No need to race to rate hike on Cup Day

A lot can happen between now and Melbourne Cup Day, but as it stands there’s little reason for another RBA rate hike.

A lot can happen between now and Melbourne Cup Day, but as it stands there’s little reason for another RBA rate hike.

Inflation kicked higher in the September quarter but not to a level which would demand a rate hike by RBA governor Michele Bullock and her board on Melbourne Cup day.

A bad CPI could trigger another RBA rate rise but that’s nothing when compared with the effect of rising government bond yields.

The ANZ board should review its understanding of its most basic obligation to shareholders after the bank was found guilty of breaching continuous disclosure rules.

Wall Street made a $US2 trillion ($3 trillion) bet on the US inflation numbers. And lost.

Star needs to do whatever is necessary to keep its NSW and Queensland casino licences. Fortunately, Crown has already shown it how to do that.

The attacks on Qantas and its CEO Alan Joyce have ranged from the viciously unfair to the just plain embarrassingly silly.

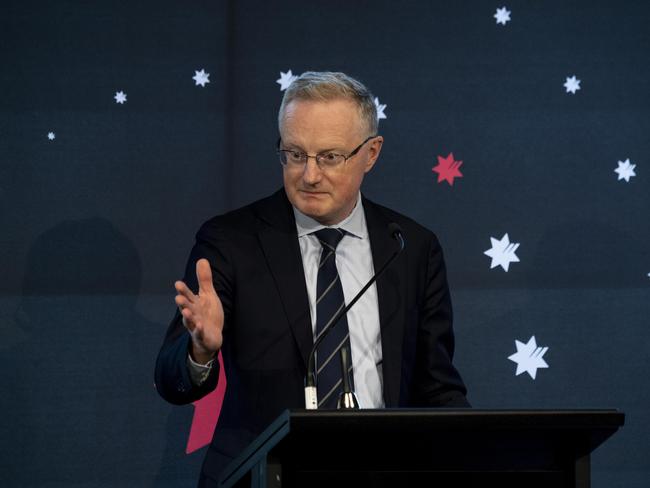

Reserve Bank governor Philip Lowe has laid out very precisely what he and his board plan to do about interest rates.

GDP figures don’t tell the real story of the Australian economy.

The Prime Minister’s ‘light-bulb moment in May’ summit was a big and even impressive success and an utter and what should have been an embarrassing failure.

Two huge days are coming up for investors this month, with the RBA’s latest decision on rates on Tuesday, followed by the US Federal Reserve a fortnight later.

Even if some successes come out of the jobs summit, we will still need to get through the rush of turmoil heading our way, demonstrated by Thursday’s $47bn market plunge.

After the PM’s job summit, the government will have to turn all the talk into policy and bureaucratic delivery, which will involve making highly unpalatable choices.

The Woodside profit result and dividends flowing to shareholders are a dramatic endorsement of the energy giant’s $40bn merger with BHP’s oil and gas business.

Original URL: https://www.themercury.com.au/business/terry-mccrann/page/33