Is antimony’s sell-off overdone?

Antimony stocks weren’t saved from the recent market carnage. But prices are at all time highs and advanced players are now looking cheap.

Antimony stocks weren’t saved from the recent market carnage. But prices are at all time highs and advanced players are now looking cheap.

ASX health stocks fall with Morgans Scott Power noting Trump’s on-again, off-again Liberation Tariffs sending shock waves through markets.

In the spirit of hopeless optimism, here are seven reasons why Australia could fare well in the redux world of tariff protectionism.

If it feels like the global economy is burning that could be a hint that gold equities are about to outperform again.

The ASX has dipped 0.82pc in trading today, while gold soared to record new highs above US$3,200 per ounce and oil fell to levels not seen since March 2020.

Legacy Minerals has returned a robust scoping study for the Drake project as investors continue to move into gold.

Tylah Tully looks at Trajan Group’s achievements in 2024, and big plans for the company this year.

Animoca Brands’ subsidiary GAMEE has launched a web3-based trading card game, Moon Cards, powered by memecoins.

Big miners are always hunting growth. Leeuwin Metals and Tesoro Gold are two gold juniors with monsters lurking on their registers.

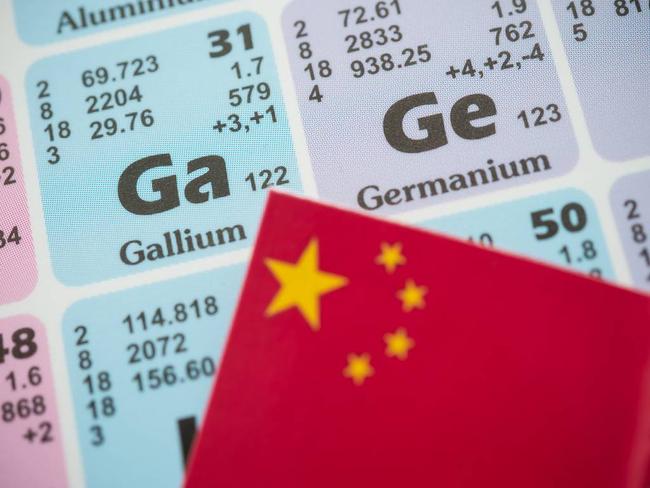

Gallium’s captured the imagination since China restricted exports, but what is it and which ASX companies are in line to become producers?

Tariffs on Chinese goods could bring risks for commodity demand, as Goldman Sachs warns on iron ore, coal and alumina.

As markets tanks and Wall Street loses the plot, investors pile into gold, and Ramsay Healthcare shakes up the top deck.

Tylah Tully digs into Legacy Minerals and a Stage 1 Scoping Study which outlined its 32koz+ annual gold production potential.

Trump’s tariffs may have throttled the market, but gold miners are riding high with bullion prices at a record and oil crashing.

Original URL: https://www.adelaidenow.com.au/business/stockhead