ASX health May winners: Sector rises 1.59pc but market volatility remains

The S&P/ASX 200 Health Care Index rose 1.59% in May, easing from a 2.16% gain in April but still finishing in the green.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

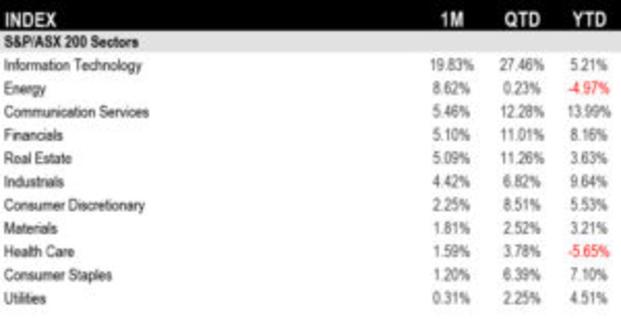

The S&P/ASX 200 Health Care Index rose 1.59% in May but remains worst performing sector YTD down 5.65%

Morgans healthcare analyst Iain Wilkie said US President Donald Trump's trade and health policies continue to impact sector

Lumos up 7.4% in May after several positive announcements including largest single purchase order for point-of-care respiratory test

The S&P/ASX 200 Health Care Index rose 1.59% in May, easing from a 2.16% gain in April but still finishing in the green. However, the sector is still not faring well and is the worst-performing year-to-date, down 5.65%.

The sector rose in line with broader markets in May with the S&P/ASX 200 gaining 4.20% as fears around escalating US tariffs and a potential US-China trade war eased, bringing relief to global markets.

Morgans healthcare analyst Iain Wilkie told Stockhead that 2025 had been very volatile for the sector.

"Each month seems to be either up or down and the sector hasn't gained any real momentum at this stage," he said.

Wilkie said US President Donald Trump and his trade and health policies were still impacting the sector.

"It's just uncertainty which is driving everything at the moment," he said.

In May Trump signed an executive order lowering prices of US prescription medicines to bring them in line with other countries, a policy referred to as the “most favored nation” (MFN).

The MFN policy aims to link US drug prices to much lower prices overseas – what Trump referred to as “equalizing” prices.

Trump said the order aimed to cut US pharmaceutical prices from between 59% to 90% and sets price targets for drugmakers to meet within 30 days and warns that further action will be taken if they fail to make “significant progress” toward those goals.

In a release The White House said the US had less than 5% of the world’s population and yet funds around three quarters of global pharmaceutical profits.

"There's no clear path on what happens next and consequences pharmaceutical companies may face," Wilkie said.

"But its just created further uncertainty in the healthcare and pharmaceutical sectors in an already uncertain time."

