Lamb prices: New AuctionsPlus data shows the impact of heavy spring rains

It’s been a strange year for lamb turnoff, and the latest figures tell the story of what could happen in the next few months.

Data is now showing the impact of the disrupted spring on lamb sales, and the often-quoted two-month delay appears fairly accurate.

It is evidence to suggest the backlog of lambs heading into the autumn-winter period could be very real. However, some agents maintain the number of store lambs that have gone out into southern areas is not as great as other years.

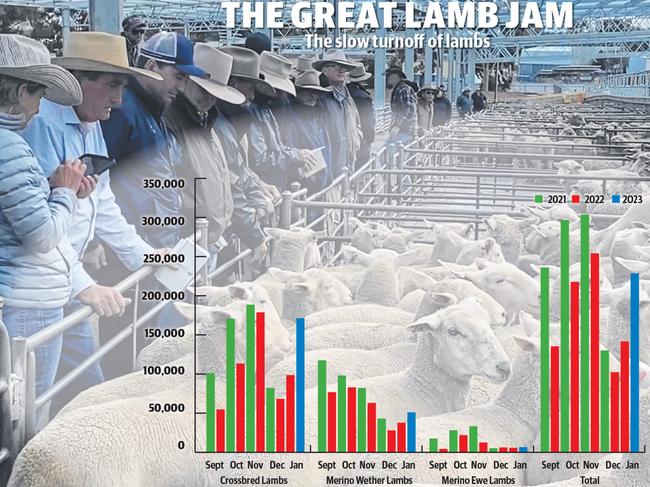

The graph on this page is from AuctionsPlus, which has become the volume marketplace for store lambs.

The interesting months are October and January. In October last year, which should have been the start of the big spring flush, only 113,162 crossbred lambs were listed on ‘the box’, compared to more than 170,000 in the previous two October selling periods.

Move forward two months to January, and there were 171,166 crossbred lambs put on AuctionsPlus to be well above the levels typically seen in the new year.

While it is simplistic, it shows the impact of all the wet weather and flooding that hit in the spring and how those delayed lambs are starting to move.

Overall, the number of crossbred and Merino lambs listed on AuctionsPlus during January was double the supply of a year ago.

It is more evidence of how lambs were late to grow, be weaned, shorn and sold – and the repercussions from this will be ongoing.

It has proved beneficial this new year, with the market for heavy lambs improving to more than 800c/kg carcass weight during January on the back of limited supplies after lambs were late being shorn and then struggled to achieve normal weight gains on washed-out pastures.

But the question being debated is when the market will feel the supply and price repercussions of the carry-over of lambs.

And while many scenarios are being talked about, there is no firm consensus on what could play out.

Some agents argue there should be ongoing price support for quality prime lambs with fewer on grain due to the lack of forward price contracts from exporters.

Currently, no processors are offering forward pricing beyond a few weeks, leaving farmers wary of investing feed costs of around $30 to $50 per animal needed to produce heavy lambs.

An agent from the Mallee said it meant a lot of lambs that would have gone from stubble paddocks onto feeders for “topping up’ would instead be sold due to the lack of opportunity to lock in a kill price.

It could lead to a flush of lambs into the market from March onwards as paddocks are cleaned out for the next round of cropping. Teeth issues could also become a pressure point for the selling of early drop March/April lambs.

To play devil’s advocate, there was a lot of talk the lamb market would take a reasonably swift price correction after Australia Day, and it didn’t happen, although rates have started to drift down in the past seven days.

But amid all the divided opinions about lamb supply and demand, there is no denying the hard figures show a significant carry over of lambs to come out in the next six months to August.

In its latest industry forecast, released this week, Meat and Livestock Australia predicts the market will come under supply pressure.

This is the picture MLA painted from the data it monitors, which includes NLRS numbers, kill data, and the sheep producer survey:

“Findings from the October release of the Sheep Producer Intentions survey indicate that 46 per cent, or 10.1 million lambs from the 2022 cohort, will be sold in the first six months of 2023.

“This dynamic mirrors how 2022 operated, with large volumes of lambs sold in the new year after being retained on-farm from the typical ‘spring flush’ period due to lack of finish as a result of the wet conditions.

“Due to this, slaughter numbers are expected to remain elevated well into the winter supply lull.”

The reference to 2022 by MLA is interesting. Last year the low price point for heavy lambs was 660c to 700c/kg in late July and early August. It dipped to these levels after sitting at 825c/kg cwt in mid-February of that year.