Mutton’s steal on lamb kill space

The quality of Australia’s lamb is undisputed so why are meat processors switching kill space to sheep? Our expert takes a deep dive.

In business you do what makes money and that is the simple rationale for why the sheep market has come to life.

Processors have been dedicating more kill space to mutton, and saleyards are now starting to see the benefits as sheep numbers tighten and strong demand pushes prices higher.

There have been price spikes of $20 to $35 for sheep at major prime markets in the past week, including Bendigo on Monday and Wagga Wagga last Thursday – both centres posting average rates above 400c/kg carcass weight for heavy mutton, according to the National Livestock Reporting Service.

It means first-cross ewes which were struggling to make $100 earlier in the year are now back above $130, reaching a top of $165 at Bendigo.

There has been an element of holiday pressure in recent markets, with some meatworks buying more sheep than normal, to paddock for kills either side of Easter due to saleyard closures.

But as one buyer sagely acknowledged on Monday, mutton is in demand because “there is a big drink (profit)’’ in it for processors.

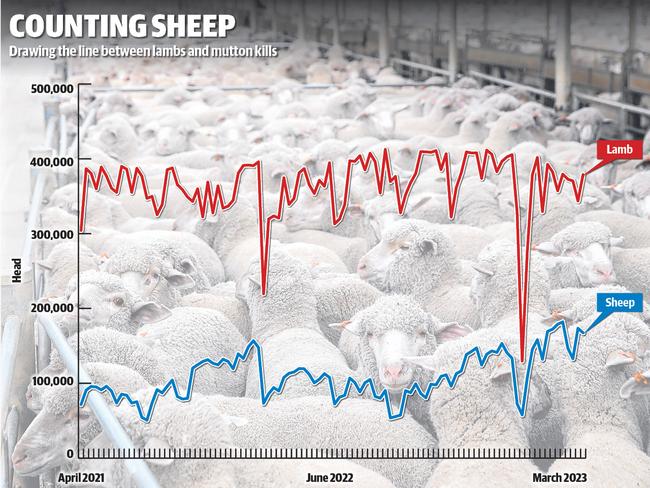

It’s a throwaway line, until you look at the data, which highlights just how much more production space is being dedicated to sheep ahead of lambs.

In March this year, the percentage of sheep in the weekly smalls kill (combined numbers of lamb and mutton processed) lifted to 30 per cent, or 5 per cent higher than the same time last year.

In simple terms, it meant for every 10 spaces on the kill chain three were taken up by sheep and seven for lamb.

At its strongest during March, the ratio of sheep to lamb in the weekly kill lifted to 34 per cent, based on raw data from Meat and Livestock Australia, which had 343,659 lambs and 173,504 sheep processed in the week ending March 20.

The graph above shows how the sheep kill has been inching upwards against the lamb slaughter trend line. It mightn’t appear dramatic but in terms of numbers, it is significant and plays into the buyer demand factor. For example, there were 621,034 sheep processed during March compared to 476,871 a year ago, which averages out to an extra 36,000 per week.

This leads into export figures.

Processors have upped the tempo for mutton because they can sell it.

Preliminary figures published by Department of Agriculture Fisheries and Forestry for March suggest Australian exporters shipped 20,175,912kg of mutton overseas, making it the strongest month for sales since November 2019. It marks an increase of 29 per cent over February mutton exports.

The full breakdown of market destinations hasn’t yet been provided by DAFF, but it looks likely that China has been a main driver behind the surge in mutton sales. Grouped together, Asian markets absorbed more than 70 per cent of all mutton shipped.

Buyers describe mutton as easier and cheaper to process than lamb, with less trim and carcass breakdown required during processing.

Price-wise, meatworks appear to have been the winners in sheep transactions this year. The average mutton price at saleyards last month was 329c/kg carcass weight, well down on the national average of 571c/kg paid a year ago, with the figures based on NLRS statistics.

To put it bluntly, processors have had access to cheap sheep amid strengthening overseas demand, which logically adds up to decent margins, a conclusion that all the above production figures support.

When current sheep prices are broken down by region, NSW leads the pack. At the close of markets last week, the average mutton saleyard price in NSW was listed at 378c/kg carcass weight. In contrast the Victorian mutton rate was on 342c/kg.

The difference is linked to supply. Decent rain across parts of NSW in the past fortnight has slowed sheep numbers. Using NLRS data, there were 22,365 sheep included in the latest mutton price indicator for NSW, well down on the 34,000 in mid-March when the price was struggling along at 310c/kg.

It has been NSW-based exporter Fletchers of Dubbo that has dominated buying at recent markets, sometimes securing the bulk of heavy mutton at saleyards such as Ballarat, Bendigo, Griffith and Wagga Wagga.

Sheep numbers have also tightened in the south as the industry heads deeper into autumn. The latest Victorian numbers are less than 10,000, compared to 12,500 sheep when prices were at a low of 280c/kg early in March.

It is unclear how much room mutton prices have to keep climbing as there were meat buyers on Monday who walked away from the sale at Bendigo when rates went above 400c/kg carcass weight.

But what should help support mutton is that it is one of the cheaper priced red meat proteins, and as the world economy slows there are reports of changes to consumer spending and demand for meat.

US market analyst Len Steiner, Steiner Consulting, noted in his latest market wrap that demand was becoming a more influential part of the meat-market puzzle.

He cited the US cow market as an example. A big drop in the American cow kill as it comes out of drought hasn’t lifted grinding beef values as some had expected.

“Price forecasts for 90 Chemical Lean manufacturing beef in April appear to have been far too aggressive, and as a result buyers are having to adjust some of their demand assumptions,’’ Mr Steiner wrote.

“As always it is important to focus not just on the supply side of the equation but also the broader demand environment and trends in competing meat products.”