Why condition is paying dividends for lamb producers

Not all lambs are equal and gaps are emerging this season, showing the value in putting on condition.

Getting fat cover onto lambs has been the key to achieving better processor support and prices in saleyards this year, and the trend is likely to continue into winter.

The difference between a lamb that ‘handles’ with reasonable fat cover, compared to those that don’t, can be $20 to $40.

It shows up in the saleyard data captured by the National Livestock Reporting Service. At the end of last week, the price average for all fat score 2 and 1 lambs sold to processors was just clinging to 601c/kg carcass weight – more than $1/kg behind the lambs judged to be in prime score 3 and 4 condition, which were tracking above 700c/kg.

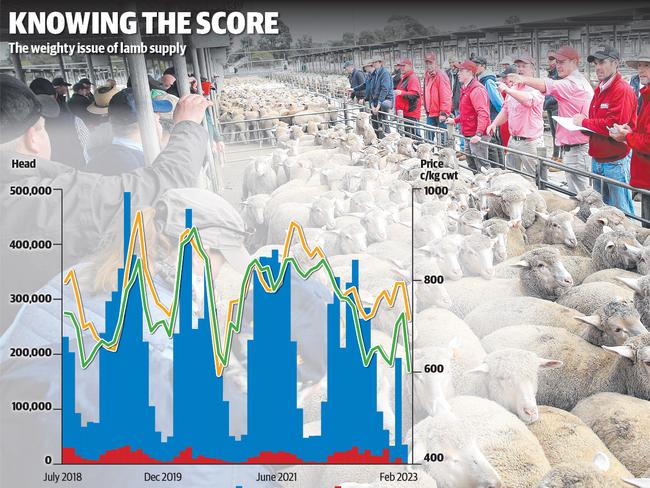

The graphic on this page shows the price trend line between the different fat grades of lamb going back five years. It also illustrates supply, with the steep rises in blue representing the masses of plainer conditioned lambs being sold.

The graphic is interesting because it clearly highlights a couple of issues.

The price performance between the fat grades used to be more aligned due to strong processor demand for leaner MK lambs when the ‘bag lamb’ trade to the Middle East was booming, and restocker support as farmers rebuilt flocks and rode the wave of record high sheep meat prices from 2019 onwards.

Both these factors have now dissipated. Exporters are doing less MK business after governments in the Middle East scrapped the huge subsidies they had been offering for Australian lamb imports. This happened in late 2020, with the Covid-19 debacle and huge spike in air freight costs further damaging the trade.

Meanwhile, restocker sentiment has shifted as producers face up to the likelihood of a dry season with more stock around them, coupled with an erratic lamb market that is offering little forward price direction.

The result has been that plain conditioned lambs are copping heavy discounting. And while the above points centre around store and MK lambs which are usually under 18kg carcass weight, in reality the bigger framed but plain trade lambs are also coping a hiding this autumn.

Consider this. The average saleyard price for fat score 2 lambs in the 20-24kg carcass weight category last week was 619c/kg, compared to 707c/kg for the better conditioned types. In dollars per head terms it means $148 for a plain 24kg lamb against $170 for a better quality kill type.

And the gap can be more extreme than this. There have been multiple times at recent markets where lambs with decent-frame size but lacking fat cover have sold for between $110 to $130.

It begs the question of whether there is money in finishing a lamb to a better standard rather than letting it go out the gate in store-like condition. The answer to this will vary depending on feeding costs, such as home grown grain compared to bought-in pre-mixed rations and a producer’s approach to risk.

At this stage there is still little happening in the marketplace in regards to forward price contracts. None of the big exporters are putting much on the table publicly, although The Weekly Times understands some deals are being done with regular suppliers of grainfed lambs at undisclosed rates.

There was a burst of optimism last week when a supermarket briefly put out up to 780c/kg carcass weight for lambs in June, but agents said it was quickly withdrawn within hours. And it is unclear if it was filled rapidly or it was more a of ‘test offer’ to see what numbers were possibly out there – ie how many agents/farmers hopped on the phone trying to book-in stock.

But when you drill down into saleyard data, processors haven’t really been able to drag down the average cost of quality processing lambs below 700c/kg this year. It briefly looked like it was going to free-fall earlier this month, but the better presented lambs have gained a little momentum.

And ultimately, the lack of forward pricing for lambs this winter is going to hurt processors, as few farmers have the confidence to feed stock. It means the number of plainer lambs is likely to keep swamping the much smaller supply pool of well bred and fed types (as the graphic shows).

If the season does go dry, the divide between finished and unfinished lambs is likely to get wider in the short term. Individual farmers will have to analyse their own costs with the feed and lambs they have around them, but it could be worth considering the advantage of having decent fat cover on lambs.