Beef, wool, wine and grain market trends

The beef herd is dropping, and it is the females that are bearing the brunt, while global demand soars for non-mulesed wool and premium wine.

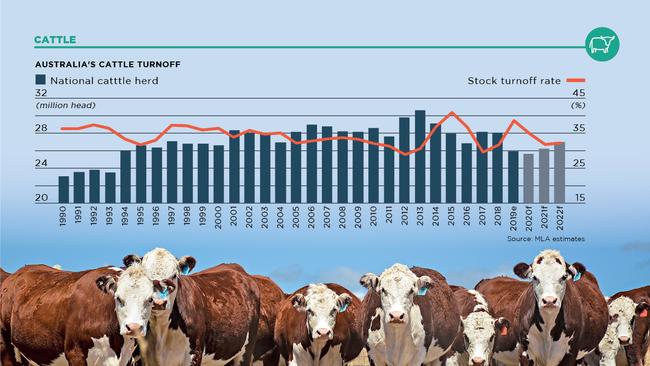

A LACK of rain and sustained turn-off of the breeding herd has resulted in adult cattle slaughter increasing 7 per cent to 8.4 million head this year.

That’s according to Meat and Livestock Australia’s updated cattle industry projections, released last month.

The report shows the higher slaughter figure is underpinned by cow and heifer slaughter increasing 18 per cent. On a 12-month rolling basis, the female percentage of adult slaughter stands at 54 per cent – when this number is above 48 per cent the herd is classed as being in a liquidation phase.

READ MORE: AGJOURNAL

AGRICULTURE’S 20 HOT ISSUES FOR THE 2020S

MLA senior market analyst Adam Cheetham says this means the national herd forecast for the end of June next year has dropped to 25.5 million.

Meanwhile, beef exports have risen this year due to strong demand, above-average cattle turn-off and a lower Australian dollar. “In the first half of the year, Australia’s total beef export value reached $6.8 billion, up 22 per cent for the same period in 2018. On the back of the forecast increase in production, 2019 exports have been revised upwards and are expected to hit 1.19 million tonnes shipped weight,” Cheetham says.

WOOL

A DEFINITIVE premium is now apparent for non-mulesed wool. While there has been anecdotal evidence of a premium in recent years, Australian Wool Exchange data shows the premium for non-mulesed wool in the first quarter of 2019-20 jumped 100c/kg.

Even as wool prices have fallen – the Eastern Market Indicator is at about 1540c/kg, more than 300c/kg lower than this time last year – the non-mulesed premium has remained.

AWEX says 16-micron non-mulesed wool attracted a premium of 108c/kg over mulesed wool from July to September, while non-mulesed 19-micron wool recorded a 83c/kg premium. Non-mulesed wool of 17 microns attracted a 57c/kg premium and 20 microns attracted 61c/kg.

National Council of Wool Selling Brokers of Australia president John Colley says the premiums are far higher than last season. Colley says the substantial premiums for non-mulesed wool reflects the clear demand signals from the global wool textile industry.

In the first quarter of this season a record 13.6 per cent of wool offered at auction was declared as non-mulesed.

HORTICULTURE

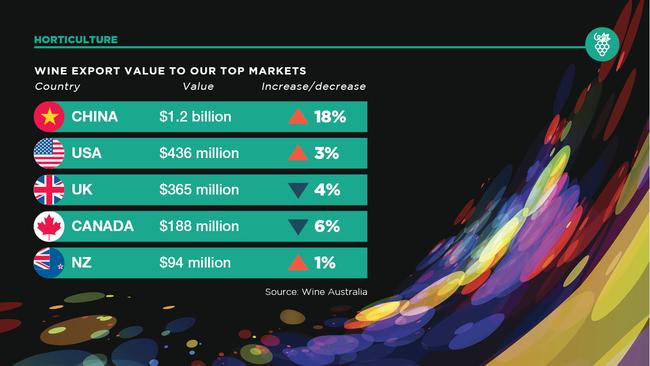

The VALUE of Australian wine exports continues to boom.

Exports have increased 7 per cent to $2.89 billion in the 12 months to September, according to Wine Australia, while the average value of bottled exports reached a record $6.79 a litre. For the first time, the value of exports over $10 a litre hit $1 billion, with growth in exports to China, the Netherlands, United Arab Emirates, Denmark, South Korea and Belgium.

“Australian wine exports to China – including Hong Kong and Macau – reached a record value of $1.25 billion, an increase of 18 per cent, with average value increasing by 40 per cent to $8.42 per litre,” Wine Australia chief executive Andreas Clark says.

However, export volumes decreased 8 per cent to 774 million litres, due to Australia’s 2018 and 2019 vintages being smaller than previous years combining with a larger 2018 global vintage – increasing competition in the market. The rise in export value and the decline in volume meant the average value increased 16 per cent to $3.74 per litre, the highest level since 2008.

GRAINS

GLOBAL trade and drought are the two biggest factors influencing grain pricing this season, as the winter-crop harvest kicks off across the nation.

But where grain has been grown is also having an effect, with prices nowhere near the highs of last season.

A recent Rabobank report estimates Australia grain harvest this season will be just 27.7 million tonnes, the smallest since 2007-08.

Throughout October, the January 2020 ASX East wheat price was at about $350 a tonne, in comparison to last season’s price of about $430 a tonne, while hay prices have stabilised, hovering at about $300 a tonne for vetch and about $250 a tonne for cereal hay.

Western Australia – which last season produced about half the nation’s total grain – is now feeling the effects of extended dry weather and frost.

READ MORE: AGJOURNAL

MACQUARIE BANK’S FIELD MARSHAL TAKES CHARGE

AFRICAN SWINE FEVER THREATENS AUSTRALIAN PORK INDUSTRY

Grain is being delivered to bulk handlers in the west, with CBH having received 600,000 tonnes of grain by November 1.

CBH general manager Ben Macnamara says he expects a slightly below-average crop.

“There is variability in yields with some areas seeing yields better than expected, in spite of the lack of rain and the impact of frost in the southern regions,” Macnamara says.

Meanwhile, the longer the US-China trade war continues, the more volatile the global market is likely to become, affecting Australian grain prices and lowering the US dollar.