Federal Budget live updates: Leigh Sales questions ‘dirty bomb’ budget move

The ABC’s Leigh Sales has wasted no time in grilling the Treasurer, suggesting the new budget hides a sneaky, so-called “dirty bomb”.

The budget is finally here – and it’s fair to say the government is hoping there’s enough sweeteners in there to score some extra votes as the election looms.

Among the highlights is a $250 payment for pensioners and other welfare recipients, a one-off tax cut of up to $1500 for millions of Aussies and some much-needed relief at the bowser.

Read on for the latest budget updates.

Stream live analysis of what the federal budget means for you on Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

Treasurer grilled over budget ‘dirty bomb’

The ABC’s Leigh Sales has grilled Treasurer Josh Frydenberg over the new budget – suggesting the government may have left a “dirty bomb” for Anthony Albanese, should he win the election.

Sales described the plan to scrap the fuel excise cut after just six months as a trap for a potentially incoming ALP government, given prices will likely skyrocket once the cut is removed.

But the treasurer denied the suggestion, insisting that wasn’t the case.

“You’ve said that it will be removed in six months. Is that timing simply a dirty bomb set for Labor if it wins the election? You’ll turn around in six months’ time and then blame them for a sudden increase in petrol prices?” Sales asked.

“No, it responds to the here and now where you’ve seen petrol prices above $2 a litre and it has been largely driven by the events overseas with a barrel of oil up by 50 per cent since the start of this year,” Mr Frydenberg replied.

“But also in the budget, Treasury have forecast that the price of a barrel of oil will come down to around $100 in the September quarter and it’s on 28 September that we pivot off that cut in the fuel excise back to where it normally was and what I’ve made very clear in my budget speech tonight is that the cut in the fuel excise is not coming at the cost of investments in roads – we’re still committing $12 billion over the year to new road funding which is very important and which is where normal fuel excise revenues go.

“Obviously I’m focusing on winning the next election and I’m very proud of the fact the Australian economy now leads the world.”

‘Over-optimistic’: Huge issue budget ignored

Leigh Sales also questioned Mr Frydenberg over the elephant in the room – the fact that Aussie wages were not rising fast enough to keep up with the cost of living.

“Every budget I’ve covered, wages forecasts have been overoptimistic compared to what’s actually happened,” Sales said.

“You’re highly optimistic that low unemployment is going to see wage increases.

“But Treasury is warning that we will already see the unemployment rate fall faster and be lower than expected without generating substantial pay rises. Why do you think that’s going to change?”

Mr Frydenberg hit back, as expected.

“I wouldn’t want to correct you but I have to. In last year’s budget, I forecast wages that were lower than what was delivered,” he said.

“When you’ve got a tighter labour market and employees are competing for workers, that will put upward pressure.

“So as more people get into work, we’ll see upward pressure on wages. If business is going well on its earnings, what you’re banking on is the businesses are going to be able pay better wages because there’s fewer workers because unemployment is low.”

‘Does nothing’: Budget backlash grows

As the dust from the latest budget announcement settles, various interest groups have wasted no time in sharing their disappointment over certain aspects.

The Australian Council of Social Service (ACOSS) was one of the first to wade in, claiming the budget was full of “temporary measures”.

“This budget ignores the big challenges that the country faces right now, which are poverty, inequality and climate change. It doesn’t deliver a budget people can rely on,” the statement reads.

“We don’t need temporary measures; we need measures that communities can rely on. This budget is full of temporary fixes, when we need permanent solutions.

“Much of the assistance goes to people who don’t need it, and too little goes to people who do.

“One of the biggest spends in this budget are more tax cuts, such as the cuts to the fuel excise and the tax offset. It does nothing to lift the incomes of people with the least.”

The Australian Institute of Superannuation Trustees (AIST) has claimed the budget failed to take more action to improve retirement savings outcomes for women.

“We’re disappointed the government has failed to take action such as introducing super on paid parental leave, assessing the financial coercion of women using the early release of super scheme in the early days of the pandemic, and more effectively addressing the gender pay gap,” AIST CEO Eva Scheerlinck said.”

Meanwhile, the Committee for Economic Development of Australia (CEDA) has claimed the budget relies on short-term quick fixes to address cost of living concerns, while missing major opportunities.

“This Budget’s focus on temporary measures to alleviate rising costs-of-living such as cutting the fuel excise, cost of living tax offsets and one-off payments will be welcomed by many,” CEDA Chief Economist Jarrod Ball said.

“But the Budget has only taken modest steps to permanently lift the capacity of households to navigate the growing pressures on the economy.

