Life360’s ambitious plans for advertising to rival its subscription business

The family tracking platform has acquired a New York-based ad start-up as it looks to ramp up location-based targeting that will send coupons for stores its users frequent.

Family tracking platform Life360 is doubling down on its advertising efforts, which chief executive Chris Hulls says have the potential to rival its subscription business.

The company is acquiring New York-based start-up Fantix’s artificial intelligence-powered advertising unit, a strategic move Mr Hulls said would help the dual-listed company leverage machine learning for hyper personal advertising.

“The ultimate view is that (our) indirect revenue, which includes advertising but other areas where users don’t pay us directly, could rival the subscription business,” he said.

“We only have about one in eight of our customers paying us (subscription fees).”

Fantix was “not a huge deal” but it would help speed up Life360’s efforts to bring new advertising models to market and help it delve further into targeted advertising.

“It’s just a slight acceleration of existing plans with people who really know advertising to their core,” Mr Hulls told The Australian.

The San Francisco-headquartered company was now looking to emulate one of its largest advertising deals to date with Uber, a partnership which pings Life360 customers with an offer to book an Uber when they arrive at airports within the US.

“What really is going to drive our platform is the unique assets that we can offer and this is what Uber really showed,” Mr Hull said.

“Instead of having to imagine this is a hypothetical, (we can say) ‘look what we did with Uber. Here’s what we could do if we make custom ad units for you’.”

Life360 is betting on a future where other businesses including retail and hospitality see that as an opportunity to bring customers through the door – a model used by the likes of cash back operators ShopBack and Cash Rewards and hospitality software start-ups Liven and EatClub.

While Life360 did not divulge details on the exact advertising partners it was targeting, Mr Hulls said: “You could imagine that if we see you go to a certain store a lot we could throw a coupon for that store on the map for you … you can imagine wherever you get your coffee or your donut in the morning,” he said.

The company, which once threatened to sue anyone who uses its trackers to stalk others for $1m, believes its data is some of the most effective available for advertisers.

“We have the location data and it’s deterministic, not probabilistic,” he said. “So a lot of the targeting we have won’t just be on the Life360 platform if you’ve allowed us to track you across websites.

“We will be able to tell advertisers very explicitly that we gave (this customer) an ad for this store, he received it and then he actually changed his behaviour.

“That’s very hard to do if you don’t have the full loop on the location data set and so very few companies have what we do. Arguably no one does.”

That data gave the company a unique advantage over other types of advertising including “banner ads” – often used on websites and across the top of mobile apps – which the company believes have little impact.

“We know banners ads have relatively low click through because we all know banners and we all tune them out,” he said.

On Friday, Life360 reported a 33 per cent year-on-year lift in fourth quarter revenue to $US115.5m ($185m), with subscription revenue making up about 68 per cent of that figure of $US78.8m.

In the three months to December 31, the family tracking company reported earnings before interest, tax, depreciation and amortisation of $US21.2m.

For the full year, Life360 reported a 22 per cent rise in revenue to $US371.5m and EBITDA of $US45.4m.

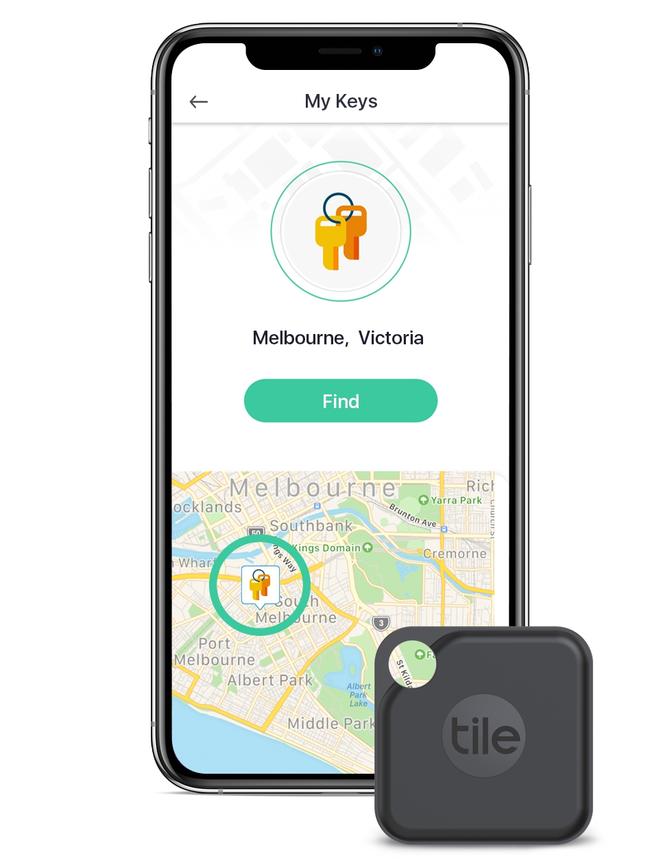

Life360’s hardware revenue took a hit over 2024, largely due to production delays and what Mr Hulls described as a “slight miss”. But the company was not prioritising hardware sales.

“We’ve also focused more on giving away devices to drive subscriptions. And while direct to consumer was very strong, retail has been a little bit slower but it hasn’t been our emphasis,” he said.

“We’re really trying to figure out where we can get a decent margin and drive subscriptions … so we’re not really focused on stand-alone sales.”

The total number of monthly active users now sits at 79.6 million, up by 2.8 million over the fourth quarter, including 700,000 news users in Australia and New Zealand.

Mr Hulls said customer growth should help raise the value of any future deals with Israeli firm Place AI, which last paid Life360 $US20m to leverage its data to sell insights to property developers, town planners and retail stores.

Average revenue per user for subscribers grew 8 per cent to $US110.43 while those with its paying circle product grew 6 per cent to $US128.

The company updated its guidance for FY25, expecting a consolidated revenue of between $450m to $480m and positive adjusted EBITDA of between $US65m to $US75m.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout