Inflation and interest rate rises factored in to 2022 federal budget

The budget includes more help for Australians trying to break into the property market – but doing so comes with considerable danger.

Tens of thousands more Australians will have access to government programs designed to help them buy their first home under changes announced in the federal budget.

But homebuyers also need to be conscious of mortgage rate rises, caused by high inflation and rising interest rates.

According to Treasury’s forecasts, Australia’s inflation rate will peak “well below” those of other comparable countries, but will reach 4.25 per cent in the June quarter this year before receding to 3 per cent in the 2022-23 financial year.

“The combination of higher global inflation and a historically tight labour market suggests that domestic inflation risks are tilted to the upside,” the budget papers say.

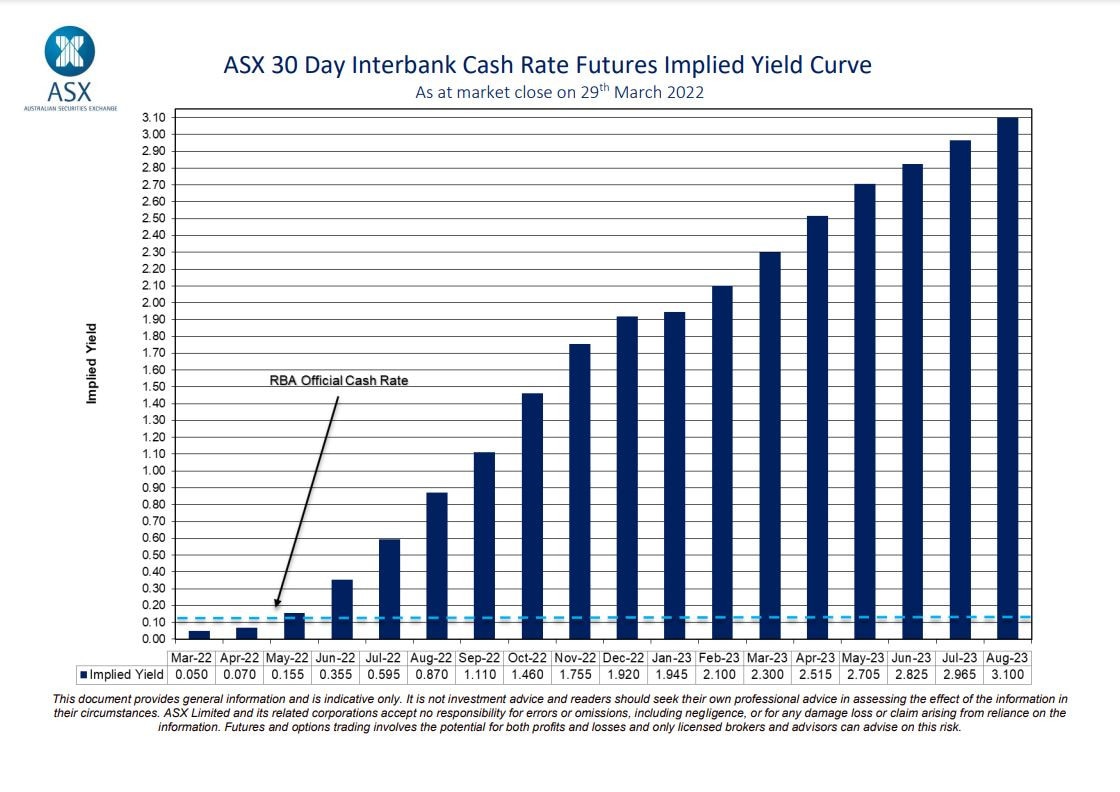

Treasury predicts monetary policy will “begin to normalise from historically low levels”, with the market “pricing in a tightening cycle from mid-2022 until 2024”. That would mean higher interest rates, and therefore higher mortgage repayments.

How fast the RBA will hike interest rates is not easy to predict - but they could hit 1.25 per cent by 2022.

That means variable mortgage rates increase from 2.28 per cent to 3.53 per cent.

With the average size of an Australian mortgage $595,568 (according to the ABS), the average annual interest repayment could soar from about $13,400 to $21,023.

Stream live analysis of what the federal budget means for you on Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

There is, however, some good news for people considering taking out a mortgage. The government is spending an estimated $8.6 million to more than double the current number of places available per year under its Home Guarantee Scheme, which dramatically lowers the deposit required to buy a home to just 5 per cent, instead of the usual 20 per cent.