“The $8.6 billion of cost-of-living measures mostly benefit income earners and motorists, with many income support recipients receiving the least relief from cost-of-living pressures.”

‘Pretending to care’: ALP skewers budget

Shadow treasurer Jim Chalmers has given the ALP’s verdict on the budget, telling the ABC it failed to deliver.

“The government is now pretending to care about those cost of living pressures because Scott Morrison has to call an election in the next fortnight,” he said.

“If they cared about cost of living pressures they wouldn’t have spent the best part of a decade coming after peoples wages and job security.

“All the government’s done here is take a whole bunch of economic challenges before the election and push them to the other side of the election.

“So it’s very shortsighted, very desperate, very panicked and I think the country deserves much better.”

What the budget means for you

The budget is finally here – and here’s a round up of some of the highlights.

– One-off $250 payment for welfare recipients

– Aussies earning less than $126,000 per year to score one-off tax cut of up to $1500

– New parents able to access a combined 20 weeks of paid parental leave under major overhaul

– Petrol price slashed by 22 cents a litre

– Children aged “zero to four” added to vaccine injury claims scheme

– New support for young tradies to complete apprenticeships

– Buy home with deposit as low as 2 per cent

Who can claim new $1500 tax cut

Australian workers earning under $126,000 a year will score a one-off “Lamington” tax bonus in tonight’s budget that will deliver a bumper tax cut of up to $1500 in July.

Treasurer Josh Frydenberg has confirmed a one-off $420 ‘Cost of Living Tax Offset’ which will be delivered to 10 million working Australians in the form of a more generous low- and middle-income tax offset (LMITO), also known as the Lamington.

The election sweetener will bump up the low- and middle-income tax offset from $1080 to up to $1500.

The bad news is the existing $1080 Lamington tax cut will be scrapped for the 2022 financial year, as foreshadowed in previous budgets.

The one-off $1500 tax cut will be available from July 1 this year when you lodge your tax return for the 2021/22 financial year.

– by Samantha Maiden

Treasurer’s speech underway

Treasurer Josh Frydenberg has kicked off his budget night speech, telling Australians the budget is all about “putting more money in the pockets” of millions of Australians struggling with higher prices for petrol, groceries and medicines.

As war rages in Ukraine, communities struggle to rebuild after devastating floods, and the Covid-19 pandemic continues to disrupt global supply chains amid fresh lockdowns in China, the Treasurer has headlined his pre-election budget with billions of dollars worth of sweeteners as part of a major cost-of-living package.

“Events abroad are pushing up the cost of living at home,” Mr Frydenberg said in his budget speech on Tuesday night.

“Higher fuel, food and shipping costs are increasing inflation and stretching household budgets. Tonight the Morrison Government announces a new temporary, targeted and responsible cost-of-living package to ease these pressures. Practical measures that will make a difference.”

Mr Frydenberg said the measures were “delivering cheaper fuel, cheaper medicines and putting more money in the pockets of millions of Australians”.

– Frank Chung

How much you’ll save on petrol

The federal government has formally announced it will halve the fuel excise from midnight tonight in an effort to address the spiking cost of petrol.

The fuel excise is currently 44.2 cents per litre. That will be cut to 22.1 cents per litre for a period of six months – taking it well beyond the looming election in May. But don’t expect the price cut to flow through to the bowser immediately.

In his budget night speech, Treasurer Josh Frydenberg said the measure was part of a “temporary, targeted and responsible cost of living package”, designed to ease the pressure caused by higher fuel, food and shipping costs.

“For the next six months, Australians will save 22 cents a litre every time they fill up their car,” Mr Frydenberg said.

“A family with two cars they fill up once a week could save around $30 a week, or around $700 over the next six months.

State of the Nation Survey

“Whether you’re dropping the kids at school, driving to and from work or visiting family and friends, it will cost less.”

Big problem with new budget

We still don’t know all the details, but one thing’s for sure – the Morrison government will be hoping tonight’s budget is the sweetener it needs to secure votes come election time.

But that comes with a huge risk, according to Deloitte Access Economics partner Chris Richardson, who told the ABC splashing the cash could ultimately make life harder for many Aussies.

“If you have a pulse and a vote, you’re going to get something out of this budget,” Mr Richardson told the network on Tuesday.

“But what you won’t notice is that extra money poured atop a strong economy will result in higher inflation and more dollars chasing the same things.

“That higher inflation will annoy the Reserve Bank which is starting to think about raising interest rates so they will raise them earlier and more than they otherwise would have.”

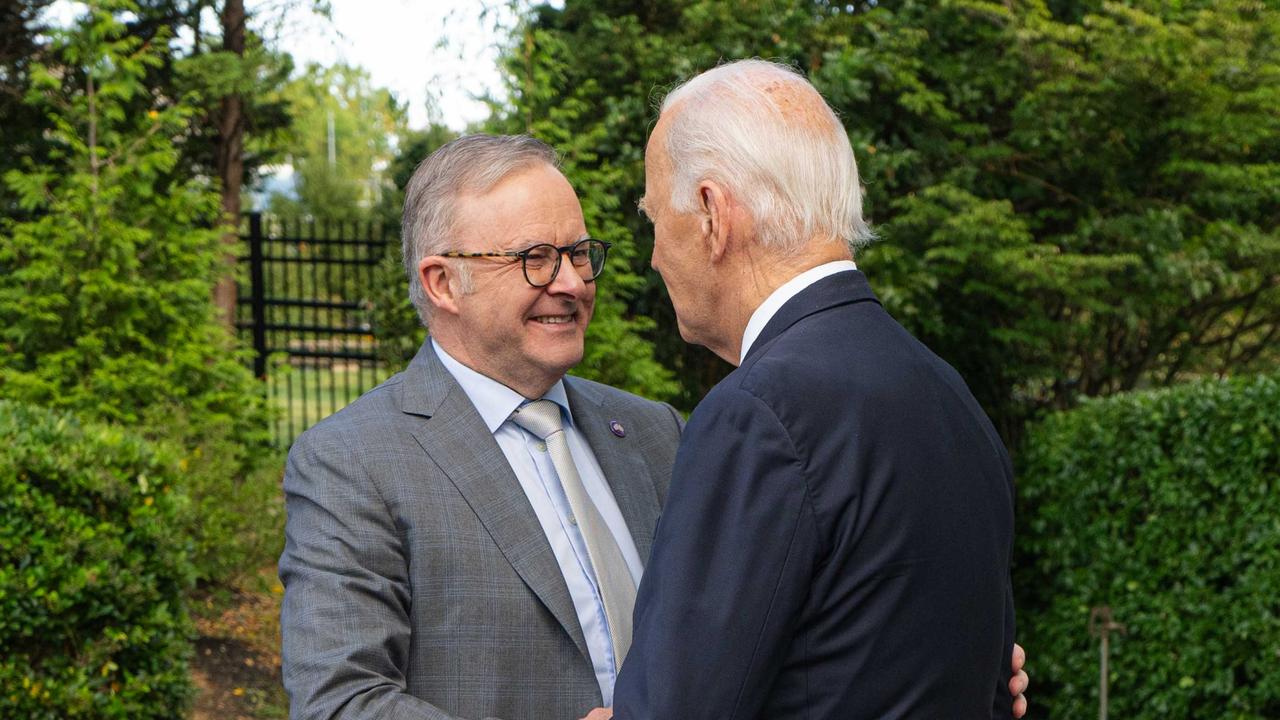

The one question PM won’t answer

Prime Minister Scott Morrison refused to question one crucial question close to most Aussies’ hearts just hours before the release of the hotly-anticipated budget.

The PM copped a grilling from Labor leader Anthony Albanese about the lack of wage growth which has been impacting the standards of living of countless families during Question Time on Tuesday afternoon.

But the PM ignored the question completely, instead speaking at length about tax rates.

When Mr Albanese and Manager of Opposition Business Tony Burke objected to the non-answer, it was overruled by the Speaker.

Instead, Mr Morrison simply spruiked the importance of a healthy economy.

“The best remedy for higher wages is a stronger economy, and the way that you get that stronger economy is through responsible economic management,” he said.

$1.3b for Aussie flood victims

Question Time is underway, with the PM confirming $1.3 billion had already been paid out to those affected by the ongoing flood crisis in NSW and Queensland.

He said the total government flood package was worth $2.4 billion, including $291 million for mental health support, business recovery and financial counselling, in addition to the $1.3 billion paid directly to those impacted.

Mr Morrison added that more than 40,000 requests had been made for help and that 22 local government areas in Queensland and 45 in NSW were included in the government’s disaster response.

“Even in these events, the devastation that has occurred … too much support can ever be enough,” Mr Morrison said.

“For those right now, there is a long 48 hours ahead for flood-affected communities.”

“It has just been unrelenting. Already this year we have seen huge swathes of our landscape transformed into a brown sea,” Labor Leader Anthony Albanese said, adding that “extraordinary stories” of Aussies helping each other through had emerged.

Government’s $11 billion saving

Treasurer Josh Frydenberg told reporters this morning the unemployment rate was expected to fall to 3.75 per cent, and it would be the first time the figure had a three in front of it in 50 years.

