How the RBA delivered big banks billions

The RBA has delivered the big banks an unparalleled golden period, the likes of which we have never seen before, and which we should hope to never see again.

The RBA has delivered the big banks an unparalleled golden period, the likes of which we have never seen before, and which we should hope to never see again.

Next year we’ll be told how the votes have flowed for and against interest rate rises at the RBA, which will pose a challenge for the governor.

This interest rate rise was a surprise to many – but it indicates that Michele Bullock and this board are answerable only to what they see as their one job – to control inflation.

Everyone needs to take a chill pill about the prospect of a Cup Day rate hike. It’s not as significant as ‘they’ are saying, for the economy or for the new RBA governor.

The multi-billion dollar implosion of the FTX crypto empire was at its core like any other spectacular collapse over the decades.

RBA governor Philip Lowe and his board have almost locked in a 25 basis point rate rise next month and will be hoping that the December quarter inflation data doesn’t surprise them.

For Oz Minerals directors to tick off on a takeover offer, it really has to be very close to $30 at the bare minimum.

The CBA’s latest trading update showed it really went to town at its depositors’ expense on the back of the RBA’s rate hikes this year and it’s not a bit shy admitting it.

The big question facing Australia and the US is whether low inflation can come quickly and obviously enough before big wage hikes threaten to lock in a wages, prices and rates spiral.

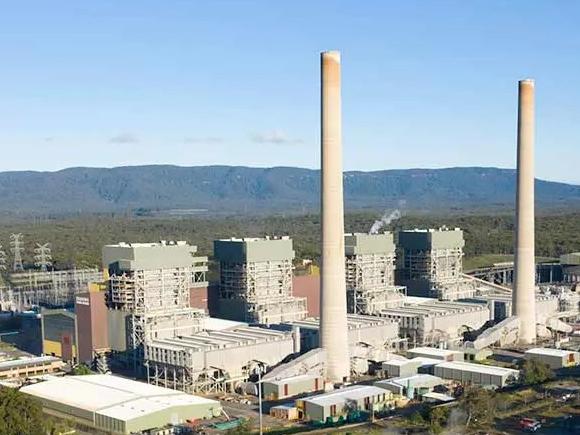

An $18bn foreign takeover bid for Origin Energy has shown why the energy giant should be worth more to the right local buyer than the $9 offer price accepted by the board.

If you look at the fine print at the back of their official reports and crunch the numbers you’ll see how banks have been boosting their profits and screwing depositors.

American investors seem determined to be bullish despite the prospect of a paralysed hyper-left wing presidency after the US mid-term elections.

Despite the completely over-the-top hysteria over ‘plunging prices’, the vast majority of property owners are still sitting on huge, tax-free, capital gains.

Federal Reserve chair Jerome Powell is doling out tough medicine – something we sorely need from our own Reserve Bank.

Original URL: https://www.themercury.com.au/business/terry-mccrann/page/31