Lunch Wrap: ASX dips, Bluescope flexes on Trump’s latest steel tariff

The ASX has dipped on Monday amid reignited Trump-induced trade tensions. Meanwhile, investors chased gains in Bluescope, and in the Brickworks-Soul Patts merger.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX wobbles as Trump fires up trade war again

Bluescope flies on steel tariff boost

Brickworks and Soul Patts merge in $14bn deal

The ASX opened the week on a bit of a downer, slipping by 0.2% in the first session of trade.

Blame it on nerves from Wall Street, which pulled back slightly after Donald Trump, never one for a quiet weekend, fired off fresh salvos in his on-again, off-again trade war with China.

This time, Trump’s doubling down on steel tariffs, lifting duties from 25% to 50%, which sent tremors through global markets.

The move, which came just hours after he accused Beijing of “totally violating” trade agreements, threw up a big, flashing question mark for investors: is this trade war reheating?

But amid the news, some stocks surged. ASX-listed Bluescope Steel (ASX:BSL), for instance, shot up as high as 9% this morning before paring back.

Unlike most Aussie exporters, Bluescope makes a stack of its profits in the US. Its North Star mill in Ohio churns out about 3 million tonnes of steel a year for American buyers in the auto, agriculture and white goods sectors.

Elsewhere, Brent crude dipped below US$63 as traders braced for more OPEC+ supply.

It was a reminder that while everyone’s focused on China and steel, the real engine room of the global economy, crude oil, still needs watching.

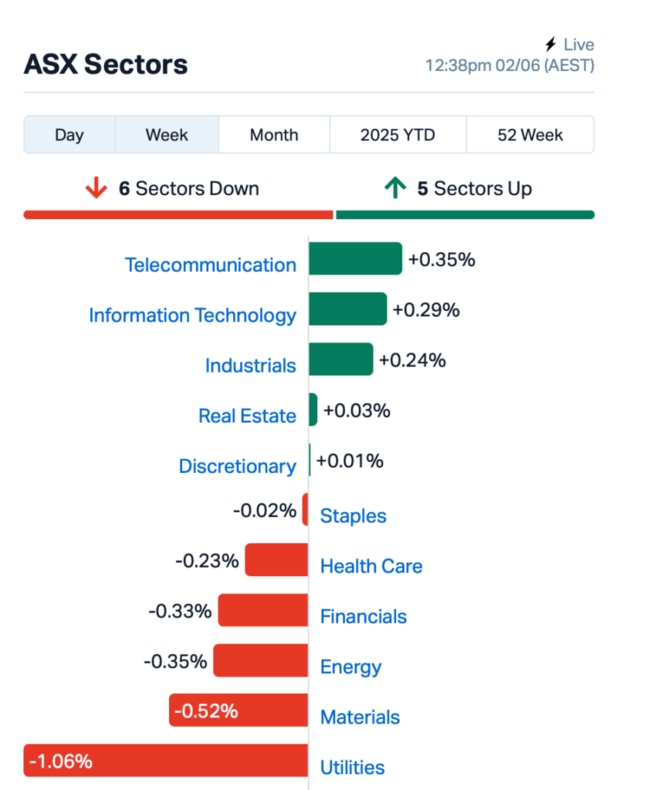

Back on the ASX, sectors like utilities, banks and miners took a hit.

Traders are weighing up what an escalation between the world’s two largest economies could mean for Chinese demand, and, by extension, Aussie commodity exports.

In the large caps space, Brickworks (ASX:BKW) and Soul Patts (ASX:SOL) lit up the boards after announcing they’ll merge into a $14 billion investment, building products and property giant.

Brickworks jumped 21%, while Soul Patts soared 12.5%. The merger effectively unwinds a decades-old cross-holding setup: Soul Patts owns 43% of Brickworks, and Brickworks owns 26% of Soul Patts.