“This is a remarkable achievement that belongs to 26 million Australians,” he said.

Fewer jobless also means a big drop in unemployment payments.

The Australian reports the government is expected to slash its costs for JobSeeker and youth allowance payments, saving taxpayers about $11 billion over the next four years.

Tax cuts, cash payments and fuel excise changes are also expected to be announced within hours.

With unemployment so low, there are also hopes wages will rise.

Deloitte Access Economics partner Chris Richardson said the low unemployment rate should be enough to trigger faster wage growth, but warned that it would be a slow rise.

“I am absolutely not expecting that to be a sprint,” he told ABC RN Breakfast.

Labor leader Anthony Albanese was sceptical about any boost saying there was massive underemployment.

“The figures hide the fact that people can be working just a few hours a week to get by to get some money. But that’s not a sustainable income,” Mr Albanese told ABC RN Breakfast.

Mr Albanese has said Labor will wait to look at the detail before making its position clear on budget measures but said ‘we’re unlikely to say, ‘no, don’t give people a one-off payment’.

“But I’ll tell you what. We’ll point out that it’s probably timed for the election.

“What we need is a plan for the economy, not a plan to get the coalition a fourth term in office. And that’s all we’re seeing from this government.”

Cash payments for those earning under $126k

This morning Mr Frydenberg confirmed there would be a temporary cut to the fuel excise to ease pressure on motorists at the bowser, with drivers to see a drop in prices within days.

Other measures flagged include one-off cash payments of at least $250 for pensioners and other welfare recipients, as well as a childcare subsidy boost.

The Daily Telegraph is also reporting a temporary modest cash payment is expected to be provided for people earning under $126,000, as an alternative to extending the $1080 low and middle income tax offset (LMITO), known as the “lamington”.

According to 7 News, the one-off cash bonus could provide between $200 and $400 to help with skyrocketing costs of petrol and food. It’s thought providing a higher amount would risk stimulating the economy and pushing inflation higher. The payment is due to reach people’s bank accounts prior to the federal election expected in May.

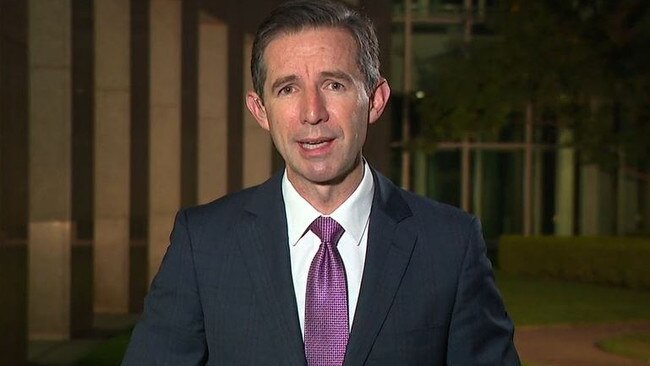

However, the ”lamington” sweetener, worth up to $1080 for singles earning under $126,000, is also due to be paid over the coming months, starting from July 1, Finance Minister Simon Birmingham confirmed on ABC News Breakfast this morning.

“So Australians are going to receive that tax offset and that support and that’s going to provide yet more assistance in terms of cost of living pressures,” Mr Birmingham said.

The LMITO is provided once people lodge their tax returns and was originally introduced as a temporary measure in a package of tax reforms that was extended a number of times during the pandemic. There has been speculation it would not be extended again but the impact of this won’t be felt until next year.

‘Don’t make savings on my catheter bags’

Labor has warned against any cost cutting within the National Disability Insurance Scheme (NDIS), saying it was “playing Russian roulette with people’s lives”.

Mr Albanese held a press conference with shadow minister for the scheme Bill Shorten and NDIS participant Elly Demarchelier in Canberra, and was asked about previous underspending in the scheme that had helped improve the budget bottom line.

“Those cost savings were made at the expense of my catheter bags,” Ms Demarchelier said.

She said if she got a bladder infection, she had previously ended up in intensive care.

“I just think the tiny amount of money that they’ve saved on my catheter bags is going to be far outweighed when I have to make a trip to the ICU.”

Mr Shorten said if the government tried to “dodgy up its budget on the backs of cuts to people with profound and severe impairment — shame on them.

“If they want to save money, perhaps they shouldn’t have wasted so much on their dodgy rorts and dodgy deals. People with disabilities should not pay for the Morrison Government’s incompetence.”

Extra money could be ‘eaten up’ by inflation

Mr Richardson noted the government’s cost of living cash splash would pressure the Reserve Bank of Australia to lift rates sooner, something that Commonwealth Bank economists have also predicted.

