Tech group Life360 shares soar amid popularity of tracking family members

A little known company is becoming one of the ASX’s hottest tech stocks as it generates record revenue from its location sharing app that allows families to keep tabs on one another.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Family tracking app business Life360 has generated record revenue, as its number of subscribers soar, despite the cost of living crisis crunching household budgets.

The ASX-listed but San Francisco-based company’s revenue soared 32 per cent to $US103.6m ($162.70m), in the three months to March 31, beating analysts’ expectations. Investors lapped up the news, with its shares surging more than 12 per cent to $26.73 in morning trade on Tuesday.

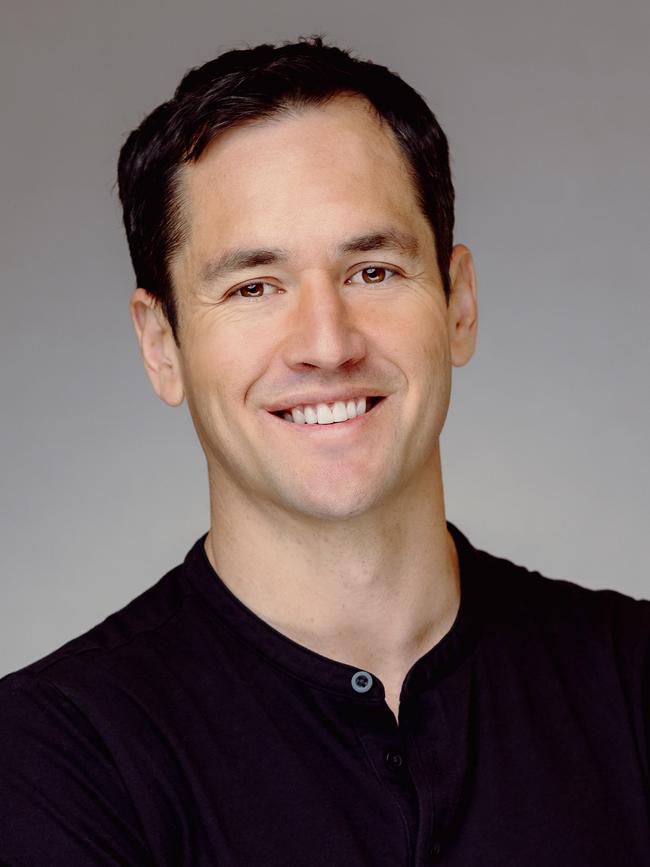

Chief executive Chris Hulls said the results show location sharing and keeping tabs on family members had entered the mainstream, which the $4.2bn company has long forecast.

“I’m surprised how right we’ve been. I’m always nervous about mistaking smarts for luck. There was a huge amount of luck, and I have been wrong on so many things, but … it’s obviously quite exciting that it came together,” he said.

“(We knew) family-specific location sharing would go very mainstream when millennials aged into our category, because they’re the first generation where you don’t really have to explain why you should reach to the phone,” he said.

“We grow as the generation comes online. And that’s why we’ve just had this ongoing, consistent growth.”

Earnings before interest, tax, depreciation and amortisation jumped to $US15.9m from $4.4m.

The boost comes as 4.1 million new monthly active users were added to the company’s location-sharing platform, with total MAUs increasing 26 per cent year-on-year to approximately 83.7 million.

Paying customers grew by 137,000, or 43 per cent, to 2.4 million people total.

Mr Hulls said: “In a more cautious consumer spending environment, our performance reflects both the resilience of our business model and the growing demand for our services that keep families safe, connected, and provide peace of mind. As a trusted daily essential for millions, we are uniquely positioned to support families through uncertain times — and beyond.”

Mr Hulls said he envisioned even more growth in the core business, with “pretty good” churn rates among paying subscribers, as most of those paying subscribers — families with teenagers — continue to rely on the service to make sure their loved ones are safe.

“The paid user base is very centred on the families with teens, because that’s when you have that visceral anxiety of parents worried about their kids out at night and all that. So our strategy is, how do we have premium products at different life stages? So from young kids to ageing parents, everything in between.”

Life360 is planning on launching its pet tracking product in the fourth quarter of FY26.

Mr Hulls told investors on Tuesday morning the company had planned to launch the new pet tracking device in the US this year, but decided to first launch in international markets due to the threat of American tariffs on products made in China, which he commented was “frustrating, but fine”.

The company is also working on a product for customers wishing to track an elderly relative. Mr Hulls, whose mother has Alzheimer’s, said being able to make sure she was safe gave him peace of mind. “It’s been very helpful to make sure she’s home at night.”

Life360 shares rocketed at the market open on Tuesday, up 12 per cent to $26.77. On Wall Street overnight, its US shares jumped 8.3 per cent to $US49.51, before falling marginally in after-hours trading.

RBC Capital Markets analyst Wei-Weng Chen was positive on the results, saying revenue beat expectations by 3.2 per cent and EBITDA by 75 per cent.

Mr Chen also said the compositional change of the company’s guidance, with more subscription revenue and less from hardware, was a “higher quality mix”.

The main bum note from the quarterly results was the dip in revenue from hardware, such as the Tile tracking device. Hardware revenue for the quarter was 13 per cent lower to $US8.9m.

Mr Hulls said US President Donald Trump’s tariff trade war didn’t help hardware operations — the Tile is manufactured in Asia — but overall may have even been a net positive for the business, before recent trade deals.

“We’re not really dependent on hardware to drive the business,” he said. “And in some respects, if the whole market got hammered with tariffs, that could be good for us, because we’re trying to make money off of subscriptions. Not the stand-alone sales.

“In a world where competitors raise they’re prices, we’re not, because we can absorb that cost … I’m not trying to say tariffs were good for us. They weren’t. They did change plans. It’s much more in the annoying bucket, with possibly some interesting side benefits.”

Mr Hulls said the drop in hardware revenue was mainly due to softer retail demand and a shift in strategy in the face of potential hits from tariffs. “Why would we double down on something that has a lot of these external risks?”

For the full financial year, Life360 reaffirmed overall guidance of consolidated revenue reaching between $US450m and $US480m, with positive adjusted EBITDA of between $US65m and $US75m.

Life360 also announced earlier on Tuesday a deal with AI online safety firm Aura, where it will invest $25m in Aura. In return, Aura will sell Life360 bundles through its employee benefits channel and Aura will begin to advertise itself directly to Life360 users through the app.

It follows a string of advertising deals Life360 has struck, including one with ride-share app Uber where customers would get pinged with an Uber add when at the airport. Mr Hulls called the Aura deal “a big win” for both companies.

More Coverage

Originally published as Tech group Life360 shares soar amid popularity of tracking family members