Under the new structure, a freshly minted company called “TopCo” will scoop up both, with Brickworks shareholders receiving a 10% premium. TopCo will eventually carry the familiar Soul Patts ticker (SOL) and name.

Elsewhere, on the move was James Hardie (ASX:JHX), up 3% after locking in $3.5 billion in new debt to help bankroll its acquisition of US building materials group Azek.

And, Perenti Global (ASX:PRN) added 4% after winning a five-year, $1.1 billion underground mining contract at Endeavour Mining's (LSE: EDV, TSX: EDV) gold operations in Burkina Faso.

Perenti has been working on site since 2018, and the deal keeps them locked in through to FY26 and beyond.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for June 2 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| BYH | Bryah Resources Ltd | 0.009 | 80% | 9,429,219 | $4,349,768 |

| DTR | Dateline Resources | 0.155 | 60% | 89,869,503 | $277,247,109 |

| OSL | Oncosil Medical | 0.003 | 50% | 100,000 | $9,213,164 |

| CRI | Criticalim | 0.018 | 38% | 36,181,768 | $34,949,832 |

| LKY | Locksleyresources | 0.110 | 38% | 20,163,719 | $11,733,333 |

| IIQ | Inoviq Ltd | 0.600 | 36% | 1,945,378 | $49,118,433 |

| OB1 | Orbminco Limited | 0.002 | 33% | 3,580,335 | $3,596,352 |

| FTL | Firetail Resources | 0.080 | 33% | 3,263,690 | $22,801,679 |

| DXN | DXN Limited | 0.047 | 31% | 2,939,090 | $10,753,331 |

| ERA | Energy Resources | 0.003 | 25% | 700,044 | $810,792,482 |

| FHS | Freehill Mining Ltd. | 0.005 | 25% | 4,846,206 | $12,934,111 |

| KPO | Kalina Power Limited | 0.005 | 25% | 10,300,784 | $11,731,879 |

| TEM | Tempest Minerals | 0.005 | 25% | 210,000 | $2,938,119 |

| TMG | Trigg Minerals Ltd | 0.099 | 22% | 30,718,294 | $74,833,461 |

| BKW | Brickworks Limited | 33.520 | 22% | 1,274,605 | $4,207,514,804 |

| BSN | Basinenergylimited | 0.017 | 21% | 212,461 | $1,719,610 |

| BP8 | Bph Global Ltd | 0.003 | 20% | 200,000 | $2,627,462 |

| EAT | Entertainment | 0.006 | 20% | 28,942 | $6,543,930 |

| EE1 | Earths Energy Ltd | 0.006 | 20% | 32,378 | $2,649,821 |

| GLL | Galilee Energy Ltd | 0.006 | 20% | 185,049 | $3,535,964 |

| IPT | Impact Minerals | 0.006 | 20% | 443,094 | $19,776,650 |

| RNX | Renegade Exploration | 0.003 | 20% | 5,196,477 | $3,220,909 |

| TMB | Tambourahmetals | 0.025 | 19% | 603,441 | $2,469,391 |

| NNL | Nordicresourcesltd | 0.100 | 18% | 735,280 | $15,360,960 |

| BCC | Beam Communications | 0.140 | 17% | 148,117 | $10,370,631 |

Dateline Resources (ASX:DTR) is ramping up exploration at its Colosseum gold and rare earths project in California after fresh data confirmed more breccia pipes could be hiding west and southwest of the old pits. The company is kicking off a new program mid-June, using soil sampling, geophysics, and mapping to zero in on drill targets, with rare earths now firmly on the radar thanks to geological similarities with the nearby Mountain Pass mine.

Inoviq (ASX:IIQ) has unveiled breakthrough results for its early ovarian cancer screening test, showing 77% sensitivity and 99.6% specificity across all stages, with no early-stage cancers missed in the study. The AI-powered blood test, which uses exosome tech and runs on high-throughput lab instruments, was presented this week at the big ASCO cancer conference in Chicago. There’s currently no screening test on the market.