Today host Karl Stefanovic pushed Mr Birmingham on the question of whether the government’s cost of living package — potentially worth $2.5 billion — would just be eaten up by higher inflation and interest rates.

Mr Birmingham said “we’re responding here to spikes in oil prices, to other inflationary impacts, and we’re doing it the same way we did through Covid — by being targeted, by making sure that things are temporary to respond to temporary shocks, and by being responsible in how much we spend but trying to help Australians.”

The minister said the budget forecast of 3.75 per cent unemployment would see it reach levels not seen since 1974.

“That’s involving investment in skills, investment in manufacture, investment in digital economy, support for small businesses, all of that will be detailed in the budget.”

The budget arriving for its big day #auspol â¦@9NewsAUSâ© #budgetpic.twitter.com/w6tGobE0lO

— Fiona Willan (@Fi_Willan) March 28, 2022

Infrastructure cash splash targeted to must-win voters

Analysis suggests the Morrison Government’s massive infrastructure spending is targeted at crucial voters ahead of the federal election.

The Australian Financial Review has looked at the $17.9 billion in spending for new and existing infrastructure projects announced on Monday.

It found in New South Wales for example, that five of the seven $100 million-plus funding promises, were in marginal electorates. One was in a safe Nationals seat and the last remaining commitment was funding road safety barriers in regional areas.

Grattan Institute transport and cities project director Marion Terrill told the AFR it continued a “pattern” of the past 18 years in which Queensland “consistently does better out of federal spending” while Victoria is “consistently under done”.

Analysis from Guardian Australia also found just 21 of the 144 projects had been endorsed as priorities by Infrastructure Australia in its current list of priority projects, with the coalition instead funnelling billions into must-win marginal seats.

‘Spending like drunken sailors’

Today host Karl Stefanovic didn’t hold back in his interview with the Finance Minister, describing him as the “Imelda Marcos of Australian politics”.

Stefanovic pulled up Mr Birmingham on his comments the government was planning lower levels of government spending.

“Where do you get low levels of spending from? You’re spending like drunken sailors before this election?” Stefanovic said.

But Mr Birmingham defended his remarks saying: “No Karl what we’ll see here is the fact that there is a real reduction and a nominal reduction in the amount of spending by government.

“We’ve been very careful here to make sure that we actually squirrelled away and save some of the dividend to the stronger economy, to make sure Australia is better positioned for the future.”

We’ll see evidence of budget repair

Mr Birmingham defended the government spending, telling Sunrise earlier there were real pressures in Australian households from petrol prices, from inflationary pressures and from overseas.

“It’s only appropriate that with the strong economy we’ve got we give Australians that bit of a helping hand to deal with these temporary pressures we’re seeing, and there’ll be very targeted and very responsible measures,” Mr Birmingham said.

He said people would also see proof of the government moving towards budget repair now it had secured the economic recovery from Covid-19.

“We’re bringing down the rate of government payments by the largest levels in close to 50 years, we’re banking savings to repair the budget bottom line.”

Help for first home buyers

The government will also deliver relief to first home buyers with the expansion of the deposit guarantee scheme.

Changes were announced on Monday that will see another 25,000 guarantees available from July 1 to support buyers purchasing a new or existing home with a deposit as low as 5 per cent. Previously just 10,000 guarantees were available each year.

A new Regional Home Guarantee will also be introduced, which will also help non-first home buyers, once legislation is passed.

The Family Home Guarantee will also be expanded to 5000 a year from July 1 this year until June 30, 2025. It supports eligible single parents to buy their first home or to re-enter the housing market with a deposit of as little as 2 per cent.

Training and jobs also a focus

Extra training places for skilled jobs across in-demand industries is expected to be provided for hundreds of thousands of Aussies, including in the aged care sector.

This will be on top of plans to subsidise apprentices and trainees already unveiled by the federal government.

On the weekend the government announced it would extend the Boosting Apprenticeship Commencements and Completing Apprenticeship Commencements program, which subsidises the wages of apprentices including future tradies, plumbers, tilers and chefs.

The $365.3 million investment will support an extra 35,000 apprentices and trainees to get into a job.

Prime Minister Scott Morrison has said the budget is all about a plan to deal with cost of living pressures now.

“That immediate relief that is required to deal with the very real cost of living pressures that are on Australian families and are on Australian businesses, particularly small businesses right now,” he told reporters on Monday.

“The impacts on fuel prices and things like that is really causing some great concern to people. And the budget on Tuesday night, the Treasurer will hand down, will provide that immediate relief, but that’s part of a balanced and responsible plan.”

Originally published as Federal Budget live updates: Leigh Sales questions ‘dirty bomb’ budget move