Australian suburbs facing worst mortgage stress as interest rate rise looms

Red flags have been raised that a huge number of homeowners are already in financial trouble, with an interest rate rise set to tip some areas over the edge.

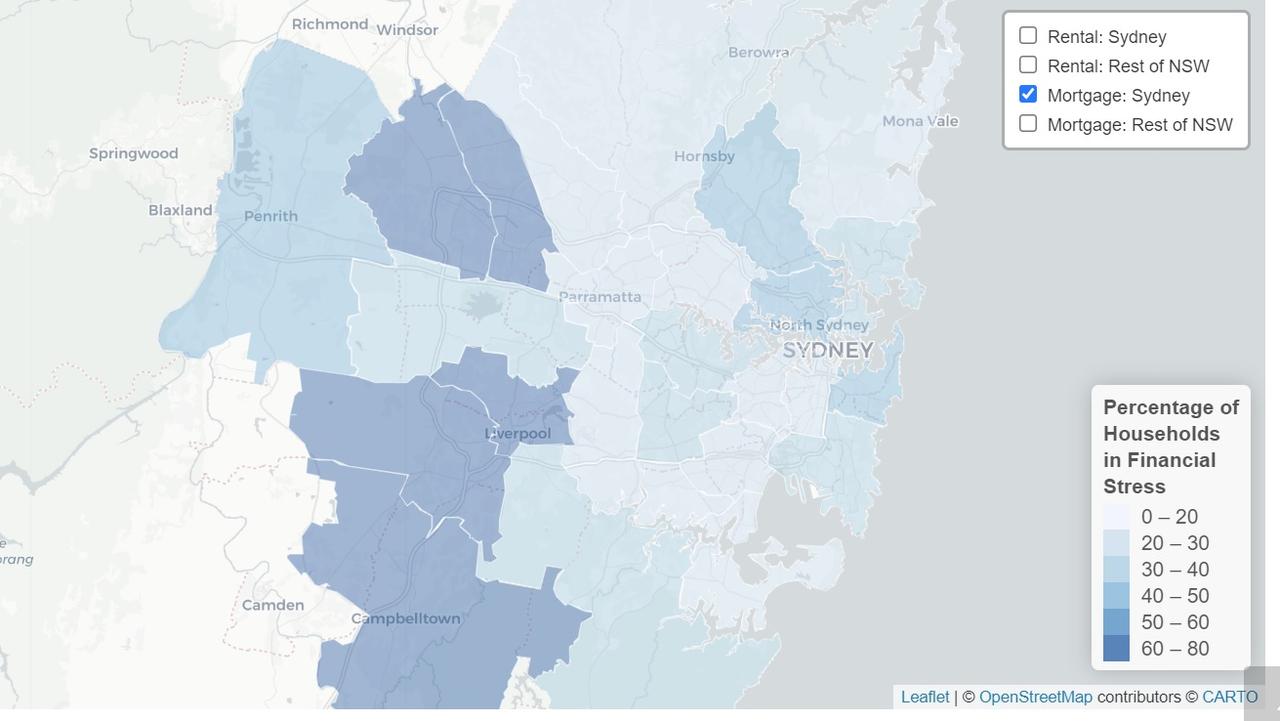

As interest rates are predicted to rise, new heat maps are showing the suburbs most in danger of mortgage stress, with some of the wealthiest suburbs set to be among the hardest hit if rates go up by just 1 per cent.

The data has found that already up to three-quarters of homeowners in some parts of Australia are facing financial stress.

