Micros with Majors: These gold juniors have caught the eye of some big fish

Big miners are always hunting growth. Leeuwin Metals and Tesoro Gold are two gold juniors with monsters lurking on their registers.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Micros with Majors is Stockhead’s column profiling and examining the stories behind micro-cap ASX companies in partnerships with some of Australia’s, and the world’s, leading organisations.

This week we’re looking at a couple of gold juniors who’ve caught the eye of a big fish, taking a stake in two intriguing ASX gold juniors.

With the gold price going gangbusters, there’s been a flurry of M&A activity in the sector, as investor sentiment for the precious metal heats up.

And the big miners are looking to the future, taking a stake in early stage projects with the potential to add ounces to their current operations either through joint venture or acquisition down the line.

One of those is Ramelius Resources (ASX:RMS) who recently announced their acquisition of Spartan Resources (ASX:SPR), which will see the Dalgaranga project adding feed to Ramelius’ Mt Magnet operations. But it's not that investment we're looking at today, rather one that has slid under the radar.

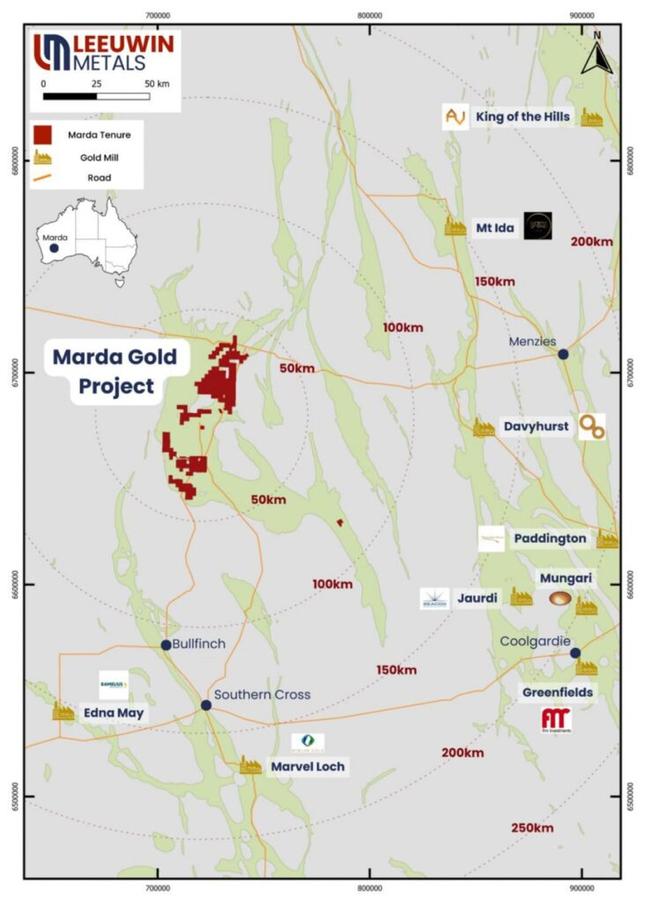

RMS holds a strategic stake in newly minted gold explorer Leeuwin Metals (ASX:LM1), which recently closed its deal to buy the Marda project in WA off the mid-tier gold miner last month.

Marda has already been mined in four discrete open pits by Ramelius, which treated the ore at the Edna May mill near the WA town of Westonia. With Edna May heading into care and maintenance, Leeuwin engineered a potential company making transaction, picking up the project for just $500,000 worth of its own stock, with future cash payments contingent on the discovery of JORC compliant resources.

“You can look at the deal they did with Spartan which demonstrates the type of size and scale they’re looking for,” Leewuin executive chairman Chris Piggott said.

“For us, Marda is the right size asset and there’s a long history of companies from our position on the sub $10m market cap having success from picking up old, unloved gold mines, and adding some ounces via exploration at the drill bit.

“As part of the deal, Ramelius got the upfront consideration in stock so that really validates the view that we all think the asset is good. Ramelius just wasn’t the right home for Marda and it's found a home in Leeuwin.”

Just last week the company announced drill hits outside previously mined deposits, supporting its theory there’s plenty more ounces to be added through targeted brownfields exploration at Marda.

Those drill hits include 4m at 14.05g/t from 25m, 9m at 7.93g/t from 41m, and 11m at 6.9g/t from 21m.

“Since completing the purchase a couple of weeks ago we’ve commenced drilling, we’re doing database reviews of other prospects within the tenure, we’ve put announced drill hits showing the significant exploration potential outside of the pits,” Piggott said.

There’s also prospects at Evanston, Golden Orb, and King Brown and a bunch of historic prospects around old mines that haven’t seen much exploration in the last five years which could provide even more exploration upside on the company’s 500km2 of tenure.

“We’ve got the ability to find ounces that are commercial, but there’s also exploration potential outside of the known mining leases,” Piggott said. No surprise then that Ramelius is keeping its skin in the game.

Chile gold play attracts the big guns

Another junior which has attracted a big fish is Tesoro Gold (ASX:TSO), which holds the El Zorro project in Chile. That boasts the 1.5Moz Ternera deposit, which remains open in all directions.

South African behemoth Gold Fields – one of the world's ten largest gold producers with a $31 billion market cap – holds 17.5% of Tesoro's shares, and TSO managing director Zeff Reeves reckons they probably like the project for the same reason TSO does: Ternera has an exploration target of 3Moz – and it could be much larger.

“They’re also intrigued, as we are, with the district and the concession holding throughout the district that we’ve got,” he said.

“El Zorro is Chile’s first ever intrusive related gold system, no one else has been looking for these types of system in Chile before.”

The closest similarity is the Tintina province in North America, where deposits tend to cluster together, and that’s what Gold Fields is keeping a close eye on, Reeves says.

“I think Gold Fields want to know if there’s potential for more deposits on our ground, and certainly the more work we do the more encouraged they are that there’s potential for additional discoveries and it could be a multi-million ounce new district that’s been completely overlooked,” he said.

Gold Fields has recently commissioned and started production from the Salares Norte project, about 175km from El Zorro, Andes 4000m+ above sea level in the Andes mountains. El Zorro, by contrast, sits at low altitude in a coastal location close to infrastructure like power and water.

“If it was to get to a size where they might want to acquire the entire project then it’s a much better proposition to build on the coast as opposed to the Andes,” Reeves said.

If you build it they will come

Reeves sees two options for the project. One is that TSO will continue to de-risk and push through to feasibility, development and production to build and operate the mine.

"Or it will get to a size where a company such as Gold Fields will take it off us for the right price,” he said.

In the meantime, the company is continuing to drill and expects to update the project’s resource in the coming months with a scoping study to follow using the updated gold price.

“We’re targeting to get enough ounces into an initial 8-9 year mine life that is able to produce upwards of 100,000 ounces a year, probably closer to 120,000 ounces a year for the initial mining operation,” Reeves said.

“We’re continuing to do that work that will provide feasibility towards the end of this year, early next year.

“We’re also continuing to explore the district and some additional targets we found very close to Ternera, so we’re pushing on with de-risking those targets and we anticipate drilling some of those this calendar year.”

At Stockhead, we tell it like it is. While Tesoro Gold and Leeuwin Metals are Stockhead advertisers, they did not sponsor this article.

Originally published as Micros with Majors: These gold juniors have caught the eye of some big fish