Last Big Bank smacks Aussie homeowners

Australia’s biggest bank is the last of the Big Four to slug Aussie homeowners with another lift in interest rates. Here’s how much you’ll pay.

Australia’s biggest bank is the last of the Big Four to slug Aussie homeowners with another lift in interest rates. Here’s how much you’ll pay.

One group of Aussies are “undermining” efforts to ease inflation and some of the nation’s most vulnerable are paying the price.

Almost all of the big four banks has announced it would lift interest rates once again in response to the RBA’s Melbourne Cup hike, increasing pressure on homeowners.

NAB has become the first big four bank to pass on the RBA’s November interest rate rise in full.

Hundreds of thousands of mortgage holders face a jarring surge in repayment costs in the coming months as their ultra-low fixed-term plans wind down.

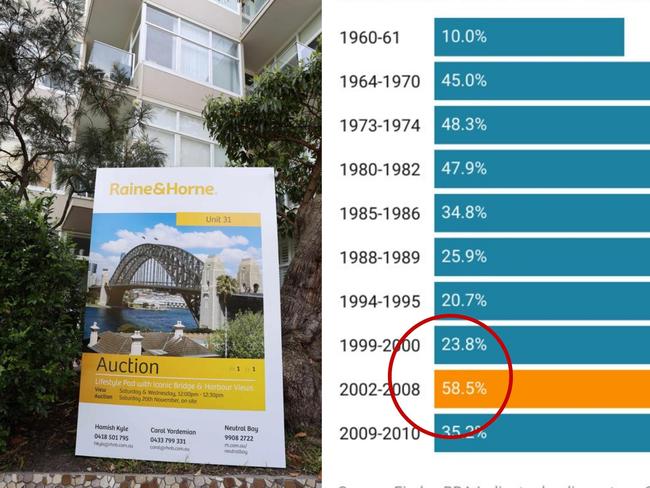

Bring up today’s cash rate and Boomers will often retort with the 17 per cent rate of the 1980s. But it turns out their argument simply doesn’t stack up.

Investors wiped $42bn off Australian shares as higher-than-expected US CPI data stoked fears of rampant inflation fuelling aggressive rate rises that may cause a global recession.

A worrying sharemarket sell-off resumed on Thursday in the wake of concerning US data, with one particular tech stock savaged.

Gains for the major miners helped the Australian sharemarket avoid a fourth straight loss and consolidate its position above the 7000 level.

New data suggests fewer people will enter the housing market amid fears of more interest rate rises, but one of Australia’s top four banks insists the economy is strong.

The ASX tumbled again amid fears Chinese Covid-19 lockdowns and rate hikes will hurt global growth, with mining and energy companies particularly affected.

Some of the best home loan lenders are offering small interest rates and other benefits. Here’s what you need to know.

Original URL: https://www.couriermail.com.au/business/economy/interest-rates/page/172