Firetail Resources (ASX:FTL) has locked in options to acquire two high-grade gold projects in the US, one in Nevada’s massive Walker Lane belt and the other near the legendary Homestake Mine in South Dakota. The Excelsior Springs project comes with strong drill hits like 51.8m at 4g/t gold and historic production of over 19,000oz at 41g/t, while the Bella project boasts rock chip samples over 100g/t and sits just 20km from the 42Moz Homestake deposit. FTL is spending just under a million bucks in cash and issuing shares to get the exploration going.

DXN (ASX:DXN) has scored a $4.6 million deal to deliver three modular data centre units to Globalstar in Hawaii by the end of 2025. It won the contract after a competitive tender. The company said the deal puts DXN deeper into the booming satellite and LEO (Low Earth Orbit) comms space, and marks another step in its push into edge-ready data centres.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for June 2 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ASR | Asra Minerals Ltd | 0.002 | -33% | 450,000 | $8,299,608 |

| HLX | Helix Resources | 0.002 | -33% | 38,970,809 | $10,092,581 |

| AJL | AJ Lucas Group | 0.005 | -29% | 17,610 | $9,630,107 |

| ADD | Adavale Resource Ltd | 0.002 | -25% | 2,570,000 | $4,574,558 |

| NAE | New Age Exploration | 0.003 | -25% | 176,721 | $10,637,596 |

| SFG | Seafarms Group Ltd | 0.002 | -25% | 159,652 | $9,673,198 |

| ATV | Activeportgroupltd | 0.007 | -22% | 397,619 | $6,164,794 |

| HWK | Hawk Resources. | 0.014 | -21% | 2,328,771 | $4,605,801 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 392,525 | $15,867,318 |

| AYT | Austin Metals Ltd | 0.004 | -20% | 1,000,000 | $7,870,957 |

| RGL | Riversgold | 0.004 | -20% | 9,200,289 | $8,418,563 |

| TEG | Triangle Energy Ltd | 0.002 | -20% | 123,824 | $5,223,085 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 1,896,263 | $23,423,890 |

| VBS | Vectus Biosystems | 0.050 | -17% | 92,135 | $3,196,699 |

| 1AI | Algorae Pharma | 0.005 | -17% | 1,478,761 | $10,124,368 |

| FIN | FIN Resources Ltd | 0.005 | -17% | 1,152,420 | $4,169,331 |

| GGE | Grand Gulf Energy | 0.003 | -17% | 126,288 | $8,461,275 |

| JAV | Javelin Minerals Ltd | 0.003 | -17% | 1,445,333 | $18,378,447 |

| PGY | Pilot Energy Ltd | 0.005 | -17% | 4,500,000 | $11,898,450 |

| RB6 | Rubixresources | 0.070 | -16% | 495,317 | $5,100,350 |

| GTE | Great Western Exp. | 0.011 | -15% | 2,800,391 | $7,380,853 |

| TRI | Trivarx Ltd | 0.011 | -15% | 2,491,625 | $8,026,124 |

| SHO | Sportshero Ltd | 0.023 | -15% | 1,014,939 | $19,749,044 |

| LOC | Locatetechnologies | 0.098 | -15% | 562,647 | $23,539,791 |

IN CASE YOU MISSED IT

Singular Health Group (ASX:SHG) has completed a share issue for a placement with Marin and Sons, fulfilling the terms of a follow-on investment from SHG’s largest shareholder. Marin and Sons invested $773k at $0.16 per share on May 15, 2024, with the issue of shares approved by SHG shareholders on March 19, 2025.

In today's Break It Down, host Tylah Tully explains the latest developments in Sweden, where the country is looking at potentially removing a ban on uranium mining. Aura Energy (ASX:AEE) has interest in uranium projects in Sweden, and is working with the coalition to get the ban lifted.

At Stockhead, we tell it like it is. While Singular Health Group and Aura Energy are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX dips, Bluescope flexes on Trump’s latest steel tariff