How ASX biotechs performed in May

| CODE | COMPANY | PRICE | 1 MONTH RETURN % | MARKET CAP |

|---|---|---|---|---|

| DVL | Dorsavi Ltd | $ 0.02 | 36.4% | 10.97 |

| IVX | Invion Ltd | $ 0.11 | 28.0% | 8.47 |

| CC5 | Clever Culture | $ 0.02 | 26.7% | 33.55 |

| VFX | Visionflex Group Ltd | $ 0.003 | 25.0% | 8.42 |

| NYR | Nyrada Inc | $ 0.18 | 24.1% | 37.97 |

| IIQ | Inoviq Ltd | $ 0.55 | 23.9% | 63.07 |

| OSX | Osteopore Limited | $ 0.02 | 21.4% | 2.95 |

| PEB | Pacific Edge | $ 0.09 | 18.7% | 60.89 |

| ICR | Intelicare Holdings | $ 0.01 | 14.3% | 3.89 |

| MVP | Medical Developments | $ 0.67 | 11.7% | 75.48 |

| PCK | Painchek Ltd | $ 0.06 | 11.5% | 106.83 |

| IRX | Inhalerx Limited | $ 0.03 | 11.1% | 6.40 |

| ALA | Arovella Therapeutic | $ 0.08 | 11.0% | 88.79 |

| IPD | Impedimed Limited | $ 0.03 | 10.0% | 66.91 |

| LGP | Little Green Pharma | $ 0.11 | 10.0% | 34.96 |

| ATH | Alterity Therapeutics | $ 0.01 | 10.0% | 100.40 |

| DOC | Doctor Care Anywhere | $ 0.11 | 10.0% | 38.50 |

| AGH | Althea Group | $ 0.03 | 8.7% | 20.56 |

| ALC | Alcidion Group Ltd | $ 0.09 | 8.6% | 114.15 |

| HMD | Heramed Limited | $ 0.01 | 8.3% | 11.38 |

| MDR | Medadvisor Limited | $ 0.09 | 8.1% | 57.48 |

| RAD | Radiopharm | $ 0.03 | 8.0% | 65.35 |

| LDX | Lumos Diagnostics | $ 0.03 | 7.4% | 21.71 |

| AVR | Anteris Technologies | $ 6.29 | 6.6% | 99.41 |

| AFP | AFT Pharmaceuticals | $ 2.60 | 6.1% | 272.65 |

| ARX | Aroa Biosurgery | $ 0.49 | 5.4% | 165.55 |

| UCM | Uscom Limited | $ 0.02 | 5.3% | 4.76 |

| RHC | Ramsay Health Care | $ 37.90 | 5.1% | 7,049.83 |

| CVB | Curvebeam Ai Limited | $ 0.09 | 4.9% | 26.97 |

| REG | Regis Healthcare Ltd | $ 8.13 | 4.9% | 1,242.92 |

| TRI | Trivarx Ltd | $ 0.01 | 4.8% | 6.79 |

| ACR | Acrux Limited | $ 0.02 | 4.3% | 9.79 |

| VLS | Vita Life Sciences | $ 1.89 | 4.1% | 104.29 |

| PGC | Paragon Care Limited | $ 0.40 | 3.9% | 662.12 |

| NSB | Neuroscientific | $ 0.06 | 3.8% | 7.95 |

| CMP | Compumedics Limited | $ 0.28 | 3.7% | 53.82 |

| SPL | Starpharma Holdings | $ 0.09 | 3.4% | 38.48 |

| NOX | Noxopharm Limited | $ 0.07 | 2.9% | 21.04 |

| GLH | Global Health Ltd | $ 0.08 | 2.6% | 4.63 |

| CMB | Cambium Bio Limited | $ 0.21 | 2.5% | 3.75 |

| PIQ | Proteomics Int Lab | $ 0.42 | 2.4% | 59.56 |

| SDI | SDI Limited | $ 0.85 | 2.4% | 99.25 |

| CSX | Cleanspace Holdings | $ 0.45 | 2.3% | 34.81 |

| ATX | Amplia Therapeutics | $ 0.05 | 2.0% | 19.40 |

| MVF | Monash IVF Group Ltd | $ 0.78 | 2.0% | 301.97 |

| IDX | Integral Diagnostics | $ 2.43 | 1.9% | 870.95 |

| EZZ | EZZ Life Science | $ 1.54 | 1.7% | 72.65 |

| IMC | Immuron Limited | $ 0.07 | 1.5% | 15.67 |

| FRE | Firebrickpharma | $ 0.07 | 1.5% | 15.05 |

| SHL | Sonic Healthcare | $ 26.62 | 1.4% | 12,821.98 |

| FPH | Fisher & Paykel Healthcare | $ 34.59 | 1.4% | 6,585.46 |

| IMR | Imricor Med Systems | $ 1.67 | 1.2% | 541.55 |

| OCC | Orthocell Limited | $ 1.27 | 1.2% | 307.31 |

| PME | Pro Medicus Limited | $ 280.98 | 0.9% | 15,316.67 |

| PAR | Paradigm Biopharmaceuticals | $ 0.31 | 0.8% | 120.72 |

| CTE | Cryosite Limited | $ 0.75 | 0.7% | 36.61 |

| CHM | Chimeric Therapeutic | $ 0.00 | 0.0% | 8.06 |

| IXC | Invex Therapeutics | $ 0.09 | 0.0% | 6.99 |

| COV | Cleo Diagnostics | $ 0.35 | 0.0% | 27.74 |

| IDT | IDT Australia Ltd | $ 0.10 | 0.0% | 45.12 |

| EYE | Nova EYE Medical Ltd | $ 0.13 | 0.0% | 35.52 |

| OCA | Oceania Healthc Ltd | $ 0.59 | 0.0% | 427.30 |

| EPN | Epsilon Healthcare | $ 0.02 | 0.0% | 8.29 |

| TD1 | Tali Digital Limited | $ 0.00 | 0.0% | 3.30 |

| OIL | Optiscan Imaging | $ 0.13 | 0.0% | 112.77 |

| PER | Percheron | $ 0.01 | 0.0% | 10.87 |

| OSL | Oncosil Medical | $ 1.20 | 0.0% | 13.82 |

