ING to increase variable home loan interest rate

A major Aussie bank has alerted customers to an immediate rate rise following the RBA’s massive cash rate announcement.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

ING has announced it will be increasing all new and existing owner occupier and investor variable home loan rates by 0.25 per cent per annum.

The new rates are effective from 10 May 2022. Existing home loan customers to receive a letter in the post confirming the updates by 1 June 2022.

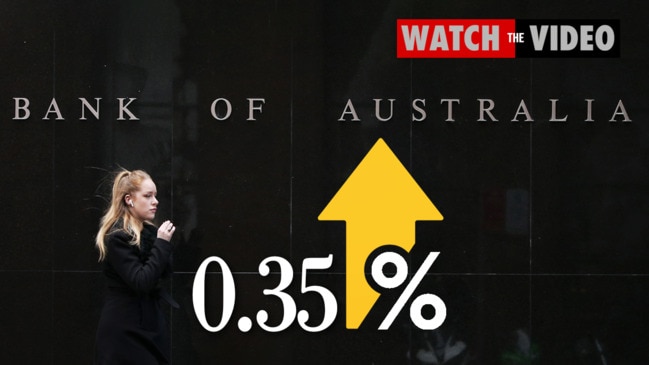

The decision came after the RBA announced it would lift Australia’s official record low cash rate by 25 basis points to 0.35 per cent from 0.1 per cent on Tuesday.

“Any customer that may be concerned about their ability to repay their home loan is encouraged to reach out ING as soon as possible so the bank can work with them to find a solution,” the bank said in a press release on Wednesday.

We will be increasing all new and existing owner occupier and investor variable home loan rates by 0.25% p.a.

— ING Australia (@ING_Aust) May 4, 2022

The new rates are effective from 10 May 2022. Existing home loan customers will receive a letter in the post confirming the updates by 1 June 2022.

It is the first rate rise in 11 years – since November 2010 – and is a desperate attempt to clamp down on skyrocketing inflation, which has reached an annual rate of 5.1 per cent and has sent prices climbing at the fastest rate in two decades.

Prime Minister Scott Morrison argues many of the cost of living pressures affecting Australians are being caused by international factors which are out of the government’s control.

Shadow Treasurer Jim Chalmers spent Tuesday slamming the Morrison government, arguing an Albanese government would be more capable at handling Australia’s fragile economy.

Appearing on ABC’s 7.30 program on Tuesday night, Mr Chalmers said one of the positives to come out of the change was that those living off savings would be better off.

“The rule of thumb is for every $20,000 you‘ve got saved for an interest rate rise of this magnitude, it is $50 a year,” he said.

“It is not a massive amount of money, but it is better than nothing.”

While acknowledging the RBA’s decision was to be expected, Mr Chalmers said the government had a responsibility to address some of the surrounding factors.

“We don‘t judge Scott Morrison for not taking responsibility for all of it. We judge him for not taking any responsibility for any of it,” he said.

“We have a full blown cost of living crisis in this country. We’ve got skyrocketing inflation, falling real wages and now interest rate rises are part of the pain on Scott Morrison’s watch.”

Treasurer Josh Frydenberg also appeared on the program, describing the rate rise as a “normalisation” of monetary policy following the pandemic.

He noted that other countries had similar or even greater increases in their official interest rates in recent months, including the US, UK, Canada and New Zealand.

Originally published as ING to increase variable home loan interest rate