The scheme has three distinct components with annoyingly similar names, so bear with us.

The First Home Guarantee, which is aimed at first homebuyers in major cities, will now have 35,000 places per year.

A newly created Regional Home Guarantee, with 10,000 places, will focus on helping aspiring homebuyers in regional areas.

It will be available to both citizens and permanent residents who have not owned a home for five years. The government hopes that will have the added benefits of encouraging more home construction outside the nation’s capital cities, and encouraging more migrants to live in regional areas.

Finally the Family Home Guarantee, which is targeted at single parents who are either buying their first properties or seeking to re-enter the housing market, will see its allotment doubled to 5000 places.

Beneficiaries of the Family Home Guarantee can buy homes with an even lower deposit of 2 per cent.

The changes announced in the budget bring the total number of places available under the umbrella of the Home Guarantee Scheme to 50,000 per year.

That new limit will apply for three years, before it is reduced to 35,000 in 2025.

The expanded First Home Guarantee and Family Home Guarantee will be available from July 1, while the new Regional Home Guarantee will start three months later, on October 1.

The estimated cost of all this is $8.6 million over the next four years, then a much larger $138.7 million in the seven years after that.

In his budget night speech, Treasurer Josh Frydenberg described home ownership as “fundamental to the Coalition”.

“HomeBuilder, the First Home Super Saver Scheme and the Home Guarantee Scheme have helped make the dream of home ownership a reality,” he said, adding that 160,000 Australians purchased their first home in the last year.

“Tonight we go further, more than doubling the Home Guarantee Scheme to 50,000 places per year,” the Treasurer said.

“Helping more single parents to buy a home with a deposit as low as 2 per cent. Helping more first home buyers to buy a home with a deposit as low as 5 per cent.

“In this budget, we are also increasing our support for affordable housing by $2 billion through the National Housing Finance and Investment Corporation.

“Helping more Australians to own a home is part of our plan for a stronger future.”

By having the government guarantee up to 15 (or in some cases 18 per cent) of a deposit, the Home Guarantee Scheme allows borrowers to avoid tens of thousands of dollars in lenders mortgage insurance, which kicks in when their deposit is less than 20 per cent.

It is available to singles who earn up to $125,000, and couples who earn up to $200,000 in combined income.

According to the government, the scheme has helped almost 60,000 people enter the housing market since its inception.

To illustrate its effectiveness, the budget papers point to the case study of a couple currently renting in Wagga Wagga, NSW. The pair want to buy their “perfect house” for $400,000 but are struggling to save the required deposit of $80,000 while also paying rent.

The First Home Guarantee would allow them to instead buy the home with a deposit of $20,000, a quarter of the size.

Bear in mind that there are price caps on the scheme, which differ depending on your state, and whether you’re trying to buy a home in a major city or regional centre.

In Sydney, for example, a home is eligible for the guarantee if it costs $800,000 or less. In a regional centre that cap falls to $500,000.

The nation’s other price caps are as follows.

Victoria: $700,000 in cities, $500,000 in regional centres.

Queensland: $600,000 in cities, $450,000 in regional centres.

Western Australia: $500,000 in cities, $400,000 in regional centres.

South Australia: $500,000 in cities, $350,000 in regional centres.

Tasmania: $500,000 in cities, $400,000 in regional centres.

ACT: $500,000.

Northern Territory: $500,000.

The government is also expanding the scope of the National Housing Finance and Investment Corporation (NHFIC), which has so far supported about 15,000 affordable homes by giving low-cost loans to community housing providers.

The NHFIC’s liability cap will rise to $5.5 billion – a $2 billion increase – and that measure is forecast to support about 10,000 more affordable dwellings for vulnerable Australians.

The Coalition is continuing to talk up its HomeBuilder scheme, which supports the construction of new homes and major renovations.

And there is, of course, the First Home Super Saver Scheme, which allows people to salary sacrifice pre-tax income into their superannuation accounts and use that money to buy their first home.

In last year’s budget, it was announced that the maximum threshold of contributions people could make to their super under the scheme would rise from $30,000 to $50,000 on July 1, 2022. That increase is still happening.

On that note, another case study from the budget papers: a couple earning $95,000 each per year, and salary sacrificing $12,500 each per year, will save $86,000 over a four-year period. That is $21,000 more than they would save using a standard savings account.