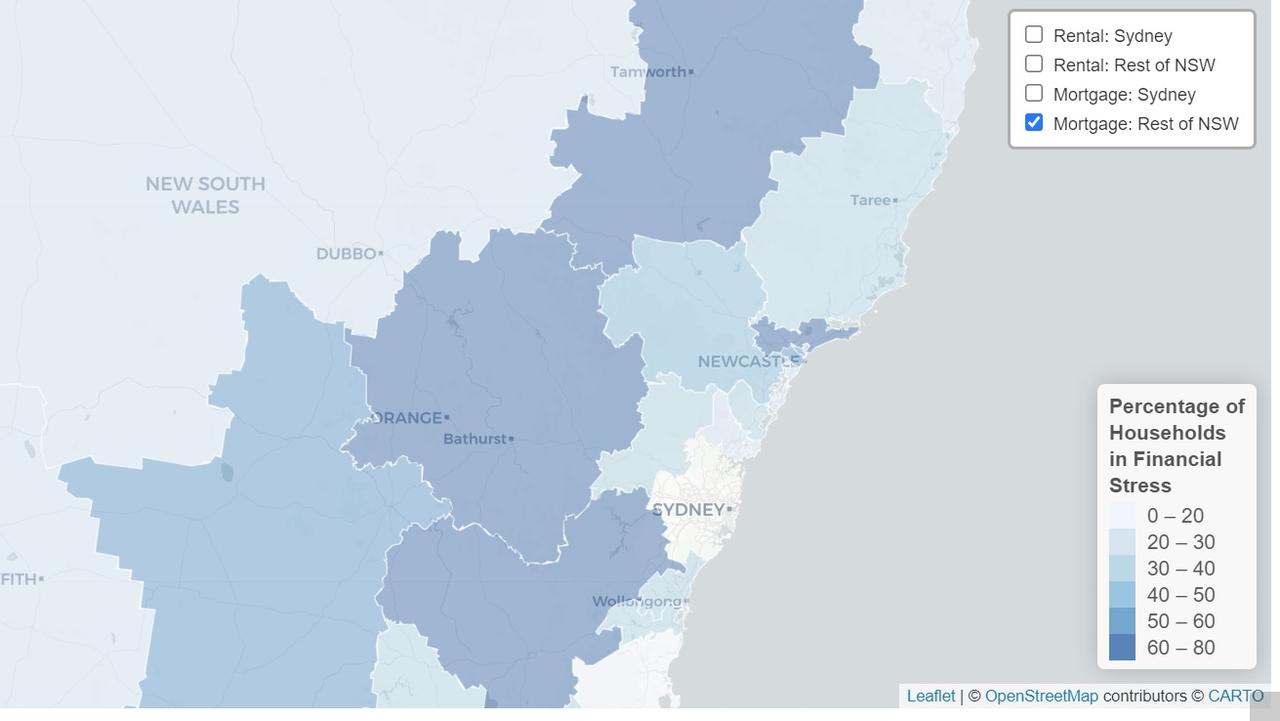

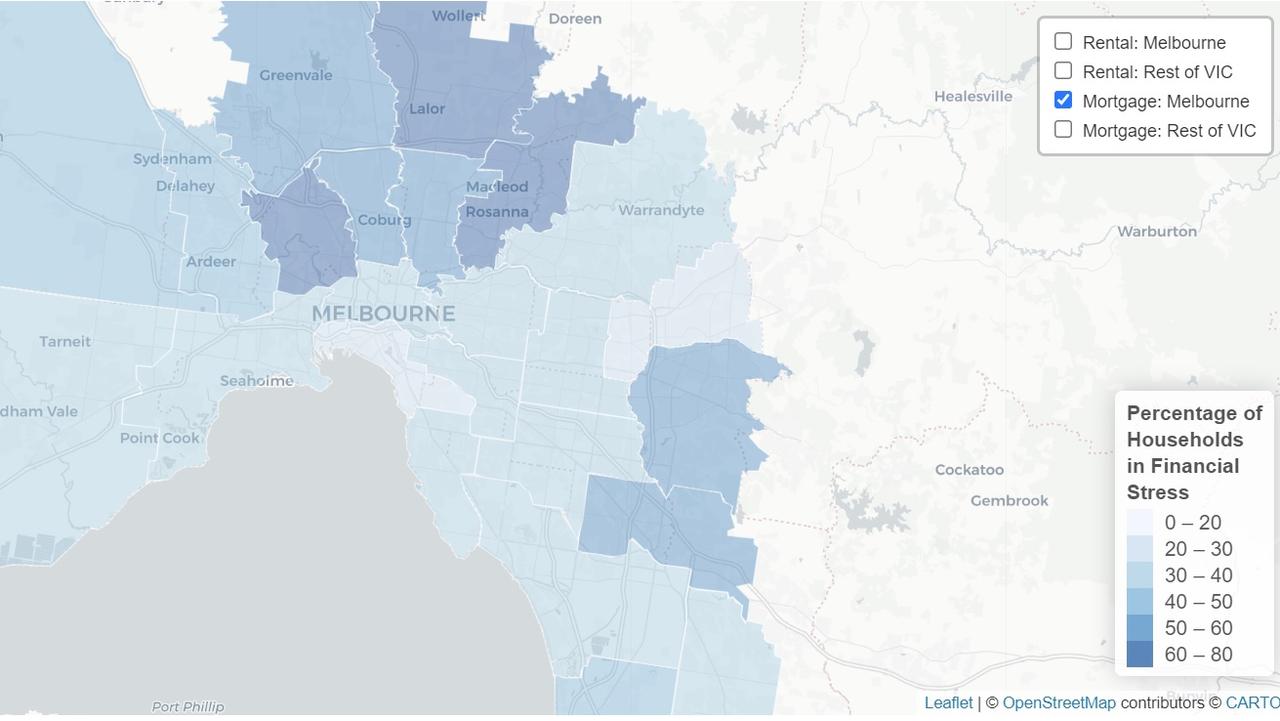

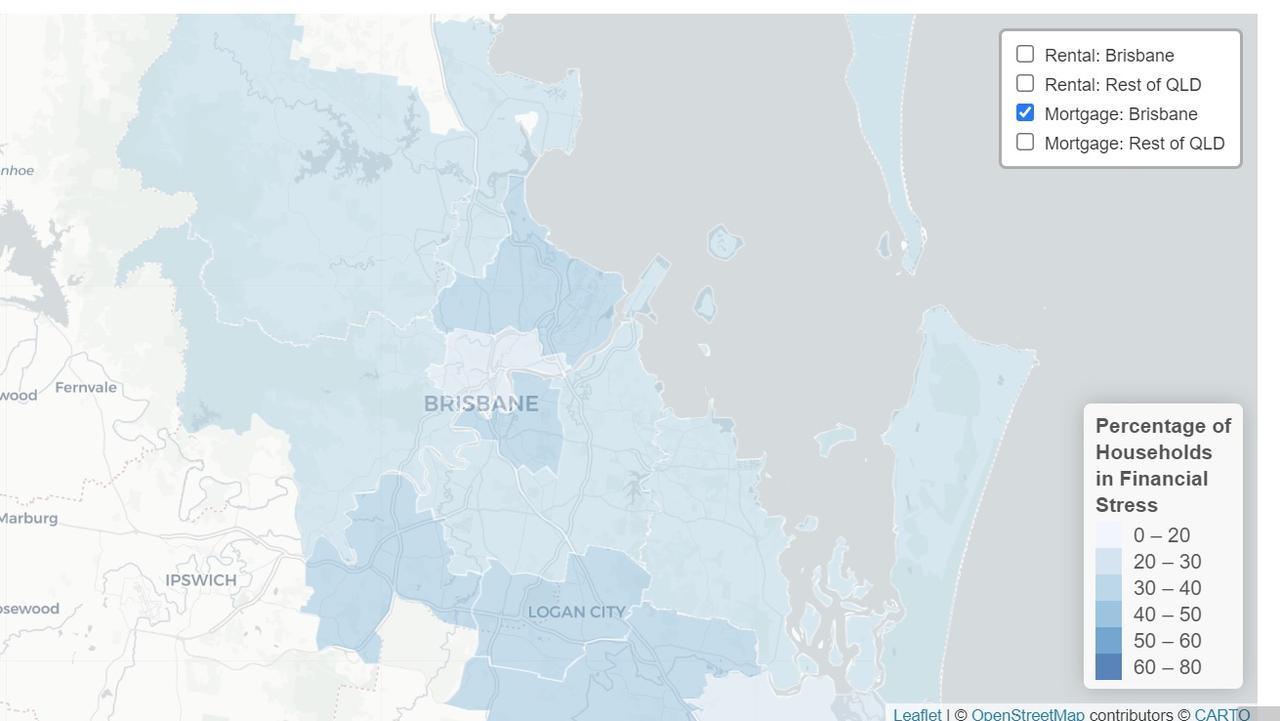

The heat maps have revealed that the worst-hit areas for mortgage stress include western Sydney, the NSW Central Coast, parts of Brisbane and outer Melbourne – with a warning that when interest rates rise, it will only add to the problem.

Sydney house prices jumped by an extraordinary 27 per cent last year alone. The price rise saw people scrambling to get into the market, and many took on big mortgages with the low interest rates on offer.

But the data now shows a huge number of those homeowners are facing trouble.

Hot spots include the western Sydney electorate of Macarthur held by Labor, where the suburb of Campbelltown has 75.6 per cent of households suffering mortgage stress.

The more affluent electorate of Mitchell, currently held by the Liberal Party, which includes the suburbs Baulkham Hills and Winston Hills, has a high rate of stress with 73 per cent impacted.

The research from social housing advocacy group Everybody’s Home, Digital Finance Analytics and the University of New South Wales City Futures Research Centre surveyed more than 52,000 households across Australia.

Financial stress was defined as having less than 5 per cent of income left over after expenses.

It found the Labor seat of Chifley in Sydney, which includes Mount Druitt and Rooty Hill, recorded 73.6 per cent of households in stress.

Over in southern Sydney, 70 per cent of mortgage holders in the Labor seat of Barton, which covers Rockdale and Hurstville, are also in mortgage stress.

Kate Colvin, spokeswoman for advocacy group Everybody’s Home, said while outer metro areas of Sydney tended to have the most financial stress, there were affluent suburbs that were also in trouble.

“Outer metro areas are where lower income households tend to be purchasing a home and are geared up to the eyeballs to do so, for example in Sydney in outer metro areas, we have more than 70 per cent of mortgagees in financial stress in Macarthur and Fowler,” she told news.com.au.

“These are people who have less than 5 per cent of income left after paying ordinary costs and if interest rates go up then they will be [in] a really tight position to manage that cost increase.

“But there are some safe Liberal seats where more than 40 per cent of mortgagees are in financial stress, so the electorates of North Sydney, Wentworth and Bradfield.”

On the Central Coast, 70 per cent of borrowers were in mortgage stress in the Liberal electorate of Robertson, which covers Gosford and Woy Woy – areas where house prices skyrocketed during the pandemic to seven figures.

Interest rates to rise

More than 135,000 Sydney households and 88,000 in Melbourne will slide into mortgage stress if interest rates increase by just 1 per cent. And it’s not just those on modest incomes either.

Suburbs with young wealthy households – including Dee Why, North Curl Curl and Five Dock in Sydney and Glen Waverley, Ringwood and Eltham in Melbourne – will be some of the hardest hit across Australia after skyrocketing property prices saw them take on huge mortgages.

Ms Colvin said the Government needs to take action against the real drivers of the housing crisis.

“It’s not just putting a bandaid on it by quick cash handouts like first homeowners grants. That doesn’t do anything; it just pushes prices up further,” she said.

“We are calling on Government to invest in more social housing, which is particularly focused on rental affordability as there are not enough low-cost rentals in the market and … there needs to be government intervention to deliver more affordable rentals into the system.

“It doesn’t just help by delivering more rentals but it also takes heat out of the market.”

The RBA has warned that Australian mortgage holders could be facing a major interest rate rise earlier than expected because of Russia’s invasion of Ukraine.

The official cash rate has been at a record low of 0.1 per cent since November 2020 in response to the Covid-19 pandemic but it is expected to jump by 1 per cent by the end of this year and hit 1.25 per cent next year.

Although a 1 per cent rise sounds like a tiny amount, it could add hundreds or even thousands of dollars extra every month for the average Australian mortgage.

Australia’s median property price stood at $728,034 in February so a borrower with a 20 per cent deposit would have monthly repayment obligations of $2269 if they had a variable loan rate of 2.39 per cent.

If it was to hit a 4.54 per cent variable rate, they would then owe $2965 a month – an increase of almost $700.

Other areas already in mortgage stress

Over in Melbourne, house prices surged by 18.6 per cent in the past 12 months and a whopping 35 per cent in the less than three years, yet outer suburbs like the Labor seat of Bruce, which includes Narre Warren, has 64 per cent of borrowers in stress.

The Labor seat of Calwell in Melbourne’s north that encompasses the suburb of Craigieburn, has 63.3 per cent in mortgage stress.

Meanwhile, interstate buyers have helped to push Brisbane houses to a record median high of $792,065 and it was one the fastest growing property markets in Australia last year, with prices jumping by 25 per cent.

Yet, the Liberal electorate of Bowman in the city’s east which includes the suburb of Cleveland has 59.8 per cent of borrowers in mortgage stress.

Renters also in trouble

It isn’t just homeowners who are impacted; renters are also feeling the pinch with more than 40 per cent of tenants in a majority of electorates in Sydney and Melbourne in financial stress.

Ms Colvin said particularly in Sydney, Melbourne and Brisbane there are a really high number of people who are in financial stress after paying rent.

“But across all of those cities, the majority of seats have more than 40 per cent of renters in stress so that’s a lot of renters who are struggling,” she said.

More Coverage

She said while there had been a focus on the cost of living rising – on everything from food prices to petrol – housing was the biggest expense for all households in Australia.

“There is all this is talk about petrol prices, but housing is a much more significant cost for families,” she said.

Everyday Housing has called for 20,000 new properties a year, particularly as middle income Australians can’t keep up with rent and mortgage payments.