Why petrol prices affect your mortgage

The Reserve Bank has slugged homeowners with another rate rise and a recent surge in petrol prices is partly to blame.

The Reserve Bank has slugged homeowners with another rate rise and a recent surge in petrol prices is partly to blame.

Aussie home buyers are needing nearly double the average full time salary to be able to afford a home, devastating new research reveals.

Despite the RBA hiking interest rates for the first time in five months, the ASX clawed back some of its earlier losses to finish slightly lower on Tuesday.

Freshly minted RBA governor Michele Bullock has dealt borrowers fresh rate pain as the central bank grapples to tame persistent inflationary pressures.

The Australian sharemarket had its worst day since Russia invaded Ukraine back in February, capping a miserable week for investors.

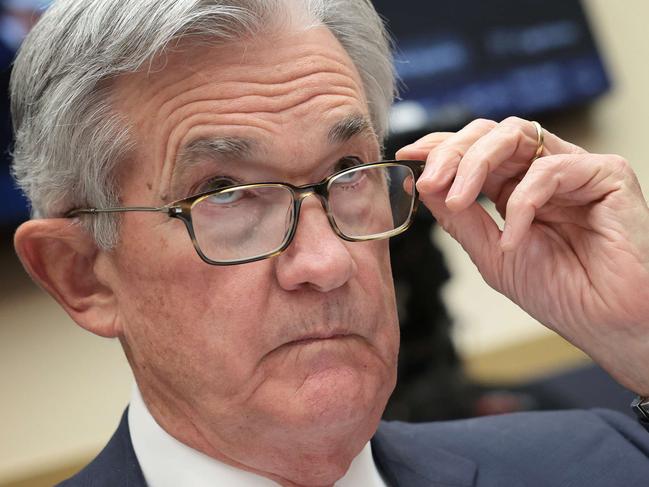

A move by the US central bank could mean Australians are set for some mortgage pain after this week’s first rate hike in 12 years.

A major Aussie bank has alerted customers to an immediate rate rise following the RBA’s massive cash rate announcement.

Volumes were subdued as ASX investors waited for Wednesday night’s meeting of the US Fed and an expected 50 basis-point rate hike.

There are warnings that the outlook for the property market is “dire”, with predictions the rate rise will spook buyers and see prices plunge.

The interest rate rise will mean higher mortgages for millions of Australians, but there is another large group it could impact.

A man from Perth said young people impacted by the rate hike should quit their complaining because he’s had to do it tougher.

Startling new data has shown exactly why the Reserve Bank felt it was necessary to raise the interest rate to 0.35 per cent.

Original URL: https://www.couriermail.com.au/business/economy/interest-rates/page/173