a home to live in – it’s central to a sense of belonging and wellbeing.

An ambitious housing agenda not only addresses this need but also supports the economy through local builders, tradespeople and material suppliers,” Mr Schneider said.

“Progress nationally in housing will serve as a prime example of the benefits of broader policy alignment across states and territories, which we’d like to see more of.”

Meanwhile Macquarie chief Shemara Wikramanayake pointed to reform in skills and education to drive slowing productivity levels.

“Better alignment and diversification of international student intakes to address critical skills gaps also strengthens long-term regional relationships between countries,” Ms Wikramanayake said. Telstra chief executive Vicki Brady said more could be done to leverage digital technologies to boost efficiency through the economy.

The development of the necessary skills within the workforce and a supportive investment environment would set up Australia for longer term growth, Ms Brady said.

BHP chief executive Mike Henry said that future policy reform should be based around making Australia more competitive. “Australia’s economy is well positioned to benefit from the megatrends reshaping the global economy: decarbonisation, electrification and population growth,” Mr Henry said. “But we have to compete with other nations that are moving with increasing pace to attract global capital and new investment.”

Running with this theme, the BHP chief said an environment of fiscal and regulatory certainty was the base needed to ensure confidence and encourage new investment to flow into Australia.

The BHP boss also nominated improved permitting that “maintains strong protections and provides certainty, consistency and predictability” for major investments.

For Kevin Gallagher, who heads gas major Santos, top of the reform agenda should be “restoring investor confidence in Australia – especially in the engine room of the economy, which is still the resources sector and will be for a long, long time”.

This investment was needed more than ever to support the energy transition, he said – and this included using the best and most economic technology available.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout