‘Unaffordable’: State of Australia’s housing market laid bare

Australia is facing some of the most unaffordable housing in living memory, with the extent of the crisis exposing a stark reality for the country.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

ANALYSIS

As the nation tries to come to grips with the ongoing rental crisis and what is by some metrics the most unaffordable housing in living memory, the issue of housing is shaping up to be a key political battleground for both the coming year and the next federal election.

With the debate hotly contested by the major parties and the Greens, it’s worth exploring where demand for new housing stock stems from and how the nation is faring in building new homes relative to past construction cycles.

New home demand

Before we get into the figures, we need to make an important distinction, the numbers that will follow are based on the number of new dwellings that are required in net terms, not the number of dwellings that need to be completed.

As of the latest comparable figures from the ABS, roughly 15 per cent of new dwelling completions do not result in a net addition to overall dwelling stock.

This can be due to the impact of knock down rebuilds, the demolition of existing homes to make way for new developments and infrastructure or a number of other factors.

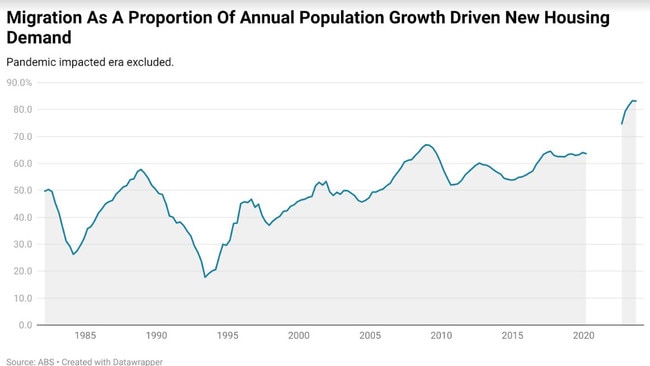

Over the last 40 years, the source of demand for new homes stemming from population growth has varied dramatically.

In the year to June 1993, 17.8 per cent of demand for new homes stemmed from the impact of migration, assuming a consistent household size across the population.

As of the latest figures from the ABS which cover up to the September quarter of 2023, 83.2 per cent of demand driven by population growth stems from net migration.

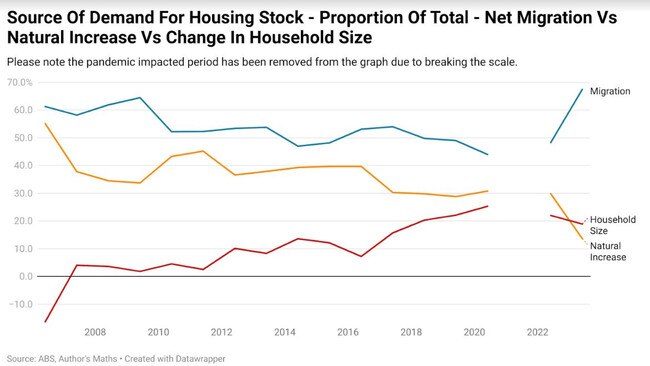

But there is another factor beyond population growth that influences demand for housing; the average size of the nation’s households.

For example, in 2006, the average household size was 2.606 people. It may seem a bit pedantic to measure something to the third decimal place, but when the divisor is the entire population of Australia, every little bit matters.

As of the latest ABS figures which cover up until June 2023, the average household size is now 2.502.

When the difference is applied to the current population as measured by the ABS Population Clock, Australia requires roughly 435,000 more homes than it would have if household size had remained the same as it was in 2006.

In the mid-2000s through to 2011, changing household size was not a huge factor in housing demand, contributing up to a peak of 4.5 per cent of overall demand during any given year.

The largest proportion of demand to stem from changing household size occurred during 2020, at which time 25.3 per cent of demand for new homes was driven by this factor.

When put into context with the demand stemming from the natural population increase (births minus deaths) and net migration, net migration has been by far the greatest driver of housing demand since the current ABS data set on household size began in 2005.

Over the period since records began between 44.0 per cent and 67.5 per cent of demand for new housing (excluding the pandemic) has stemmed from net migration, which the figure currently at its peak in data covering up to the end of the June quarter of 2023.

New home statistics in reality

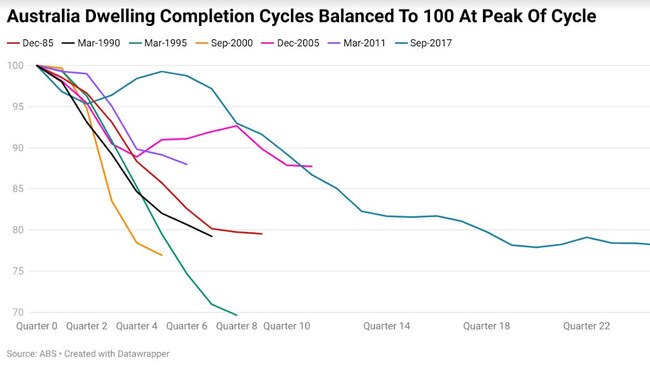

As of the latest figures from the ABS which cover up to the end of the March quarter of 2024 dwelling completions are currently sitting at their lowest level since the September quarter of 2014 on a rolling 12-month basis.

Forecasts from the RBA expect that residential construction activity will remain weak into the end of the year, before beginning to bounce back in 2025.

When put into context with the size of the population the picture further deteriorates, with the current level of dwelling completions per 100,000 people sitting at its second lowest yearly level on record.

However, when contrasted with the draw downs in construction sector activity seen in past cycles, the current reduction in activity from its relative peak is down 21.9 per cent versus 19.8 per cent during an average cycle.

While the level of new home completions per capita is extremely weak relative to where it has been over the last 40 years, relative to other large nations in the Anglosphere, Australia’s performance is still absolutely standout for the right reasons.

Despite the construction sector in the US surging strongly, Australia is still completing 49.6 per cent more dwellings per capita than the United States, 15.8 per cent more than in Canada and 135.3 per cent more than the U.K.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator

Originally published as ‘Unaffordable’: State of Australia’s housing market laid bare