Price surge amid US beef demand

Australian cow prices are rising, fuelled by strong US beef demand and a favourable exchange rate. See what it means for sellers.

The cow market has recorded its sharpest price rise since last winter, and the positive trend is that the dearer prices have held, despite a surge in saleyard numbers.

The data suggests the cow market is finally starting to better reflect the significant money being paid for grinding beef into the US.

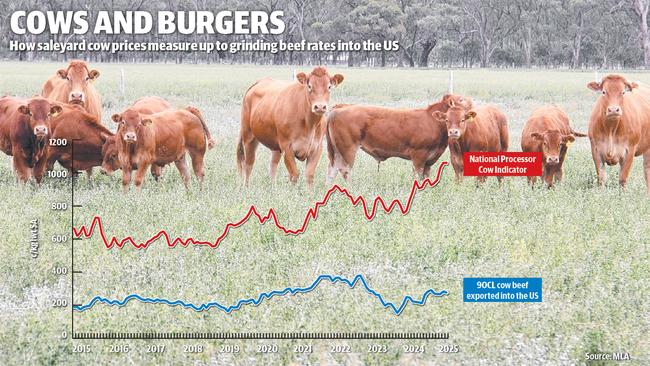

The graph on this page shows the trend line for 90 chemical lean (CL) cow beef into the US – converted into Australian dollars – compared to the average saleyard price being paid for cows.

The gap has been incredibly wide, explained by the record-high cattle market in America and a favourable exchange rate, which has kept returns for exporters shipping grinding beef into the US above 900c/kg since April last year.

In recent months, when the Australian dollar dipped lower against the US greenback, the price of 90CL beef converted into a record average of $10/kg plus into America.

Against this, the cow market has drifted along at saleyard averages of 250c to 290c/kg for most of the past year. To show how devalued this has been due to supply being the over riding market influence, in 2022, when the price of 90CL cow beef into the US hit a then-high of 923c in February, the average saleyard price was 364c/kg.

So, what the industry has seen in the past week to 10 days in regard to cow prices is a move in the right direction from a producer’s perspective, rather than what the market is capable of delivering if US beef prices remain elevated.

On Monday this week, the saleyard average for slaughter cows had lifted to 298c/kg liveweight, a rise of 22c in the past week and the highest price point in more than a year.

There are signs producers are starting to chase the stronger market, with 1,400 cows yarded at Wagga Wagga and 1300 at Mortlake on Monday. Despite this, good beef cows were quoted as dearer at both selling centres, with the rate for heavy cows at 300c to 348c/kg at Wagga Wagga.

The feedback from cattle buyers is that the pool of good-quality cattle, including cows, had started to tighten, triggering the rise in values. However, data doesn’t really show this. The latest available slaughter figures list the female kill at 69,236 for a female kill ratio of 47.78 per cent of total cattle production, according to Meat and Livestock Australia. This matches or is even slightly better than the female slaughter numbers and ratios evident in recent months.

When the figures are analysed by the number of cows included in the seven-day rolling saleyard price average for processing cows, there was a dip in mid-February down to 8000, but this has since lifted to 10,700 in the latest price calculation.

The positive for producers from this is that the higher prices are holding, despite better money flushing out more cow numbers at recent sales. This suggests export demand is now starting to be a greater market driver.

There has also been more positive news out of the US, with commentators talking about low American cow kills for years to come due to little evidence of herd rebuilding. Steiner Consulting this week looked at some comparisons of the 10-year cattle cycle in the US, suggesting there were some parallels between cow market structure and pricing in 2014-2015 compared to the current environment.

In 2015, the US cow beef price peaked between March and July before fading off and not showing the same price heights for some time. This was due to the influence of herd rebuilding, which took the heat off the market. Highlighting this, Steiner said, was the heifer replacement rate. In January 2015, it was estimated US producers had increased heifer numbers by nearly 10 per cent compared to 2014 levels as they looked to boost breeding numbers. In contrast, the estimate in January this year was that heifer replacement numbers were actually 1.7 per cent lower than 2024 levels.

“Perhaps (US) producers will breed more heifers than they currently indicate for 2025, but at this stage no herd rebuilding is in sight,” Steiner said. “It implies even tighter manufacturing beef supplies and no recovery in the cow herd until early 2027 at best. So not only are cow prices set to rise in the spring and summer (the Australian autumn and winter), as they typically do, but the higher prices may also be stickier than in 2015 due to the lack of herd rebuilding activity.”

Such a strong outlook for US grinding beef prices is a positive for the Australian market, as the cow market sets the tone and baseline value for all cattle sold.