| BIT | Biotron Limited | $ 0.00 | 0.0% | 3.32 |

| EOF | Ecofibre Limited | $ 0.02 | 0.0% | 7.58 |

| TRP | Tissue Repair | $ 0.19 | 0.0% | 11.19 |

| IBX | Imagion Biosys Ltd | $ 0.01 | 0.0% | 2.42 |

| SOM | SomnoMed Limited | $ 0.59 | 0.0% | 129.66 |

| ANR | Anatara Ls Ltd | $ 0.01 | 0.0% | 1.07 |

| HIQ | Hitiq Limited | $ 0.02 | 0.0% | 7.57 |

| ADR | Adherium Ltd | $ 0.01 | 0.0% | 5.31 |

| PSQ | Pacific Smiles Grp | $ 1.81 | -0.3% | 291.73 |

| COH | Cochlear Limited | $ 271.60 | -0.4% | 17,779.29 |

| CSL | CSL Limited | $ 247.16 | -0.7% | 119,986.49 |

| TLX | Telix Pharmaceutical | $ 25.98 | -0.8% | 7,546.94 |

| HLS | Healius | $ 0.88 | -0.8% | 635.37 |

| ANN | Ansell Limited | $ 31.19 | -0.9% | 4,566.62 |

| SNZ | Summerset Grp Hldgs | $ 10.21 | -0.9% | 2,461.11 |

| MYX | Mayne Pharma Ltd | $ 4.80 | -1.0% | 376.51 |

| RGT | Argent Biopharma Ltd | $ 0.09 | -1.1% | 6.86 |

| PNV | Polynovo Limited | $ 1.27 | -1.2% | 870.46 |

| PYC | PYC Therapeutics | $ 1.20 | -1.2% | 699.91 |

| BDX | Bcal Diagnostics | $ 0.08 | -1.3% | 27.45 |

| NEU | Neuren Pharmaceuticals | $ 13.85 | -1.4% | 1,765.00 |

| RMD | ResMed Inc. | $ 37.58 | -1.5% | 22,360.10 |

| IME | Imexhs Limited | $ 0.33 | -1.5% | 17.70 |

| LTP | LTR Pharma | $ 0.32 | -1.5% | 34.71 |

| AHC | Austco Healthcare | $ 0.31 | -1.6% | 112.86 |

| RHY | Rhythm Biosciences | $ 0.06 | -1.6% | 17.87 |

| ONE | Oneview Healthcare | $ 0.27 | -1.9% | 202.31 |

| VHL | Vitasora Health Ltd | $ 0.04 | -2.4% | 66.24 |

| MSB | Mesoblast Limited | $ 1.60 | -2.4% | 1,560.40 |

| CYC | Cyclopharm Limited | $ 1.18 | -2.5% | 131.70 |

| AHX | Apiam Animal Health | $ 0.39 | -2.5% | 71.74 |

| EBO | Ebos Group Ltd | $ 34.69 | -2.5% | 1,365.85 |

| IMM | Immutep Ltd | $ 0.28 | -2.6% | 407.57 |

| VIT | Vitura Health Ltd | $ 0.07 | -2.9% | 45.03 |

| CUV | Clinuvel Pharmaceuticals | $ 10.24 | -3.0% | 457.13 |

| AVH | Avita Medical | $ 1.89 | -3.1% | 123.08 |

| NAN | Nanosonics Limited | $ 4.39 | -3.1% | 1,282.02 |

| NUZ | Neurizon Therapeutic | $ 0.15 | -3.3% | 68.92 |

| MAP | Microba Life Sciences | $ 0.15 | -3.3% | 64.94 |

| BMT | Beamtree Holdings | $ 0.28 | -3.4% | 81.15 |

| SIG | Sigma Health Ltd | $ 3.06 | -3.5% | 17,428.00 |

| MX1 | Micro-X Limited | $ 0.06 | -3.5% | 36.70 |

| CGS | Cogstate Ltd | $ 1.30 | -3.5% | 219.41 |

| NC6 | Nanollose Limited | $ 0.05 | -3.8% | 15.24 |

| RCE | Recce Pharmaceutical | $ 0.34 | -4.2% | 90.39 |

| AYA | Artrya | $ 0.73 | -4.6% | 82.43 |

| ACW | Actinogen Medical | $ 0.02 | -4.8% | 63.54 |

| DXB | Dimerix Ltd | $ 0.58 | -4.9% | 326.72 |

| ACL | Au Clinical Labs | $ 2.78 | -5.1% | 395.94 |

| EBR | EBR Systems | $ 1.09 | -5.2% | 465.57 |

| NXS | Next Science Limited | $ 0.07 | -5.6% | 19.57 |

| EMV | Emvision Medical | $ 1.68 | -5.6% | 140.67 |

| AT1 | Atomo Diagnostics | $ 0.02 | -5.9% | 10.98 |

| PTX | Prescient Ltd | $ 0.05 | -6.0% | 37.85 |

| AGN | Argenica | $ 0.77 | -6.1% | 98.63 |

| M7T | Mach7 Tech Ltd | $ 0.35 | -6.7% | 84.43 |

| BOT | Botanix Pharma Ltd | $ 0.35 | -6.8% | 620.71 |

| ZLD | Zelira Therapeutics | $ 0.46 | -7.1% | 5.71 |

| SNT | Syntara Limited | $ 0.07 | -7.1% | 105.57 |

| CAN | Cann Group Ltd | $ 0.01 | -7.1% | 8.09 |

| TYP | Tryptamine Ltd | $ 0.03 | -8.6% | 44.45 |

| NTI | Neurotech International | $ 0.02 | -8.7% | 22.04 |

| SHG | Singular Health | $ 0.30 | -9.1% | 83.31 |

| ECS | ECS Botanics Holding | $ 0.01 | -9.1% | 14.26 |

| GSS | Genetic Signatures | $ 0.49 | -9.3% | 110.16 |

| CBL | Control Bionics | $ 0.03 | -9.7% | 8.84 |

| ILA | Island Pharma | $ 0.21 | -10.6% | 49.05 |

| UBI | Universal Biosensors | $ 0.04 | -10.6% | 12.52 |

| EMD | Emyria Limited | $ 0.03 | -10.7% | 13.75 |

| TRU | Truscreen | $ 0.02 | -11.1% | 13.32 |

| RHT | Resonance Health | $ 0.04 | -11.6% | 20.22 |

| RAC | Race Oncology Ltd | $ 1.21 | -12.0% | 210.22 |

| 4DX | 4DMedical Limited | $ 0.31 | -12.9% | 146.64 |

| CYP | Cynata Therapeutics | $ 0.17 | -13.2% | 37.28 |

| CU6 | Clarity Pharma | $ 1.91 | -13.8% | 535.84 |

| CDX | Cardiex Limited | $ 0.04 | -16.1% | 17.87 |

| 1AI | Algorae Pharma | $ 0.01 | -16.7% | 8.44 |

| TRJ | Trajan Group Holding | $ 0.77 | -16.8% | 116.57 |

| IMU | Imugene Limited | $ 0.01 | -17.6% | 112.01 |

| MEM | Memphasys Ltd | $ 0.00 | -18.2% | 7.93 |

| AVE | Avecho Biotech Ltd | $ 0.00 | -20.0% | 12.69 |

| BP8 | Bph Global Ltd | $ 0.00 | -20.0% | 2.10 |

| VBS | Vectus Biosystems | $ 0.05 | -21.7% | 2.50 |

| CTQ | Careteq Limited | $ 0.01 | -23.1% | 2.37 |

| 1AD | Adalta Limited | $ 0.00 | -33.3% | 1.93 |

Inoviq (ASX:IIQ) rose ~24% in May and got hit with a speeding ticket by the ASX. The oncology play had no particular news out in May and attributed the increase to publication online of an abstract accepted by the American Society of Clinical Oncology (ASCO) for a poster presentation about results of its EXO-OC test for ovarian cancer.

Inoviq said the result had already been released in December and referred to in subsequent business updates.

"Some shareholders may have missed or misunderstood the significance of our 3 December 2024 ASX release and subsequent related updates noted above and may believe the Abstract contains new or better information, which is materially price sensitive, that is not the case in the company's view.

The company said new information to be delivered in the poster presentation at the ASCO annual meeting on June 1 was "considered price sensitive".

On June 2 Inoviq announced that new data presented at the ASCO meeting showed its EXO-OC test achieved 77% sensitivity at 99.6% specificity for detecting ovarian cancer at all stages.

Clever Culture Systems (ASX:CC5) continued to build momentum in May and was up 26.7% for the month after announcing a positive quarterly update in April, including its second quarter of positive cashflow.

Clever Culture is targeting profitability in FY25 and building a substantial sales pipeline to underpin growth in FY26 for its APAS Independence instruments, which remain the only US FDA-cleared AI technology for automated culture plate reading.

Lumos Diagnostics (ASX:LDX) rose 7.4% in May after several positive announcements including the largest single purchase order to date for its FebriDx test, a rapid point-of-care (POC) diagnostic designed to differentiate between bacterial and non-bacterial acute respiratory infections.

Developer and distributor of cost-saving solutions for hospitals, surgery centres, clinics and healthcare facilities across the US iMedical purchased US$126,000 worth of FebriDx tests.

In May Lumos also expanded Medicare reimbursement coverage in the US for FebriDx. By the end of May Lumos had secured reimbursement from six out of seven US Medicare Administrative Contractors (MACs) representing over 85% of US Medicare payment coverage.

And Australia's biggest private hospital operator Ramsay Health Care (ASX:RHC) rose 5.1% in May after providing a positive update on its 52.8% stake in European hospitals business Santé, with unaudited group revenue for the nine months period ending March 31, up by 5.1%.

At Stockhead, we tell it like it is. While Clever Culture Systems and Lumos Diagnostics Biopharmaceuticals and Imricor are Stockhead advertisers, the companies did not sponsor this article.

Originally published as ASX health May winners: Sector rises 1.59pc but market volatility remains