Budget decision could see mortgages soar and interest rates rise

With cost of living one of the key issues for the 2022 federal budget, a government cash splash could spell out bad news for mortgage payers.

There are fears a federal budget spending spree could have a flow-on effect and see interest rates rise, adding hundreds of dollars to monthly mortgage repayments.

With Treasurer Josh Frydenberg expected to announce large-scale cost of living packages on Tuesday night, the cash splash could lead the Reserve Bank of Australia’s (RBA) to increase their cash rate.

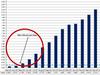

The current inflation rate is sitting at a 12.5 year high of 3.8 per cent, considerably higher than the RBA’s target band of 2 to 3 per cent.

In order to bring down inflation, the RBA may need to increase the cash rate (also known as the interest rate the RBA charges commercial banks), which currently sits at a crisis-low level of 01. per cent.

In a research note for the Commonwealth Bank, its chief economist Stephen Halmarick said the cash rate could be increased from 0.1 per cent to at least 1.25 per cent, which could see variable mortgage rates increase from 2.28 per cent to 3.53 per cent.

With the average size of an Australian mortgage set at $595,568 (according to the ABS) this could see annual interest repayments soar from around $13,400 to $21,023.

Stream live analysis of what the federal budget means for you on Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

“If the 2022/23 Budget was to provide significant additional near-term fiscal stimulus, one of the outcomes would be that the Reserve Bank of Australia (RBA) could need to take the cash rate target above our 1.25 per cent estimate of ‘neutral’ in order to bring inflation back down into the 2 to 3 per cent target range,” he said.

Whether this happens “will be a key factor to watch on Budget night”.

His colleague Gareth Aird echoed the sentiment, writing: “Policies that seek to help households deal with higher consumer prices by adding to demand in the economy will put further upward pressure on prices.”

In turn, he said, this would increase the likelihood of the RBA increasing the cash rate - and thus pushing up interest rates.

While RBA Governor Philip Lowe seemed reluctant to raise rates, he did say that “it is plausible that the cash rate will be increased later this year,” while speaking at an Australian Financial Review summit.

This comes as the US Federal Reserve, Reserve Bank of New Zealand (RBNZ) and Bank of Canada have raised interest rates in order to fight rising inflation rates.

However, as the country with the second-highest levels of household debt globally at 119.3 per cent of GDP, the effects of a rate rise would be felt more strongly in Australia than anywhere else.

With Mr Frydenberg set to deliver the 2022-23 budget later tonight, easing the cost-of-living for households will be a major priority.

So far it’s been confirmed that motorists would see a temporary cut to the 44c/L fuel excise, as well as one-off cash payments of at least $250 for pensioners and welfare recipients and a temporary modest cash payment for people earning less than $126,000.